- United States

- /

- Consumer Services

- /

- NYSE:COUR

Some Confidence Is Lacking In Coursera, Inc. (NYSE:COUR) As Shares Slide 30%

Coursera, Inc. (NYSE:COUR) shareholders that were waiting for something to happen have been dealt a blow with a 30% share price drop in the last month. Longer-term, the stock has been solid despite a difficult 30 days, gaining 20% in the last year.

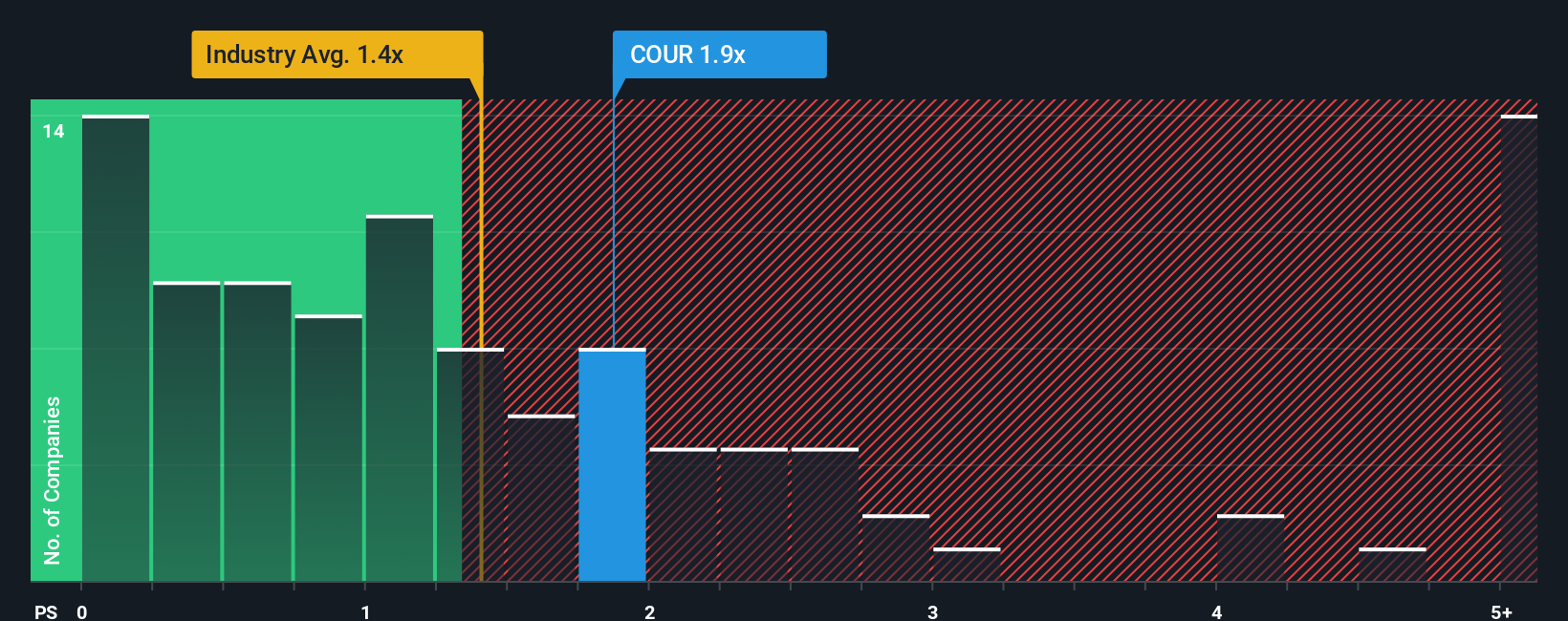

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about Coursera's P/S ratio of 1.9x, since the median price-to-sales (or "P/S") ratio for the Consumer Services industry in the United States is also close to 1.4x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Coursera

How Has Coursera Performed Recently?

Coursera could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Coursera will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

Coursera's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a decent 8.1% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 49% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 6.2% over the next year. Meanwhile, the rest of the industry is forecast to expand by 12%, which is noticeably more attractive.

With this in mind, we find it intriguing that Coursera's P/S is closely matching its industry peers. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Bottom Line On Coursera's P/S

Coursera's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

When you consider that Coursera's revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. A positive change is needed in order to justify the current price-to-sales ratio.

Having said that, be aware Coursera is showing 2 warning signs in our investment analysis, you should know about.

If you're unsure about the strength of Coursera's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:COUR

Coursera

Provides online educational services in the United States, Europe, Africa, the Asia Pacific, the Middle East, and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives