- United States

- /

- Hospitality

- /

- NYSE:DRI

Darden Restaurants Valuation in Focus as Strategic Acquisitions Drive 18% Gain in 2025

Reviewed by Bailey Pemberton

If you’ve ever wondered whether now is the right time to buy, hold, or just keep an eye on Darden Restaurants, you’re not alone. The stock has had an interesting run lately, with shares closing at $186.46. While the last week saw a modest dip of 0.5%, the year-long trajectory paints a far rosier picture, up an impressive 18.2%. It is even more notable when you look at the five-year return, which stands at 136.0%. These numbers say a lot about how the market is reevaluating Darden's potential and its perceived risk profile.

Behind this performance, some recent news has grabbed investors' attention, including ongoing strategic acquisitions and menu innovations that signal Darden’s intent to stay fresh and competitive. While these moves haven't always led to immediate stock surges, they reinforce a perception of management that is actively investing in both brand relevance and market share. It is no wonder analysts are taking a closer look at Darden’s value proposition right now.

On that note, if you follow valuation scores, Darden currently clocks in with a score of 4 out of 6, meaning it is considered undervalued by most of the standard checks investors use to gauge a stock. But how reliable are these traditional valuation methods? Next, we will dig into the different valuation approaches that go into that score. At the end, I will share an even smarter way to think about what Darden is really worth.

Approach 1: Darden Restaurants Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a popular tool for estimating a company's intrinsic value. It works by projecting the future cash flows a business is expected to generate and then discounting those amounts back to their value today. This helps investors gauge what the underlying business might actually be worth compared to its current stock price.

For Darden Restaurants, the latest reported Free Cash Flow (FCF) stands at $1.07 Billion. Analysts forecast steady growth in FCF, reaching about $1.43 Billion by 2028. Further projections, based on industry trends and analyst extrapolations, extend out ten years and indicate continued growth. These reinforce expectations of a robust cash-generating business.

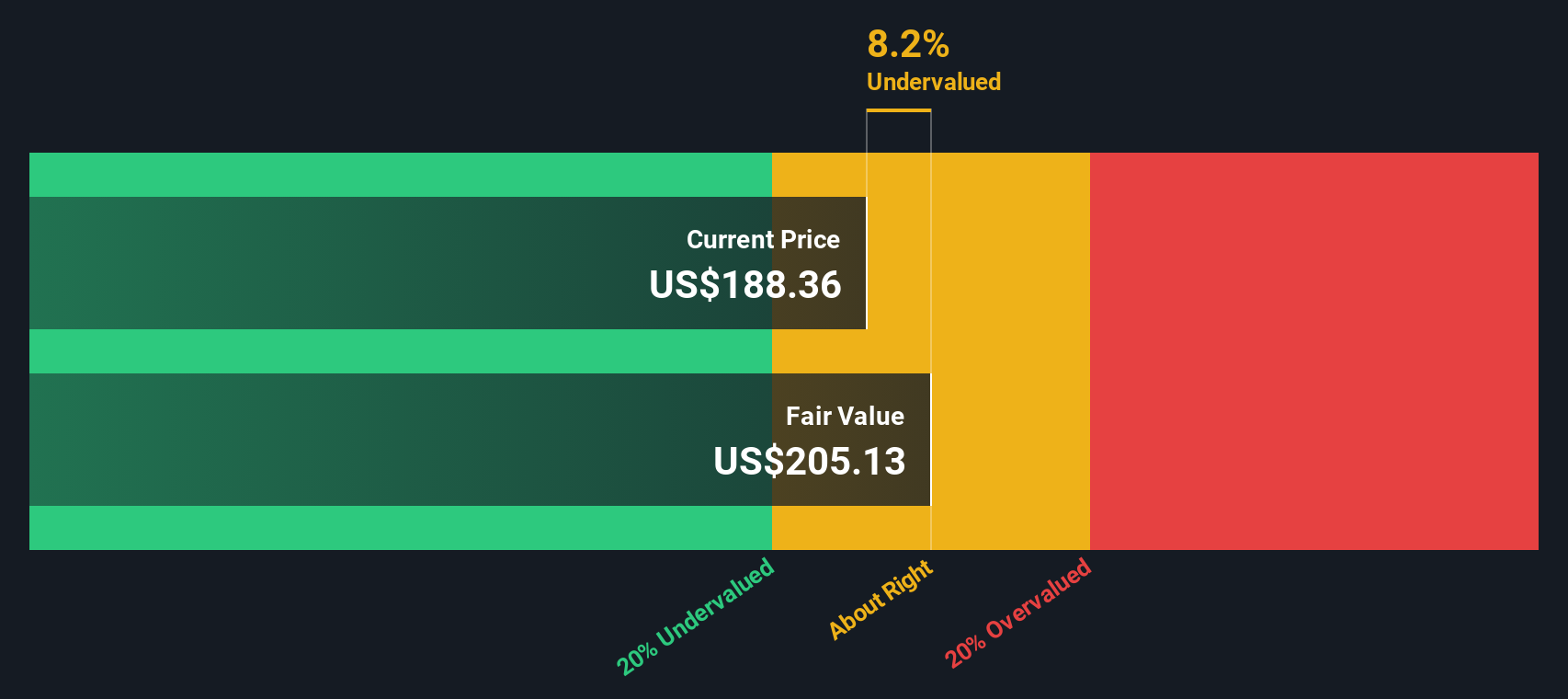

Using these projections, the DCF model arrives at an estimated intrinsic value of $205.63 per share. With shares recently closing at $186.46, the implied discount is approximately 9.3%, suggesting that the stock currently trades just below what its long-term cash flow potential would support.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Darden Restaurants's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Darden Restaurants Price vs Earnings

The Price-to-Earnings (PE) ratio is one of the most widely used ways to value profitable companies like Darden Restaurants. Since Darden has stable, positive earnings, the PE ratio offers an effective snapshot for comparing its stock price to its actual per-share earnings. This metric is especially useful because it quickly lets investors see how much they are paying for a dollar of the company's profit.

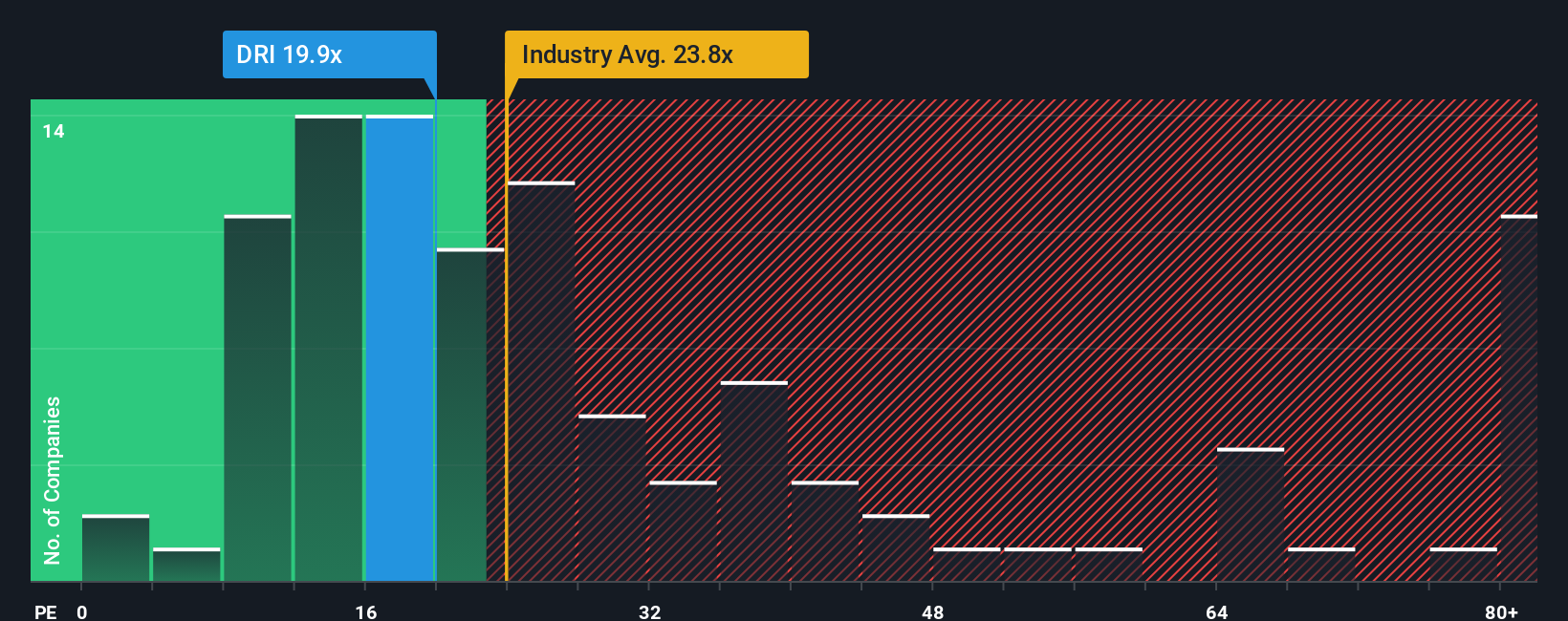

However, what counts as a “normal” or “fair” PE ratio depends on expectations for future growth and how risky the business is. Higher expected growth usually means a higher PE is justified, while more risk suggests a lower PE is sensible. For Darden, the current PE ratio stands at 19.7x. For perspective, the average PE ratio across the Hospitality industry is 23.9x, and the average among Darden’s peers is 24.0x. At first glance, this places Darden’s stock below both key benchmarks.

This is where Simply Wall St’s “Fair Ratio” comes in. Unlike traditional benchmarks, the Fair Ratio calculates the PE you would reasonably expect based on a blend of factors, including the company’s growth prospects, profitability, risks, industry positioning and market cap. It provides a more tailored view of value by accounting for the characteristics that set Darden apart from competitors. Darden’s Fair Ratio is currently 24.1x, suggesting that for its profile, the market should reasonably value it at that multiple.

Today, with the actual PE ratio at 19.7x and a Fair Ratio of 24.1x, Darden trades at a valuation that is nearly in line with what its fundamentals warrant. The small difference between these numbers reinforces the idea that the stock is fairly valued given its risk and return trade-offs.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Darden Restaurants Narrative

Earlier, we mentioned there is an even better way to understand value than just numbers alone, and that is by using Narratives. A Narrative is simply your own story about Darden Restaurants, where you lay out the company’s opportunities, risks, and market shifts, then tie those ideas to numbers such as your assumptions for future revenue, earnings, and margins.

In practice, Narratives connect Darden’s big-picture story to a forecast and then to a fair value, giving you a clear, repeatable framework for deciding if the stock is worth buying or selling. This approach is as easy as it is powerful, and millions of investors on Simply Wall St already access and share their Narratives in the Community page.

Whenever new earnings or news arrives, Narratives update automatically with the latest information, keeping your perspective relevant without the effort. Comparing your Narrative’s fair value to the current price helps you see quickly if you have a buying or selling opportunity, or if it is best to wait.

For example, looking at Darden Restaurants, one investor’s Narrative might focus on robust delivery growth, new restaurant formats, and estimate a fair value as high as $255 per share. A more cautious user, concerned about guest traffic and margin pressures, might land at just $157 per share. The takeaway: your Narrative is the key that makes investing much more personal and informed.

Do you think there's more to the story for Darden Restaurants? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DRI

Darden Restaurants

Owns and operates full-service restaurants in the United States and Canada.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives