- United States

- /

- Hospitality

- /

- NYSE:BRSL

Is Securing the Texas Lottery Extension Reinforcing Brightstar Lottery’s Global Leadership Narrative (BRSL)?

Reviewed by Sasha Jovanovic

- Brightstar Lottery PLC recently announced a two-year contract extension with the Texas Department of Licensing and Regulation, allowing the company to continue supplying lottery technology and services for the Texas Lottery through August 31, 2028.

- The renewal with one of the largest U.S. lottery jurisdictions reinforces Brightstar Lottery's presence in the sector and highlights its role as a key technology partner to major lotteries worldwide.

- We'll explore how securing a long-term Texas Lottery contract extension underlines Brightstar’s revenue stability and global leadership narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Brightstar Lottery Investment Narrative Recap

To see long-term value in Brightstar Lottery, you need to believe that the company’s position as a core technology provider to major lottery jurisdictions, including Texas, can translate into contract-driven revenue visibility, offsetting regulatory and competitive pressures in both the US and abroad. The Texas contract extension signals continued revenue support from a top client, but does not materially change the company’s biggest short-term catalyst, which remains accelerating digital adoption in markets like the US and Italy, nor does it resolve the persistent risk from volatile jackpot-driven earnings swings.

Of recent company updates, Brightstar’s five-year licensing deal with Avanti Licensing Inc. to create lottery games based on their greeting cards is particularly interesting in the context of customer engagement catalysts. While the Texas renewal reinforces core revenues, the Avanti partnership could expand both omni-channel reach and product appeal, aligning with management’s focus on innovation to diversify growth opportunities beyond traditional lottery products.

However, it’s important to remember that beyond contract news and partnerships, periods without large multistate jackpots have already shown that Brightstar’s earnings momentum can be affected by...

Read the full narrative on Brightstar Lottery (it's free!)

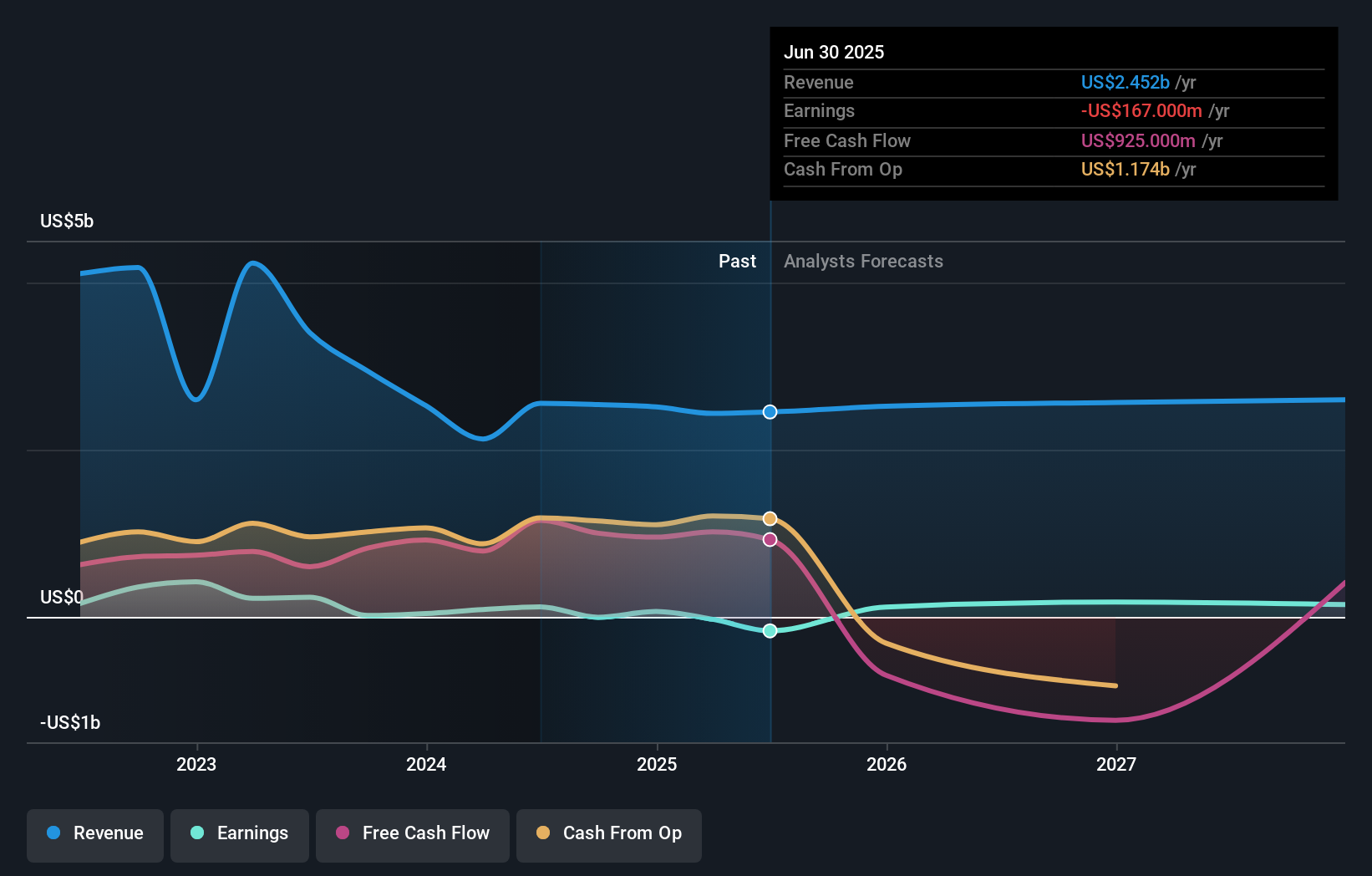

Brightstar Lottery's forecast sees revenues reaching $2.6 billion and earnings of $295.9 million by 2028. This projection assumes a 2.5% annual revenue growth rate and represents a $462.9 million improvement in earnings from the current level of -$167.0 million.

Uncover how Brightstar Lottery's forecasts yield a $19.07 fair value, a 21% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members value the company between US$10.79 and US$19.07, offering two distinct perspectives. Many highlight that contract renewals, while helpful, do not completely offset the unpredictability of jackpot-driven results, which can challenge revenue stability in future years.

Explore 2 other fair value estimates on Brightstar Lottery - why the stock might be worth 31% less than the current price!

Build Your Own Brightstar Lottery Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Brightstar Lottery research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Brightstar Lottery research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Brightstar Lottery's overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brightstar Lottery might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BRSL

Brightstar Lottery

Provides lottery solutions in the United States, Italy, rest of Europe, and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives