- United States

- /

- Consumer Services

- /

- NYSE:COUR

Coursera (COUR): Losses Narrow 7.9% Annually, But Shares Remain Expensive vs. Peers

Reviewed by Simply Wall St

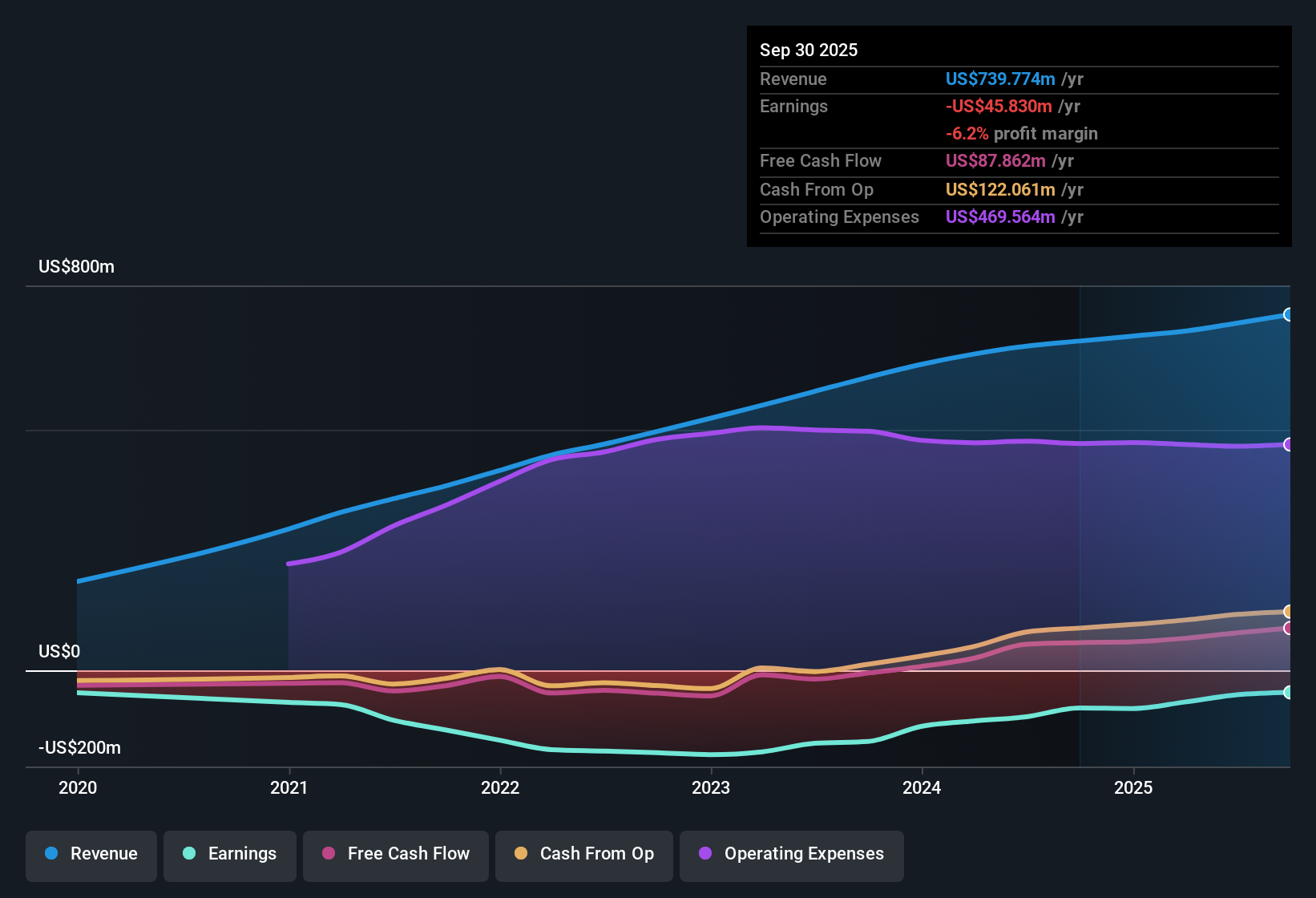

Coursera (COUR) is still operating at a loss and is expected to remain unprofitable for at least the next three years. The company has managed to narrow its losses at an annual rate of 7.9% over the past five years. Revenue is forecast to grow by 6.1% per year, trailing the broader US market’s 10% annual growth outlook. Investors are watching to see if Coursera's consistent loss reduction and below-fair-value share price will be enough to outweigh its slower growth and higher price-to-sales multiples compared to industry peers.

See our full analysis for Coursera.Next up, we will see how these latest numbers compare to the main market narratives and what the key storylines say about Coursera’s performance.

See what the community is saying about Coursera

Analyst Target Just 8.8% Above Current Price

- Coursera shares are priced at $9.20, while the analysts' average price target sits at 12.38. This reflects only an 8.8% possible upside from here and suggests analysts view the stock as fairly valued for now.

- Consensus narrative notes the small gap to target price fits the view that the company’s slower 6.1% expected annual revenue growth and continued losses may limit investor enthusiasm for a big re-rating.

- What is surprising is that the stock also trades well below its DCF fair value of 13.75, so if Coursera can demonstrate stronger operational improvement, there is some potential for an upside adjustment.

- However, its price-to-sales multiple of 2.1 times exceeds both the US Consumer Services industry (1.5x) and its peers (1.9x). This highlights ongoing concerns about growth and profitability momentum.

Consensus expectations meet a crossroads as Coursera’s valuation discounts and growth signals create both caution and opportunity. 📊 Read the full Coursera Consensus Narrative.

Losses Narrowing by 7.9% Annually

- Coursera has steadily reduced its net losses at a 7.9% annual rate over the past five years, showing management’s efforts to control costs even as the company remains unprofitable and is expected to remain so for at least three more years.

- According to the consensus narrative, analysts believe that positive value signals like loss reduction and trading below analyst targets could support the investment case, especially as enterprise partnerships and new AI-driven features may soon improve margins.

- Still, persistent negative earnings and a forecast for ongoing unprofitability temper bullish hopes for a near-term turnaround.

- Operational progress will need to translate into margin expansion for sentiment to truly shift.

High Price-to-Sales Ratio Raises Doubts

- Coursera’s price-to-sales ratio stands at 2.1x, higher than both the US Consumer Services sector average (1.5x) and direct peers (1.9x). This raises questions about whether its premium is justified given its slower growth pace.

- The consensus narrative points out that this valuation premium is a double-edged sword: on one hand, bulls hope enterprise momentum and scalable AI innovation will drive future revenue per user. On the other hand, bears warn that increased competition and conversion challenges could pressure both growth and margin expansion.

- Bears highlight dependency on institutional partners and potential skepticism over online credentials as risks that could weigh on user monetization and enrollment growth if not addressed soon.

- The high multiple, in the face of ongoing losses and below market growth, will likely drive continued debate around Coursera’s long-term potential.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Coursera on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Notice something that stands out in the data? Use your insight to shape a fresh narrative in under three minutes, and Do it your way

A great starting point for your Coursera research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Coursera’s persistent losses, slower revenue growth, and premium valuation raise concerns about its ability to deliver consistent, long-term returns for investors.

If dependable results are your priority, focus on companies proven to deliver steady revenue and earnings expansion across market cycles using our stable growth stocks screener (2099 results).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:COUR

Coursera

Provides online educational services in the United States, Europe, Africa, the Asia Pacific, the Middle East, and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives