- United States

- /

- Consumer Services

- /

- NYSE:COUR

Coursera (COUR): Evaluating Valuation Following Anthropic AI Collaboration and New Course Launches

Reviewed by Simply Wall St

Coursera (COUR) recently unveiled a partnership with Anthropic to launch two new AI-focused Specializations. By teaming up, the companies aim to make advanced generative AI skills accessible to both developers and business professionals.

See our latest analysis for Coursera.

Coursera’s recent moves, including the Anthropic partnership and new CFO appointment, arrive as the company focuses on AI upskilling and talent development. While the share price is off nearly 31% over the past three months and 6% year-to-date, this follows a period of volatility, and total shareholder return has broken even for the past year. The attention surrounding Coursera’s AI offerings and renewed leadership brings cautious optimism, but momentum has not yet resulted in sustained gains.

If Coursera’s latest AI initiative has you looking for fresh opportunities, consider widening your search and discover fast growing stocks with high insider ownership

Given this backdrop and a meaningful discount to analyst price targets, is Coursera an overlooked play in AI education, or is the market already anticipating the company’s potential for future growth?

Most Popular Narrative: 35% Undervalued

Compared to the last close price of $7.95, the most widely followed narrative estimates Coursera's fair value at $12.23. This suggests the current price reflects a substantial discount relative to projections, with investor focus on the company's future revenue and margin evolution amid ongoing innovation.

Continuous product innovation, especially through AI-powered features like personalized tutoring (Coach), AI-driven catalog expansion, and advanced go-to-market strategies such as localized pricing and onboarding enhancements, is expected to drive higher conversion rates, increase paid user retention, and boost engagement, positively influencing both revenue growth and margin leverage.

Curious why this narrative sets such a bold valuation? The story hinges on much more than just steady user growth. Intriguing financial assumptions about earnings, margins, and a shift in business fundamentals drive these numbers. Which metric has analysts betting on a turnaround? Read the full narrative to see the calculations for yourself.

Result: Fair Value of $12.23 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, growing competition from free alternatives and ongoing skepticism about online credentials could reduce Coursera's revenue potential in the coming years.

Find out about the key risks to this Coursera narrative.

Another View: What Do Multiples Say?

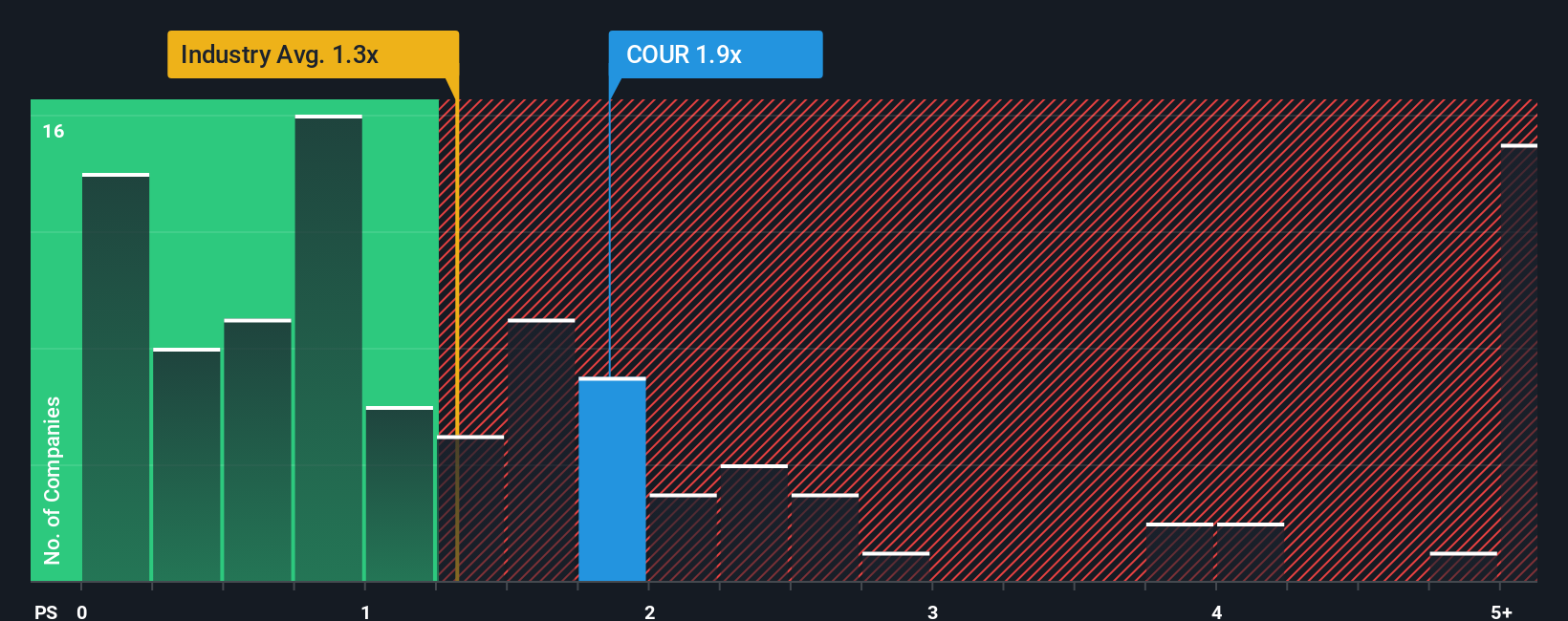

Looking from a price-to-sales perspective, Coursera trades at 1.8x, which is above the US Consumer Services industry average of 1.4x, its peer average of 1.5x, and also above the fair ratio of 1.2x that the market could come to expect. This signals a risk that the stock is expensive by comparison. What happens if sentiment shifts and the market starts to prize lower multiples?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Coursera Narrative

If you see things differently or want to dig into the data yourself, you can easily build your own narrative in just a few minutes: Do it your way

A great starting point for your Coursera research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t just stop at Coursera. Grow your watchlist with stocks that are making real waves right now. Savvy investors like you shouldn’t overlook these opportunities.

- Collect high yields with confidence by reviewing these 15 dividend stocks with yields > 3% paying over 3 percent and built for stability.

- Capitalize on emerging trends in artificial intelligence. Tap into these 25 AI penny stocks to find companies at the forefront of innovation.

- Ride the wave as digital assets reshape the markets by checking out these 81 cryptocurrency and blockchain stocks transforming finance and growth potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:COUR

Coursera

Provides online educational services in the United States, Europe, Africa, the Asia Pacific, the Middle East, and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026