- United States

- /

- Hospitality

- /

- NYSE:CCL

Could Carnival’s (CCL) Focus on Travel Advisors Unlock a New Era of Growth?

Reviewed by Sasha Jovanovic

- Carnival Corporation recently engaged hundreds of travel advisors at CruiseWorld 2025 to unveil updates on six cruise brands, including new ships, itineraries, and innovations across its portfolio.

- A unique takeaway is that Carnival emphasized capturing new-to-cruise customers and strengthening advisor relationships as key drivers behind broadening its reach and sustaining demand momentum.

- We’ll explore how Carnival’s focus on expanding its advisor partnerships and attracting new cruisers could shape its investment outlook.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Carnival Corporation & Investment Narrative Recap

For shareholders, the core belief centers on Carnival's ability to capture strong demand for cruise travel, supported by new destinations, brand innovations, and prudent capacity management, while effectively navigating ongoing financial pressures. The recent engagement with travel advisors at CruiseWorld 2025 strengthens the company’s near-term demand pipeline, but the main short-term catalyst continues to be robust guest bookings for newly launched products; meanwhile, substantial debt and interest expenses remain the most important risk. This news should further support demand but does not materially alter the underlying risk profile.

Among the recent announcements, the introduction of Celebration Key in the Grand Bahama stands out for its relevance: it unlocks an exclusive private island destination for Carnival’s brands in 2025. This move directly addresses passenger demand for curated, memorable experiences and is expected to enhance both guest volumes and onboard revenue, reinforcing one of Carnival’s key growth levers amid heightened competition.

However, investors should also be aware that, despite positive financial momentum, the company’s elevated debt load means any negative shifts in consumer or credit conditions can...

Read the full narrative on Carnival Corporation & (it's free!)

Carnival Corporation & is projected to reach $29.0 billion in revenue and $3.7 billion in earnings by 2028. This outlook is based on an expected 3.8% annual revenue growth rate and a $1.2 billion increase in earnings from the current $2.5 billion.

Uncover how Carnival Corporation &'s forecasts yield a $35.70 fair value, a 34% upside to its current price.

Exploring Other Perspectives

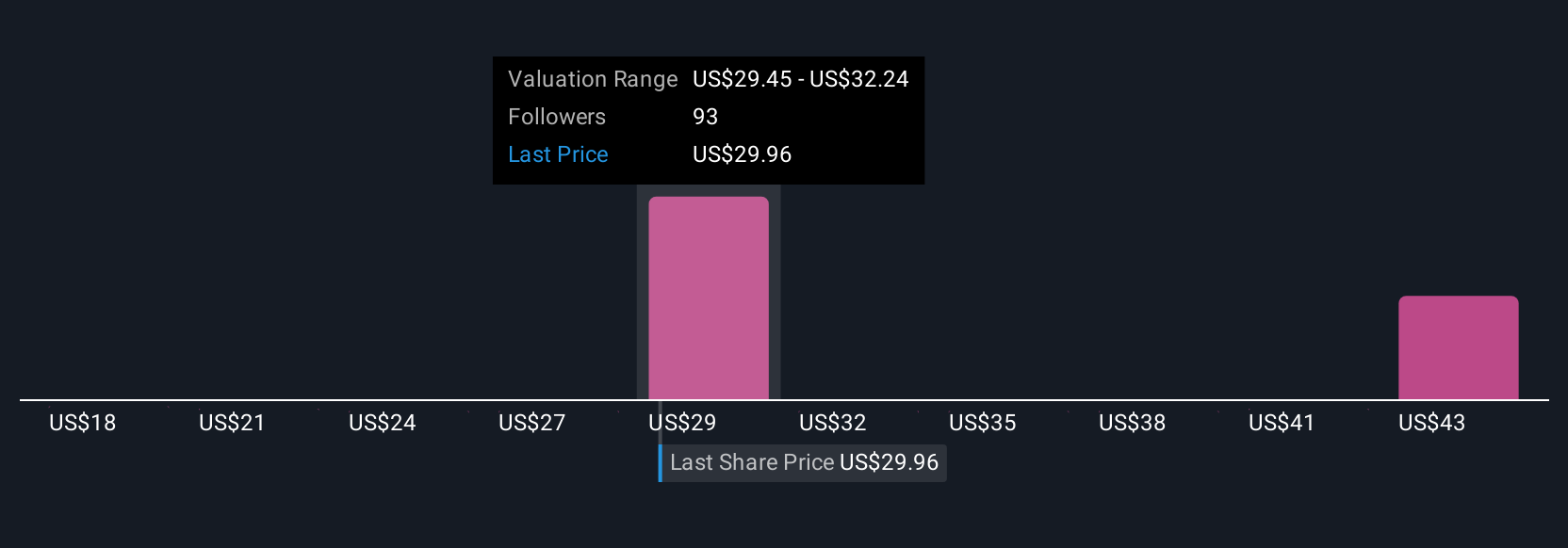

Ten separate fair value estimates from the Simply Wall St Community range from US$24.61 to US$41.57 per share. While investor optimism is apparent, ongoing risks from high capital needs and debt loads could influence Carnival’s performance in the years ahead, be sure to consider a variety of views.

Explore 10 other fair value estimates on Carnival Corporation & - why the stock might be worth as much as 57% more than the current price!

Build Your Own Carnival Corporation & Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Carnival Corporation & research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Carnival Corporation & research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Carnival Corporation &'s overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CCL

Carnival Corporation &

A cruise company, provides leisure travel services in North America, Australia, Europe, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives