- United States

- /

- Hospitality

- /

- NYSE:BRSL

Brightstar Lottery (NYSE:BRSL): Assessing Valuation Following Exclusive Avanti Partnership Announcement

Reviewed by Simply Wall St

Brightstar Lottery (NYSE:BRSL) just announced a five-year exclusive global licensing agreement with Avanti Licensing to create lottery games inspired by Avanti’s humorous greeting cards. This partnership is expected to broaden the company’s product lineup and worldwide reach.

See our latest analysis for Brightstar Lottery.

After a fairly muted first half of the year, Brightstar Lottery’s recent licensing deal comes on the heels of a steady 15.4% share price gain over the past 90 days, hinting at growing investor confidence in its growth potential. Zooming out, the one-year total shareholder return sits at 0.83%. The stock’s 183% five-year total return also stands out for long-term holders. This momentum might be building as new partnerships are announced.

If you’re tracking bold pivots like this, it may be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

The question now is whether Brightstar Lottery’s upward momentum and new partnership signal an undervalued business that investors should consider, or if the current stock price already reflects expectations for future growth.

Most Popular Narrative: 9.3% Undervalued

Brightstar Lottery’s latest closing price sits noticeably below the most popular narrative's fair value. This frames the current run-up in shares as just the beginning and sets the stage for the key catalyst outlined below.

“Ongoing investment in proprietary digital platforms (including the MYLOTTERIES app and integrated OMNIA solution) is reducing customer acquisition costs while bolstering direct-to-consumer engagement, suggesting further net margin expansion as platform scale and technology investments pay off.”

Curious why analysts are backing such a bold upside? The forecast is built on game-changing technology investments, cost-saving moves, and a revenue mix that points to substantial future margins. Want to see the math and assumptions that drive a valuation above what the market is pricing in? Discover what underpins this price target and why it might signal a turning point.

Result: Fair Value of $18.52 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sharper regulatory clampdowns in key markets or an unexpected drop in big jackpot activity could quickly shift the growth outlook for Brightstar Lottery.

Find out about the key risks to this Brightstar Lottery narrative.

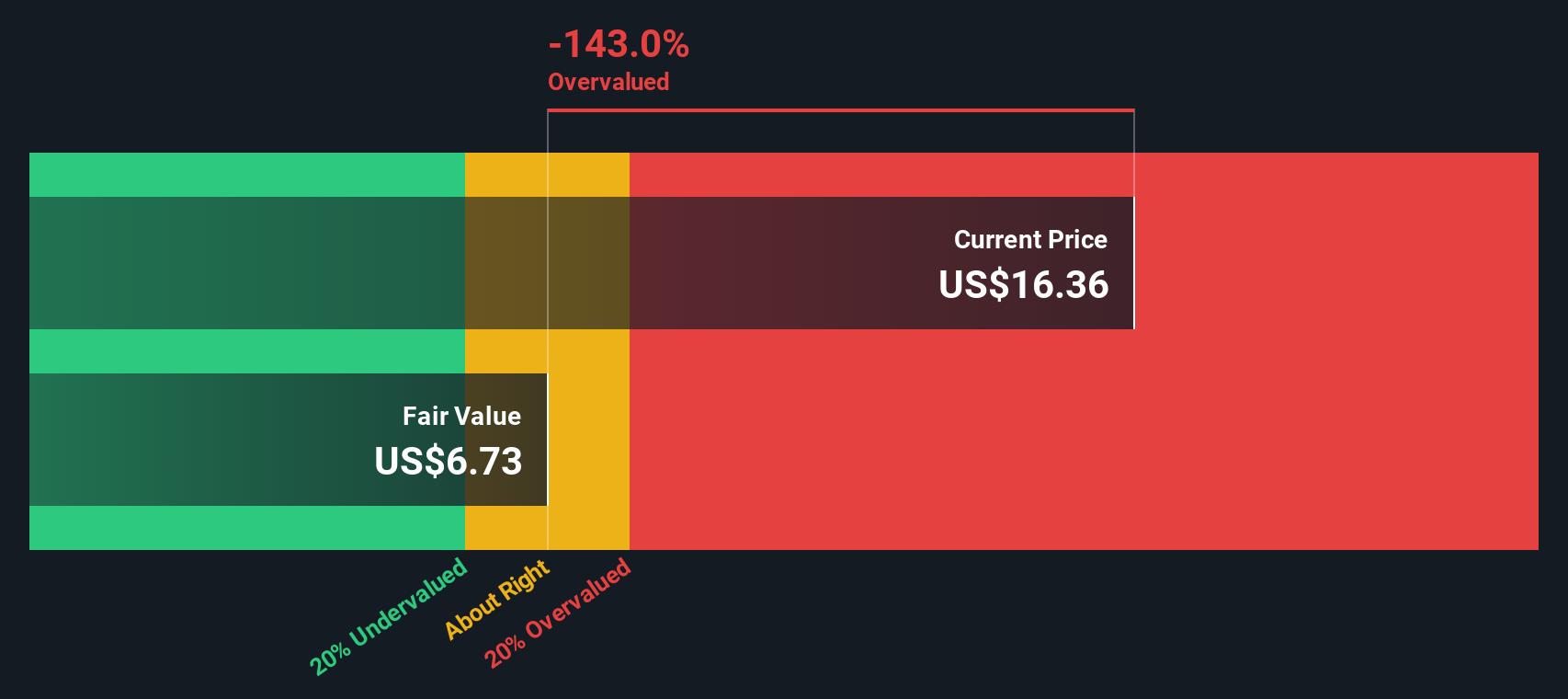

Another View: DCF Valuation Challenges the Case

While narrative-driven estimates suggest Brightstar Lottery is undervalued, our SWS DCF model presents a markedly different perspective. According to this approach, the company is trading above its calculated fair value, raising questions about whether recent optimism and projected growth are already priced in or even overstated. Which lens will prove right as the story unfolds?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Brightstar Lottery for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Brightstar Lottery Narrative

If the current analysis does not align with your perspective, or you want to put your own ideas to the test, you can craft your own view in just a few minutes. Do it your way

A great starting point for your Brightstar Lottery research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Set yourself up for smarter investing choices by tapping into proven strategies and upcoming trends. These tailored opportunities might be exactly what your portfolio needs right now.

- Boost your returns with steady income by targeting these 17 dividend stocks with yields > 3% offering attractive yields above 3% and consistent payout records.

- Stay ahead of the tech curve and invest early in breakthrough advancements with these 27 AI penny stocks showing high-growth potential in artificial intelligence and automation.

- Capitalize on tomorrow's industry leaders by finding value before the crowd. Check out these 868 undervalued stocks based on cash flows trading below their cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brightstar Lottery might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BRSL

Brightstar Lottery

Provides lottery solutions in the United States, Italy, rest of Europe, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives