Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies Despegar.com, Corp. (NYSE:DESP) makes use of debt. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Despegar.com

What Is Despegar.com's Net Debt?

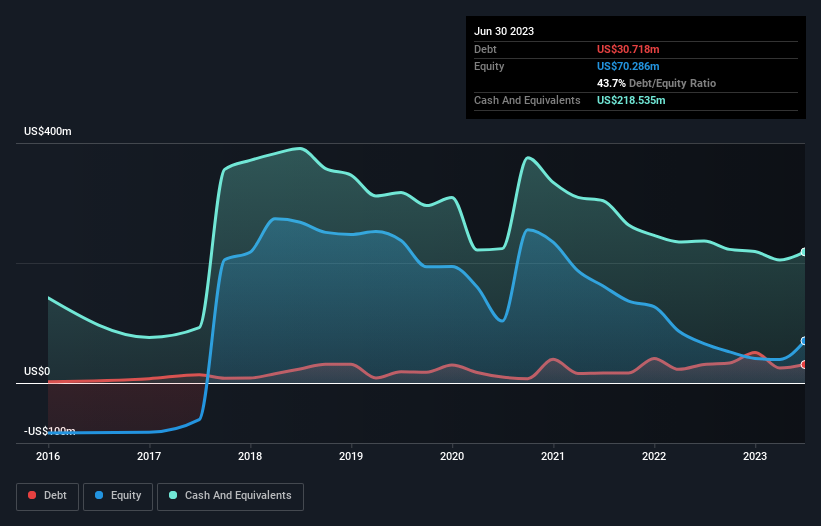

The chart below, which you can click on for greater detail, shows that Despegar.com had US$30.7m in debt in June 2023; about the same as the year before. However, it does have US$218.5m in cash offsetting this, leading to net cash of US$187.8m.

A Look At Despegar.com's Liabilities

We can see from the most recent balance sheet that Despegar.com had liabilities of US$656.0m falling due within a year, and liabilities of US$173.8m due beyond that. On the other hand, it had cash of US$218.5m and US$240.8m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$370.5m.

This is a mountain of leverage relative to its market capitalization of US$473.6m. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution. While it does have liabilities worth noting, Despegar.com also has more cash than debt, so we're pretty confident it can manage its debt safely.

It was also good to see that despite losing money on the EBIT line last year, Despegar.com turned things around in the last 12 months, delivering and EBIT of US$34m. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Despegar.com can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. While Despegar.com has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. In the last year, Despegar.com basically broke even on a free cash flow basis. Some might say that's a concern, when it comes considering how easily it would be for it to down debt.

Summing Up

While Despegar.com does have more liabilities than liquid assets, it also has net cash of US$187.8m. So while Despegar.com does not have a great balance sheet, it's certainly not too bad. Even though Despegar.com lost money on the bottom line, its positive EBIT suggests the business itself has potential. So you might want to check out how earnings have been trending over the last few years.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:DESP

Despegar.com

An online travel company, provides a range of travel and travel-related products to leisure and corporate travelers through its websites and mobile applications in Latin America and the United States.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026