- United States

- /

- Consumer Services

- /

- NYSE:CHGG

Chegg (CHGG) Valuation in Focus as Major Restructuring and Leadership Return Signal Strategic Shift

Reviewed by Simply Wall St

Chegg is making big changes in response to industry shifts, announcing that nearly half of its workforce will be cut. Longtime leader Dan Rosensweig is stepping back in as CEO. Increased competition from AI-powered tools is driving this turnaround.

See our latest analysis for Chegg.

Chegg’s dramatic restructuring comes after another tough stretch for the stock, which closed recently at $1.06 following a steep multi-month decline. While yesterday’s 11.25% one-day share price jump suggests the market welcomed bolder leadership and cost-cutting, Chegg’s longer-term track record remains painful, with a 1-year total shareholder return of -34.97% and a staggering 95% drop over three years. Momentum is still weak overall as investors weigh whether the shift toward professional skilling can reignite growth or merely stabilize ongoing declines.

If this kind of rapid pivot has you curious what else is out there, now’s the perfect moment to explore fast growing stocks with high insider ownership.

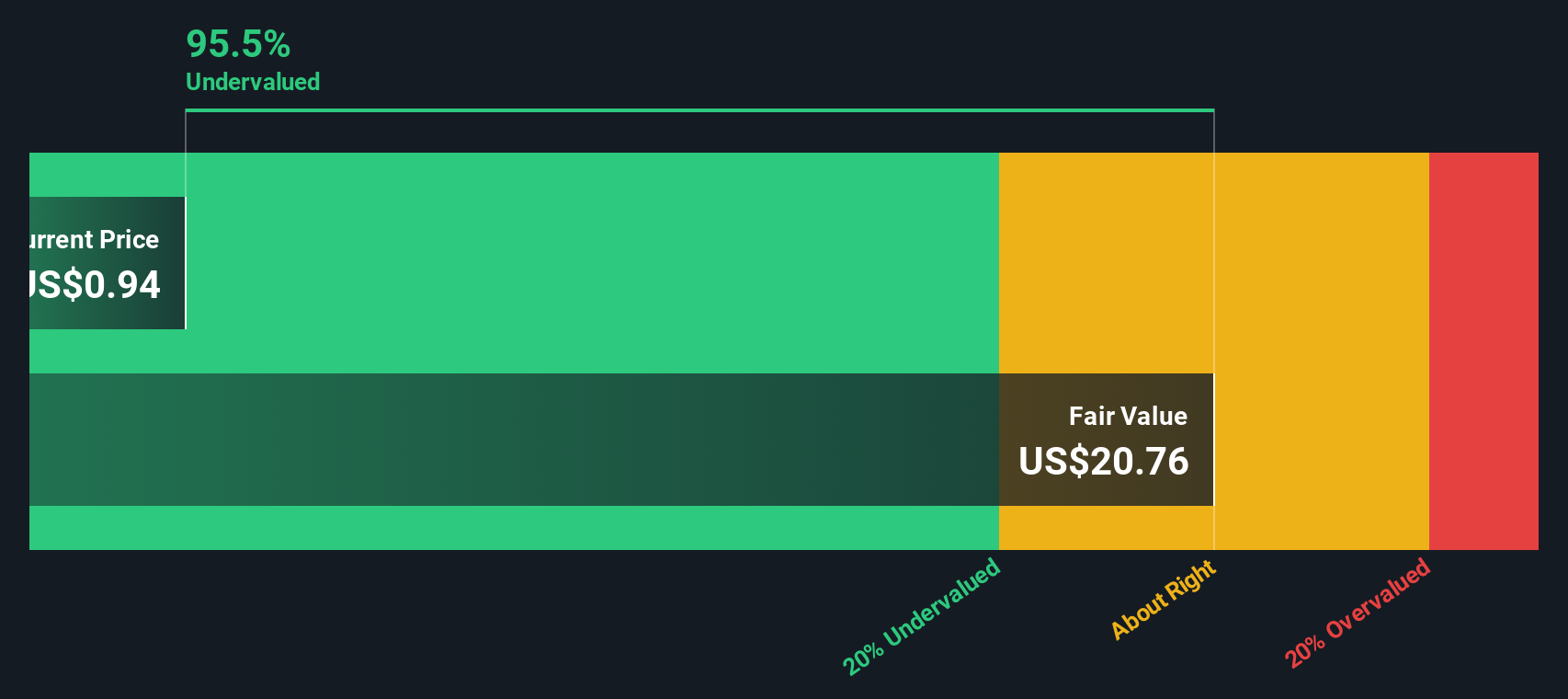

With Chegg’s valuation now deeply discounted after years of steep declines, the key question is whether investors are staring at a rare turnaround opportunity, or if the current price already reflects all the challenges and potential future growth.

Most Popular Narrative: 4.5% Undervalued

Based on the most widely followed narrative, Chegg's fair value is pegged at $1.11, just above the recent close of $1.06. This suggests that the market might be missing some upside if key assumptions play out.

AI integration in products significantly cuts costs, potentially boosting net margins and enhancing student engagement and retention. Strategic uncertainty, legal challenges, and declining traffic create instability, impacting revenue, net margins, and financial stability due to significant cash outflows.

What hidden levers could transform Chegg’s outlook? The narrative leans heavily on tech-driven cost reductions and major shifts in student growth, but key financial drivers are more dramatic than you’d expect. Want to know which bold projections shape this fair value? Read on for the controversial numbers that support it.

Result: Fair Value of $1.11 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing legal battles and falling subscriber retention could undercut the turnaround thesis if they continue to hamper revenue growth and stability.

Find out about the key risks to this Chegg narrative.

Another View: Deep Discount from Fair Value

While the most popular narrative values Chegg at $1.11, our SWS DCF model comes to a dramatically different conclusion, suggesting a fair value of $20.52. This is over 18 times the current share price. This stark gap raises the stakes. Could the market be missing a bigger turnaround?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Chegg Narrative

If you think the story is missing something, or want to dig into the numbers yourself, you can build your own take in just a few minutes. Do it your way.

A great starting point for your Chegg research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Do not wait on opportunity when you could be making the next smart move. Thousands of investors are already following fast-moving themes using our screeners.

- Tap into powerful global trends by checking out these 26 AI penny stocks leading innovation in artificial intelligence and automation.

- Unlock stable income streams and shield your portfolio from volatility by reviewing these 22 dividend stocks with yields > 3% offering consistent yields above 3%.

- Leap ahead of the crowd and seize remarkable value by evaluating these 833 undervalued stocks based on cash flows discovered using forward-looking cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CHGG

Chegg

Provides individualized learning support to students that helps build essential academic, life, and job skills to achieve success in the United States and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives