- United States

- /

- Consumer Services

- /

- NYSE:EDU

Assessing New Oriental (NYSE:EDU) Valuation After First Beijing Makes It Top Holding

Reviewed by Kshitija Bhandaru

If you follow New Oriental Education & Technology Group (NYSE:EDU), you probably noticed the headlines about First Beijing Investment Ltd making a massive bet on the company. By acquiring over 168 million shares, First Beijing not only raised its stake but also made EDU its top holding, which is an unmistakable sign that it is betting heavily on New Oriental’s future. Moves like these can signal growing confidence among institutional investors and often spark curiosity among retail shareholders considering their next step.

This development arrives at an interesting time for New Oriental. After a period of volatility, with the stock slipping 30% over the past year and rebounding nearly 10% in the past month, momentum appears to be shifting. While annual growth figures for revenue and net income remain positive, the longer-term performance shows that the stock is still working to recover from a steep decline over five years. These dynamics, combined with a steady return on capital, set the stage for a closer look at the company’s valuation.

So, with First Beijing’s conviction and changing price momentum, is there a true bargain here, or are markets simply factoring in all the future growth already?

Most Popular Narrative: 10.7% Undervalued

The most widely followed narrative places New Oriental Education & Technology Group at a significant discount to its estimated fair value, highlighting medium-term upside potential for the stock.

Enhanced operational efficiency and active capital returns are boosting profitability and shareholder value. This is achieved through increased margins, predictable cash flow, and share buybacks. However, intensifying competition, regulatory risks, and slowing growth in new ventures may constrain revenue, threaten margins, and limit long-term earnings expansion despite ongoing cost controls.

A dramatic shift is brewing beneath the surface. The numbers driving this fair value are not what most investors would expect. The foundation for this bullish view rests on ambitious growth targets and impressive profitability gains, but some critical assumptions could shift everything. Want to discover which performance levers have pushed analysts to this surprising valuation? The answer lies in the projections you have not seen yet.

Result: Fair Value of $57.40 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, slowing demand in overseas study services and increasing competition in new segments could quickly change the current outlook for New Oriental's growth.

Find out about the key risks to this New Oriental Education & Technology Group narrative.Another View: Market Metrics Tell a Different Story

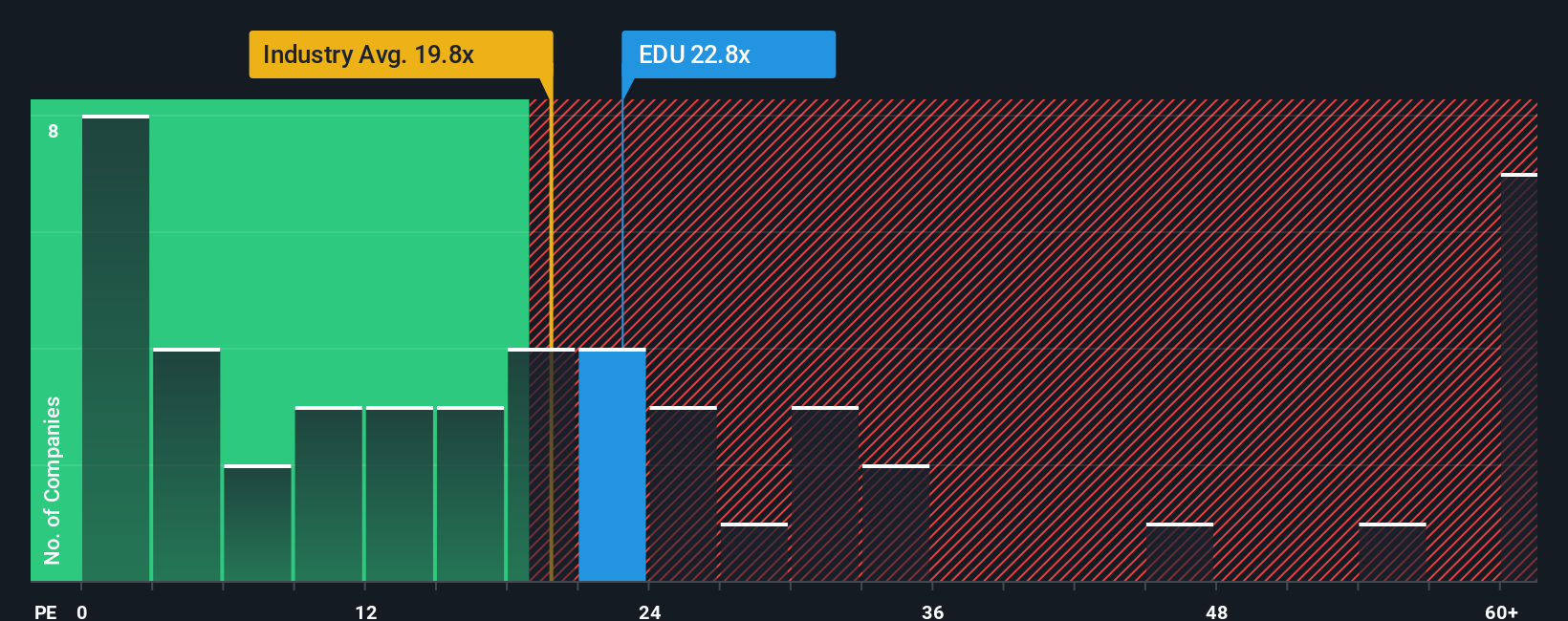

While our fair value estimate suggests New Oriental is undervalued, a look at its market-based valuation presents a challenge. The company trades at a higher price relative to earnings than its industry. This could mean optimism is already priced in. Could the optimistic forecasts withstand this reality check?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own New Oriental Education & Technology Group Narrative

If you have a different perspective or would rather draw your own conclusions, you can review the figures and form your own outlook in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding New Oriental Education & Technology Group.

Looking for more investment ideas?

Smart investors never stop at just one opportunity. Expand your investing toolkit and position yourself ahead of the curve with proven strategies other market-watchers use every day.

- Spot high-potential growth stories before the crowd by using AI penny stocks. This tool helps you find cutting-edge innovators making waves in artificial intelligence.

- Maximize your passive income with dividend stocks with yields > 3%, which connects you to companies offering standout yields and consistent dividend histories.

- Tap into tomorrow’s winners at compelling prices through undervalued stocks based on cash flows. This option is a shortcut to stocks whose future cash flows signal hidden value in today's market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if New Oriental Education & Technology Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EDU

New Oriental Education & Technology Group

New Oriental Education & Technology Group Inc.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives