- United States

- /

- Hospitality

- /

- NYSE:BROS

Will Dutch Bros’ (BROS) New Folsom Lease Reveal Insights About Its Expansion Strategy?

Reviewed by Sasha Jovanovic

- LRE & Co recently announced that Dutch Bros has signed a lease for a new drive-thru coffee shop at 3580 E Bidwell Drive in Folsom, California, with the opening targeted for the second quarter of 2026 and featuring dual drive-thru lanes and walk-up service windows.

- This expansion highlights Dutch Bros' momentum in Northern California and underscores its broader plan to aggressively increase its store footprint and access high-traffic suburban locations.

- We'll explore how the Folsom store lease announcement may influence Dutch Bros' long-term expansion narrative and growth assumptions.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Dutch Bros Investment Narrative Recap

To be a shareholder in Dutch Bros, you need to believe in its ability to scale profitably as it rapidly opens new stores, especially in high-traffic suburban locations. The Folsom drive-thru lease reinforces the company's growth story but does not materially alter the most important short-term catalyst, which remains accelerating same-store sales growth. The biggest risk continues to be potential margin pressure from labor cost inflation if unit expansion outpaces sales gains, and this latest news does little to change that risk profile.

Among recent announcements, the company's revised guidance for full-year 2025, projecting revenue between US$1.59 billion and US$1.60 billion with 4.5% same-store sales growth, is most relevant, as it underscores management's current expectations for scalable revenue against an aggressive store expansion schedule. The Folsom opening is consistent with Dutch Bros' system-wide growth plans that hinge on sustaining profitability while expanding its shop network.

But unlike the headlines, investors should be aware of the risk that labor cost inflation could impact margins if...

Read the full narrative on Dutch Bros (it's free!)

Dutch Bros' narrative projects $2.6 billion revenue and $197.4 million earnings by 2028. This requires 21.8% yearly revenue growth and a $140.2 million earnings increase from $57.2 million today.

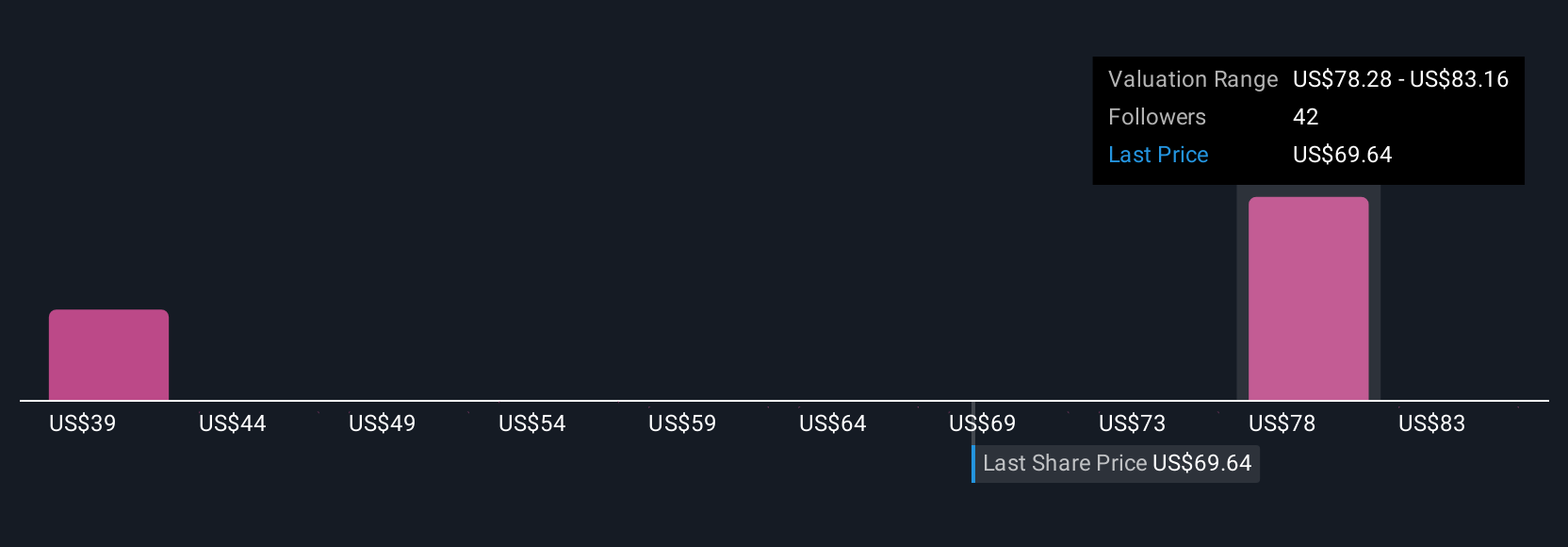

Uncover how Dutch Bros' forecasts yield a $81.59 fair value, a 43% upside to its current price.

Exploring Other Perspectives

Nine individual value estimates from the Simply Wall St Community range from US$51.04 to US$88.05, reflecting wide dispersion in fair value opinions. While some expect accelerating earnings growth to support expansion, others are watching for signs that margin pressures could test recent optimism, be sure to compare these varied viewpoints as you shape your own outlook.

Explore 9 other fair value estimates on Dutch Bros - why the stock might be worth 10% less than the current price!

Build Your Own Dutch Bros Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dutch Bros research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Dutch Bros research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dutch Bros' overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BROS

Dutch Bros

Operates and franchises drive-thru shops in the United States.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives