- United States

- /

- Consumer Services

- /

- NYSE:CHGG

Pinning Down Chegg, Inc.'s (NYSE:CHGG) P/S Is Difficult Right Now

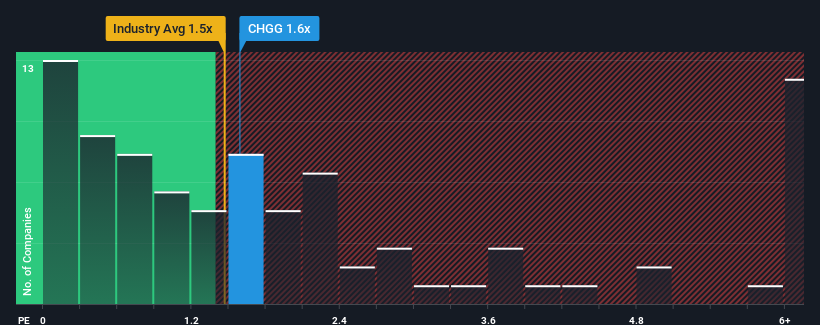

There wouldn't be many who think Chegg, Inc.'s (NYSE:CHGG) price-to-sales (or "P/S") ratio of 1.6x is worth a mention when the median P/S for the Consumer Services industry in the United States is similar at about 1.5x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Chegg

How Chegg Has Been Performing

While the industry has experienced revenue growth lately, Chegg's revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Chegg's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Chegg?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Chegg's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 4.6%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 30% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to slump, contracting by 3.0% during the coming year according to the analysts following the company. Meanwhile, the broader industry is forecast to expand by 13%, which paints a poor picture.

With this information, we find it concerning that Chegg is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Key Takeaway

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our check of Chegg's analyst forecasts revealed that its outlook for shrinking revenue isn't bringing down its P/S as much as we would have predicted. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If the poor revenue outlook tells us one thing, it's that these current price levels could be unsustainable.

It is also worth noting that we have found 3 warning signs for Chegg (1 is a bit concerning!) that you need to take into consideration.

If you're unsure about the strength of Chegg's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CHGG

Chegg

Provides individualized learning support to students that helps build essential academic, life, and job skills to achieve success in the United States and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives