- United States

- /

- Consumer Services

- /

- NYSE:BFAM

These 4 Measures Indicate That Bright Horizons Family Solutions (NYSE:BFAM) Is Using Debt Reasonably Well

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk'. So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Bright Horizons Family Solutions Inc. (NYSE:BFAM) does carry debt. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

View 1 warning sign we detected for Bright Horizons Family Solutions

How Much Debt Does Bright Horizons Family Solutions Carry?

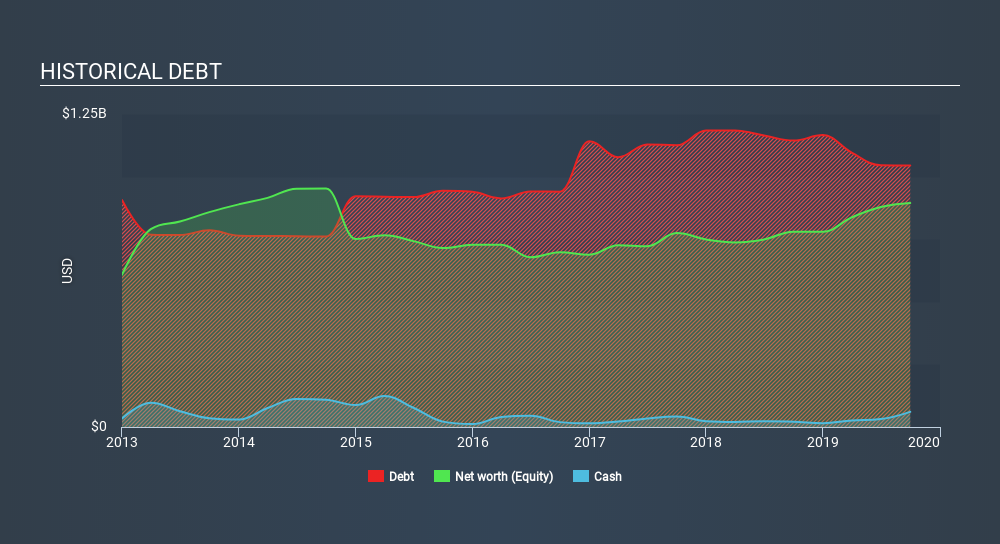

You can click the graphic below for the historical numbers, but it shows that as of September 2019 Bright Horizons Family Solutions had US$1.04b of debt, an increase on US$1.1k, over one year. However, it also had US$60.5m in cash, and so its net debt is US$983.9m.

How Healthy Is Bright Horizons Family Solutions's Balance Sheet?

We can see from the most recent balance sheet that Bright Horizons Family Solutions had liabilities of US$470.0m falling due within a year, and liabilities of US$1.85b due beyond that. On the other hand, it had cash of US$60.5m and US$117.6m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$2.14b.

While this might seem like a lot, it is not so bad since Bright Horizons Family Solutions has a market capitalization of US$8.91b, and so it could probably strengthen its balance sheet by raising capital if it needed to. However, it is still worthwhile taking a close look at its ability to pay off debt.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Bright Horizons Family Solutions has a debt to EBITDA ratio of 2.7 and its EBIT covered its interest expense 5.7 times. This suggests that while the debt levels are significant, we'd stop short of calling them problematic. One way Bright Horizons Family Solutions could vanquish its debt would be if it stops borrowing more but continues to grow EBIT at around 16%, as it did over the last year. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 1 warning sign for Bright Horizons Family Solutions which any shareholder or potential investor should be aware of.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the last three years, Bright Horizons Family Solutions recorded free cash flow worth a fulsome 84% of its EBIT, which is stronger than we'd usually expect. That puts it in a very strong position to pay down debt.

Our View

The good news is that Bright Horizons Family Solutions's demonstrated ability to convert EBIT to free cash flow delights us like a fluffy puppy does a toddler. But truth be told we feel its net debt to EBITDA does undermine this impression a bit. When we consider the range of factors above, it looks like Bright Horizons Family Solutions is pretty sensible with its use of debt. While that brings some risk, it can also enhance returns for shareholders. Of course, we wouldn't say no to the extra confidence that we'd gain if we knew that Bright Horizons Family Solutions insiders have been buying shares: if you're on the same wavelength, you can find out if insiders are buying by clicking this link.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:BFAM

Bright Horizons Family Solutions

Provides early education and childcare, back-up care, educational advisory, and other workplace solutions services for employers and families in the United States, Puerto Rico, the United Kingdom, the Netherlands, Australia, and India.

Solid track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives