- United States

- /

- Hospitality

- /

- NYSE:CHH

How Investors May Respond To Choice Hotels (CHH) Entering African Markets With Major Expansion Plans

Reviewed by Sasha Jovanovic

- Choice Hotels International recently announced its entry into Africa, with three directly franchised hotels in Kenya expected to open in early 2026 and a master development agreement to add at least 15 more properties across sub-Saharan and southern Africa by 2030.

- This move highlights the company’s drive to scale its global footprint, enhance its EMEA portfolio, and further expand its presence in fast-growing international hospitality markets.

- We’ll consider how this planned expansion into Africa could influence investor views on Choice Hotels’ international growth and earnings outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Choice Hotels International Investment Narrative Recap

For shareholders of Choice Hotels International, the big picture centers on belief in the company’s ability to translate global expansion, particularly in underserved and high-growth markets, into consistent earnings growth and resilience against industry cycles. The recent announcement of new properties in Kenya signals intent to diversify the revenue base, but it does not materially alter the key short-term catalyst: recovery in global travel demand and improving RevPAR (revenue per available room) figures. Persistent underperformance in government and international travel remains the biggest challenge for near-term results and outlook.

Among recent developments, the launch of MainStay Suites in Australia stands out as directly relevant to the African expansion, as both moves highlight Choice Hotels’ increasing emphasis on international direct franchising and broadening of the EMEA portfolio. While international growth is a clear catalyst, execution risks in new markets, such as operational start-up costs, local expertise, and achieving occupancy thresholds, will be pivotal in determining earnings momentum for the next several years.

Yet, despite the company’s ongoing international push, investors should keep in mind the significant exposure to ongoing softness in government and international travel that could...

Read the full narrative on Choice Hotels International (it's free!)

Choice Hotels International's outlook suggests $1.8 billion in revenue and $354.2 million in earnings by 2028. Achieving this would require annual revenue growth of 30.6% and an earnings increase of $48 million from the current $306.2 million.

Uncover how Choice Hotels International's forecasts yield a $115.50 fair value, a 27% upside to its current price.

Exploring Other Perspectives

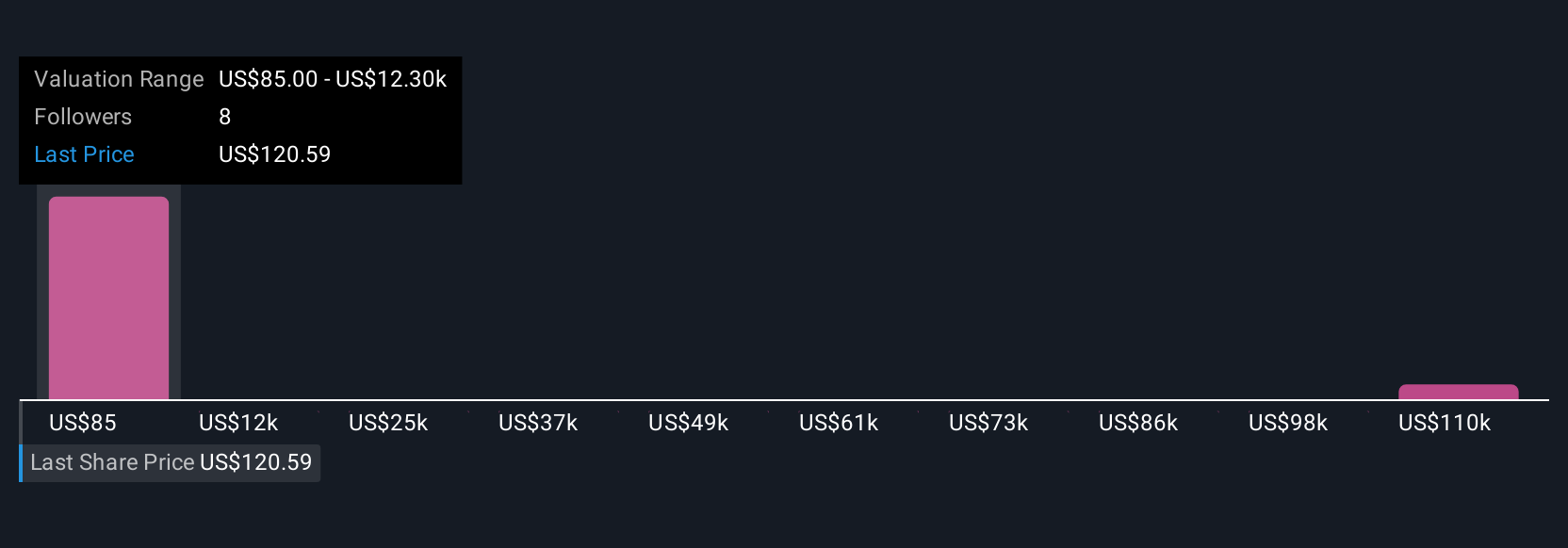

Fair value estimates from four Simply Wall St Community contributors span from US$106,728 to over US$122 million per share. With this kind of variability, and ongoing headwinds in key market segments, you will want to explore why opinions vary so much on future performance.

Explore 4 other fair value estimates on Choice Hotels International - why the stock might be worth just $106.73!

Build Your Own Choice Hotels International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Choice Hotels International research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Choice Hotels International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Choice Hotels International's overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CHH

Choice Hotels International

Operates as a hotel franchisor in the United States and internationally.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives