- United States

- /

- Hospitality

- /

- NYSE:CCL

Does Carnival Look Attractive After Recovery Headlines and Recent Price Swings in 2025?

Reviewed by Bailey Pemberton

- Wondering if Carnival Corporation & stock is a bargain or overvalued? If you have even a sliver of curiosity about the company’s current worth, you’re in the right place.

- Recent returns have been a bit of a rollercoaster. The stock is up 4.3% year-to-date and 4.0% in the past year, but it dipped 3.9% over the last week and 9.6% for the past month.

- In the last few months, Carnival Corporation & has seen increased media coverage. Much of it has focused on recovery in the cruise sector and updates on travel demand, which has influenced investor sentiment. Major headlines have discussed the easing of travel restrictions and the company’s efforts to improve its balance sheet. Both of these developments help explain the stock’s recent swings.

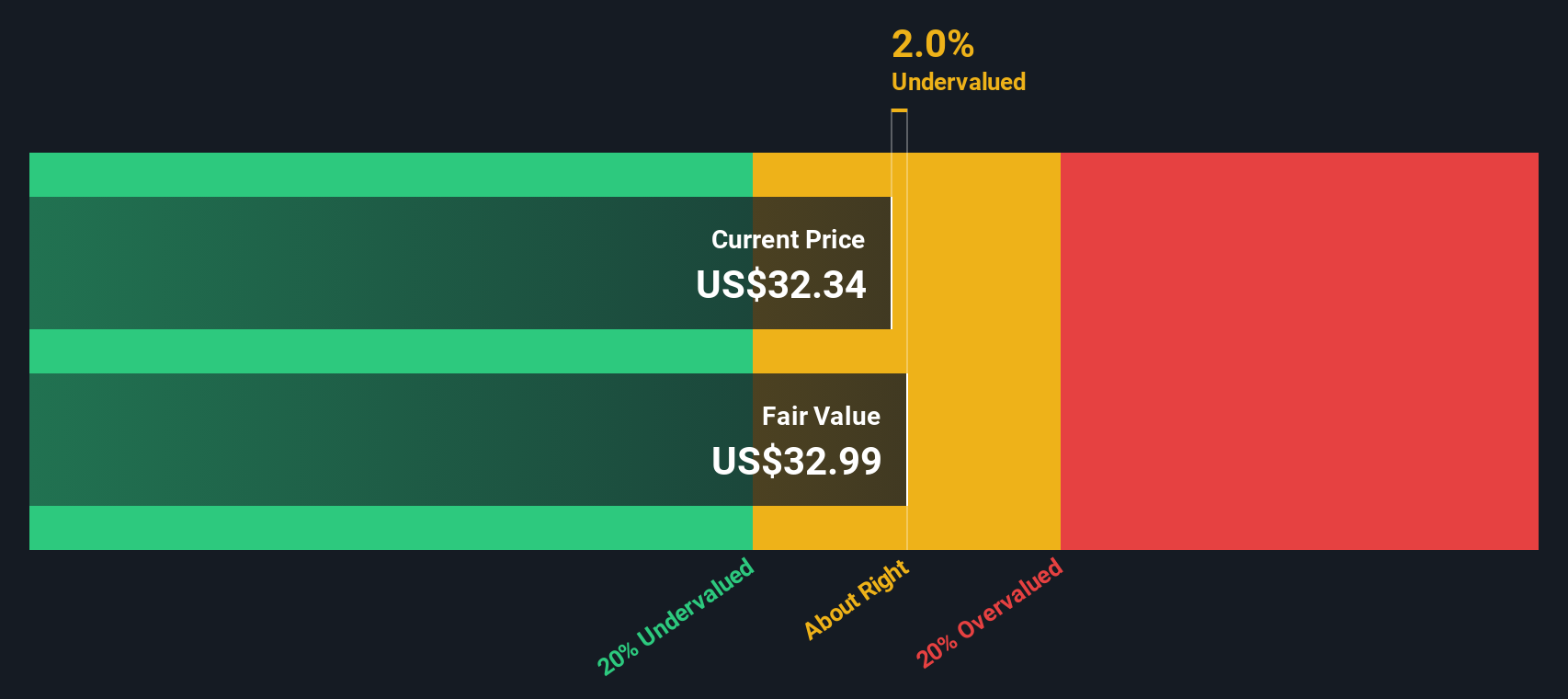

- When it comes to valuation, Carnival Corporation & currently earns a 5 out of 6 on our value checks, indicating it looks attractive on several fronts. Stick around as we break down exactly how that score was calculated using different approaches, and stay tuned for an even smarter way to assess value that could change how you view the stock.

Approach 1: Carnival Corporation & Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the intrinsic value of a company by projecting its future cash flows and discounting them back to today's value. This approach aims to represent what the company could be worth based on its expected ability to generate cash over time.

Carnival Corporation & currently reports a Free Cash Flow (FCF) of about $1.46 Billion. Analyst forecasts suggest the company’s FCF could climb to $3.94 Billion by 2029. The next five years of cash flow projections are mainly based on analyst estimates, which are then extrapolated further into the future. According to these projections, Carnival’s cash flows are expected to show meaningful growth in the coming years.

After running these figures through a 2 Stage Free Cash Flow to Equity model, the estimated fair value for Carnival Corporation & comes to $30.59 per share. This value is about 14.7% higher than the current share price. This suggests the stock trades at a significant discount relative to its projected cash generation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Carnival Corporation & is undervalued by 14.7%. Track this in your watchlist or portfolio, or discover 896 more undervalued stocks based on cash flows.

Approach 2: Carnival Corporation & Price vs Earnings

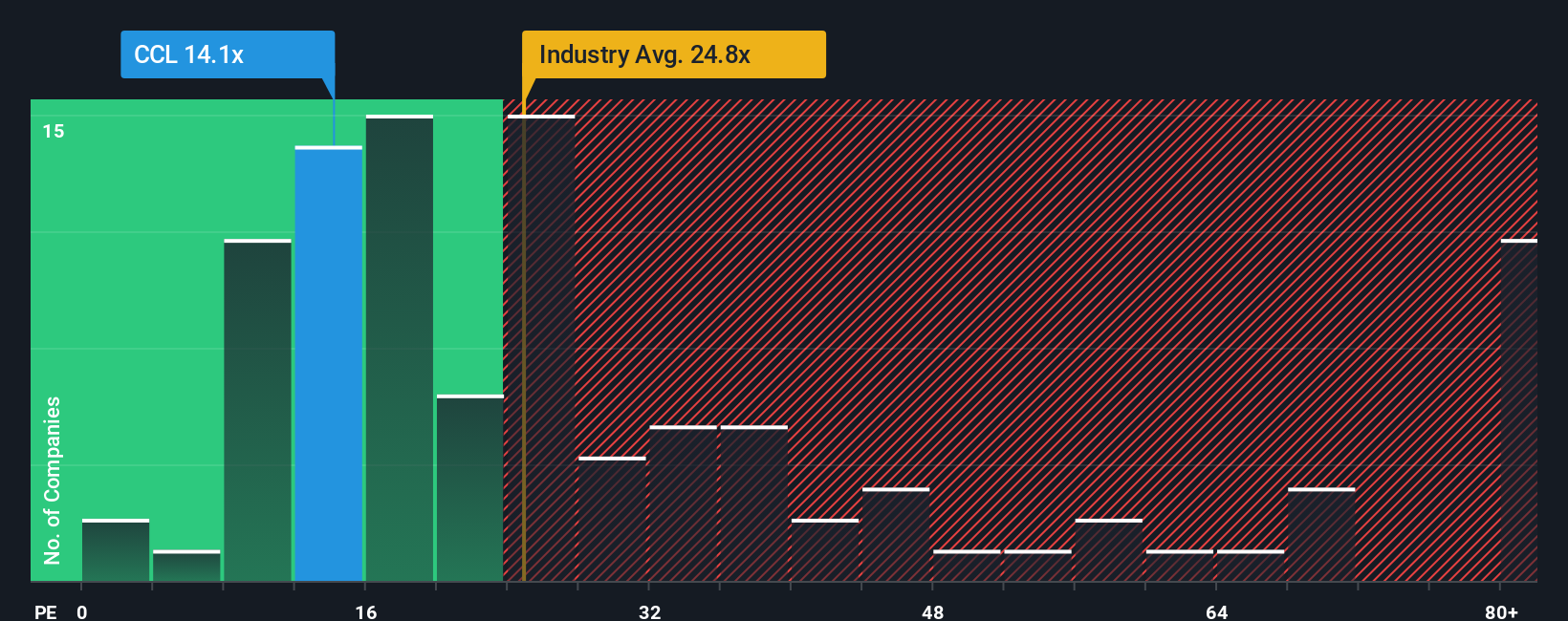

The Price-to-Earnings (PE) ratio is a popular valuation tool for profitable companies like Carnival Corporation & because it links a company’s share price with its per-share earnings. For investors, this makes the PE ratio a straightforward way to gauge whether the market’s expectations align with a company's actual performance.

What counts as a “fair” PE ratio depends on factors such as how quickly a company is expected to grow and how risky its earnings might be. Generally, companies with higher growth prospects or more stable earnings can command higher PE ratios, while those with slower growth or higher risks trade at lower multipliers.

Right now, Carnival Corporation & trades at a PE ratio of 13x. That is notably lower than the Hospitality industry average of 20.7x, as well as the peer average of 22.1x. At first glance, it seems like Carnival could be a bargain compared to similar businesses.

Simply Wall St’s “Fair Ratio” goes a step further than these broad comparisons by tailoring the expected PE multiple for Carnival specifically. The Fair Ratio for Carnival comes out to 27.5x. Unlike the industry average, this metric considers Carnival’s unique combination of earnings growth, profit margins, market capitalization, industry profile, and risk factors. Because it is customized to Carnival’s own fundamentals, the Fair Ratio provides a fuller picture of what investors might reasonably pay for the stock.

Comparing Carnival’s actual PE ratio of 13x to its Fair Ratio of 27.5x suggests the stock is trading well below what is justified by its long-term prospects. This indicates the market may be underestimating the business’s earnings potential.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1416 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Carnival Corporation & Narrative

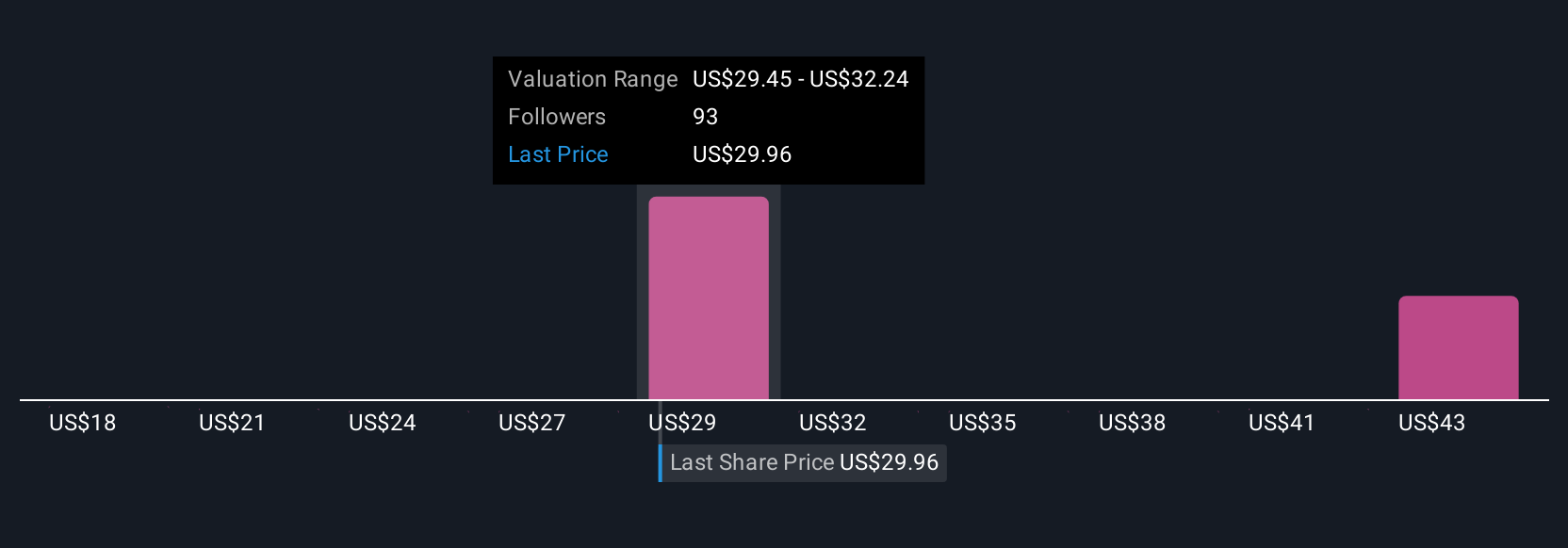

Earlier, we mentioned there's an even better way to understand valuation, so let's introduce you to Narratives, a more powerful and dynamic approach that helps investors connect the dots between a company's story and its numbers.

A Narrative is simply your own perspective or “story” about a company, where you bring together your expectations for future revenue, earnings, and margins, and link them to a financial forecast and fair value.

On Simply Wall St's Community page, used by millions of investors, Narratives make it easy and accessible to create, explore, and share these investment stories so you can see how different viewpoints translate into different fair values for the same company.

Narratives empower you to decide when to buy or sell by comparing your Fair Value to the current market Price. You instantly see if you think the stock is cheap, expensive, or fairly priced, and as new information like news or earnings releases arrives, your Narrative updates automatically so your decisions stay relevant.

For example, one investor may believe Carnival’s expanded destinations and guest loyalty programs will drive sizable revenue growth and raise their fair value target as high as $43.0 per share. Another may focus on debt and competitive headwinds, resulting in a much more conservative view and a price target closer to $24.0. This way, you can choose the Narrative that best fits your outlook.

Do you think there's more to the story for Carnival Corporation &? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CCL

Carnival Corporation &

A cruise company, provides leisure travel services in North America, Australia, Europe, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives