- United States

- /

- Consumer Services

- /

- NYSE:BFAM

Is Bright Horizons a Recovery Story After 22% Drop and New Corporate Partnerships in 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with Bright Horizons Family Solutions stock? You're not alone. Whether you already have shares or you’re just getting curious about this company, it’s one of those stocks that invites a lot of questions about whether it’s undervalued, expensive, or maybe somewhere in between. Over the past year, the stock has dropped nearly 22%, which feels like a steep slide. But if we zoom out, you’ll notice it’s actually up more than 88% over the last three years, even after a five-year decline of about 31%. Those kinds of swings can have investors wondering if this is a comeback story in the making, or if caution is warranted given changing risk perceptions in the childcare industry.

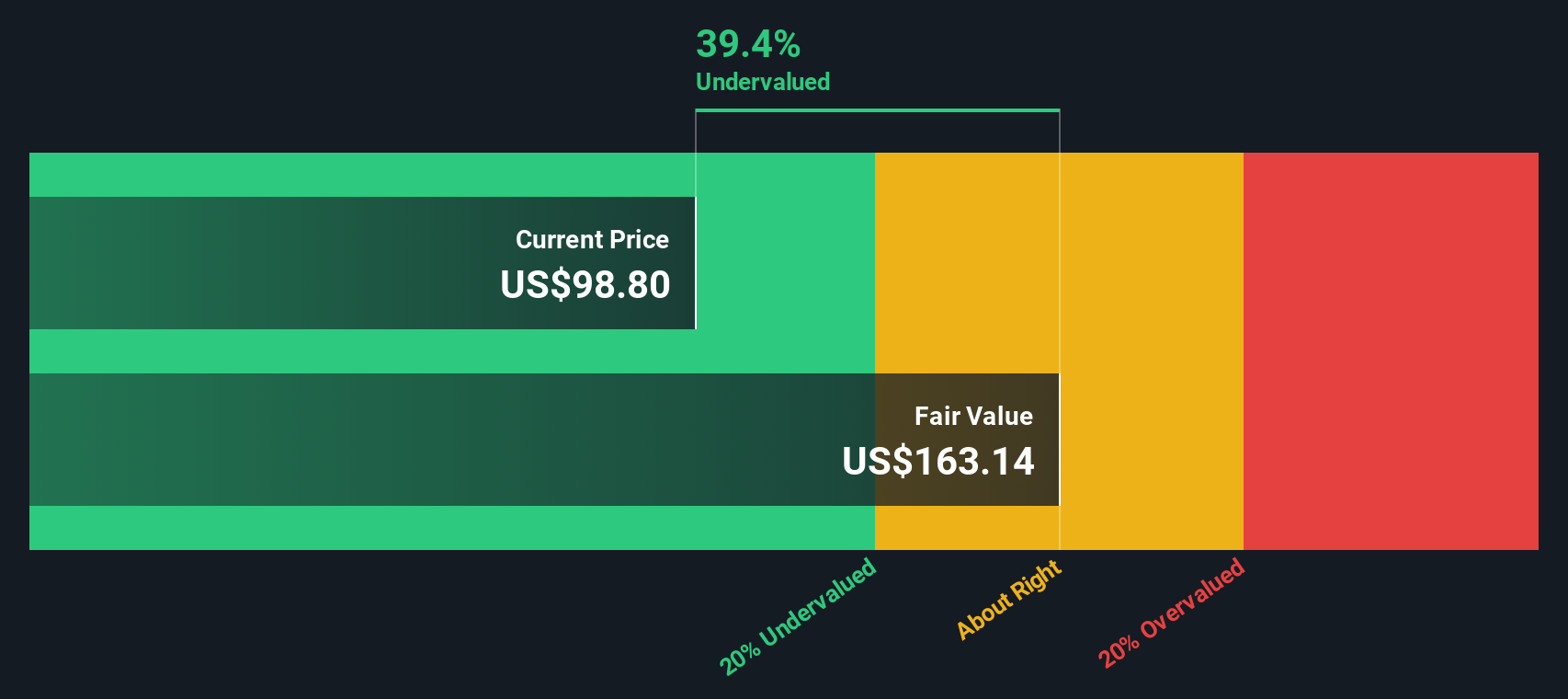

Interestingly, Bright Horizons currently clocks in with a valuation score of 3 out of 6, meaning it looks undervalued in three of the main checks analysts use to gauge price fairness. That’s a mixed signal; enough to catch the eye but not an outright bargain by every standard. These numbers aren’t just a rollercoaster. They reflect how the market views the company’s real potential in a fast-changing economy where demand for family solutions is shifting.

If you’re trying to figure out whether now’s a smart time to invest, stay tuned. Up next, I’ll walk you through how this valuation score is actually calculated using some of the most common methods. And if those numbers still leave you with questions, don’t worry. There’s an even more insightful approach to valuation I’ll reveal at the end.

Why Bright Horizons Family Solutions is lagging behind its peers

Approach 1: Bright Horizons Family Solutions Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a classic approach that estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s dollars. Essentially, this method tries to answer the question: “What is all the company’s future cash flow worth in today’s money?”

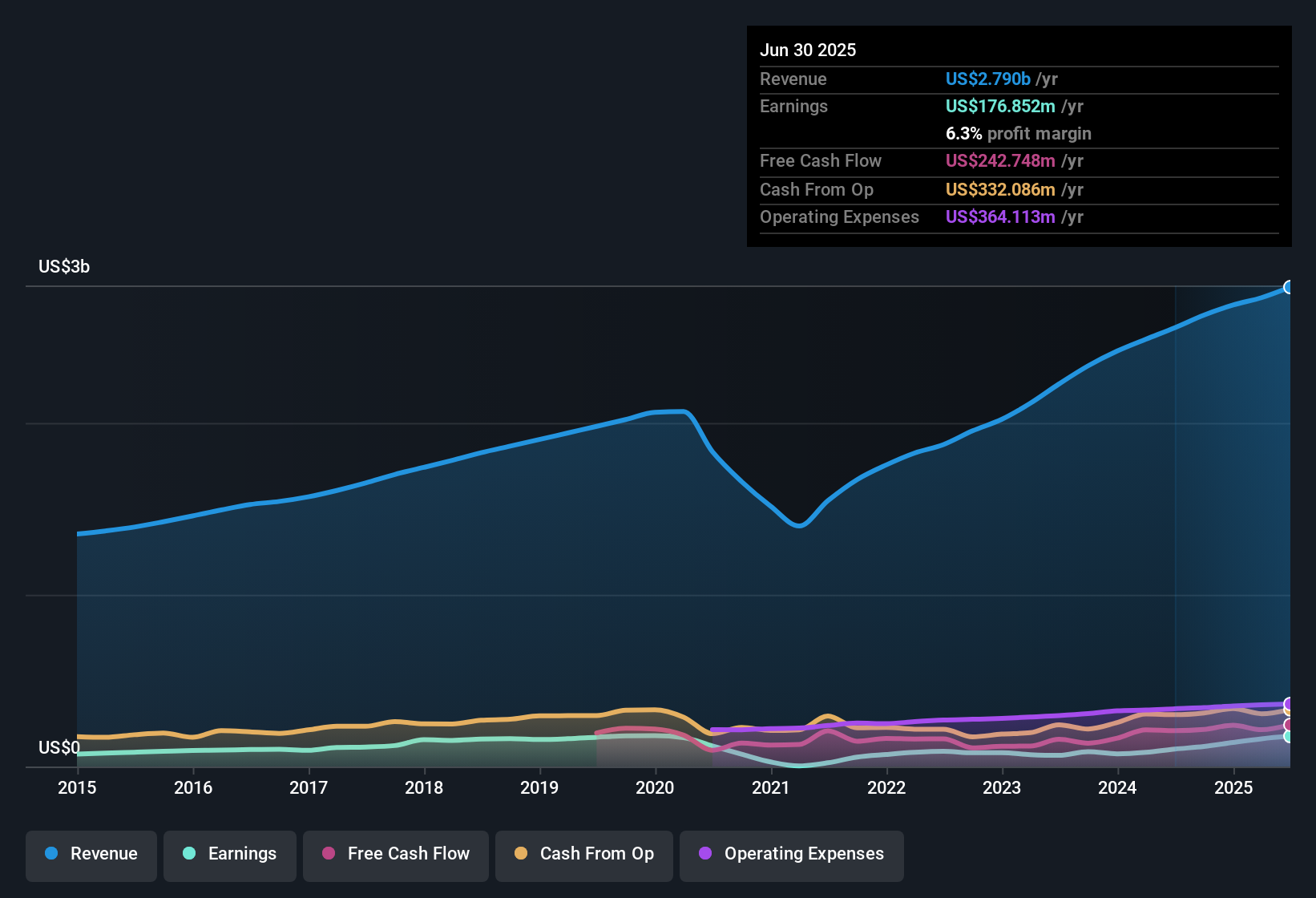

For Bright Horizons Family Solutions, analysts start with the latest twelve months of Free Cash Flow, which stands at $233.8 million. Looking ahead, forecasts suggest this figure will grow steadily, reaching $410 million by 2027. Further projections, extrapolated by Simply Wall St, estimate Free Cash Flow could rise to about $736.6 million by 2035. These ten-year projections, while subject to uncertainty, provide a reasonable window into the company’s potential path.

Using the 2 Stage Free Cash Flow to Equity model, the DCF calculation implies an intrinsic value per share of $208.66. This is a notable difference compared to its recent trading price, meaning the stock appears to be 49.0% undervalued using this method.

This sharp discount suggests the market might be missing something in Bright Horizons’ long-term growth story. For patient investors who believe in the company’s trajectory, the current price could represent an appealing entry point.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Bright Horizons Family Solutions is undervalued by 49.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

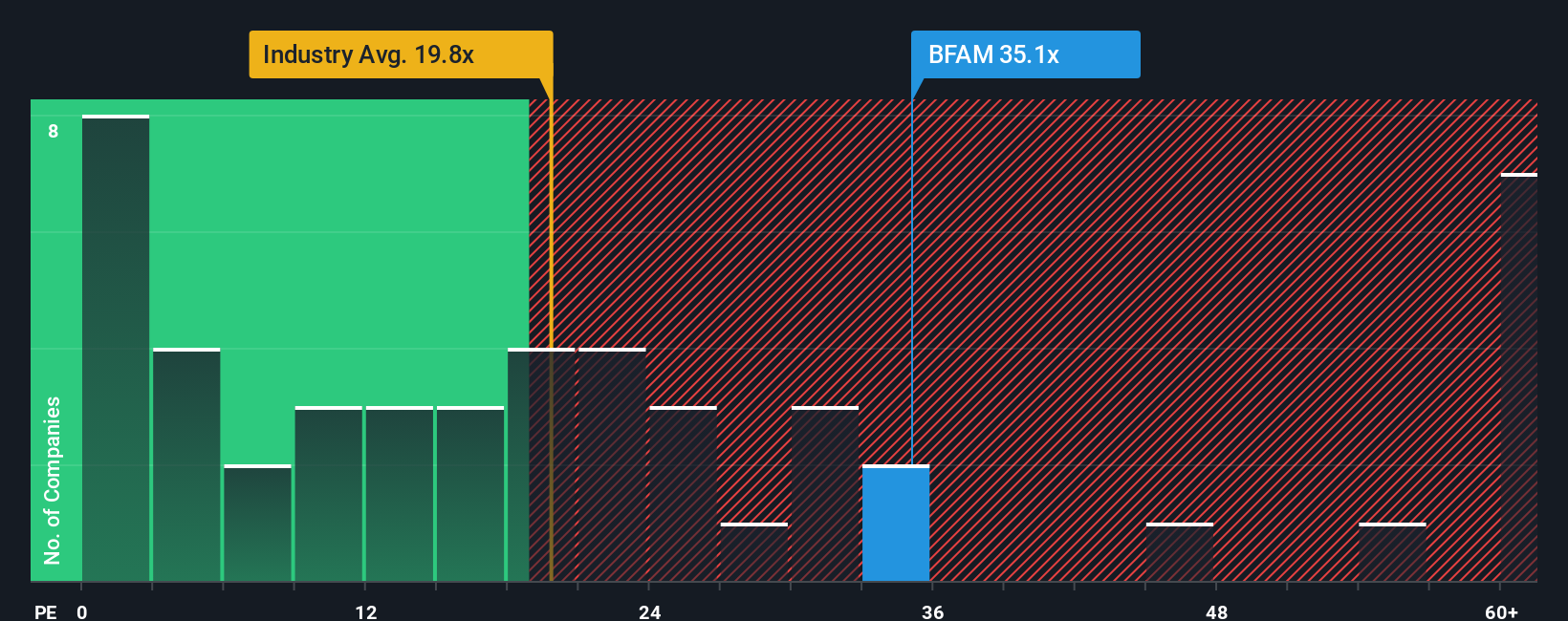

Approach 2: Bright Horizons Family Solutions Price vs Earnings

For profitable companies, the Price-to-Earnings (PE) ratio is a widely used valuation metric because it relates a company's share price to its actual earnings, giving investors a clear sense of how much they're paying for each dollar of profit. PE ratios are especially useful when the business has steady earnings, as is the case with Bright Horizons Family Solutions.

The definition of a "normal" or "fair" PE ratio varies depending on how quickly a company is expected to grow and the perceived risks in its business model. Higher growth expectations can justify higher PE ratios, while companies facing more risk tend to trade at lower multiples.

Bright Horizons currently trades at a PE ratio of 34.2x, which is higher than both the Consumer Services industry average of 18.3x and the peer average of 19.3x. On the surface, this premium suggests investors are pricing in above-average growth or lower risk.

This is where Simply Wall St's proprietary "Fair Ratio" comes into play. The Fair Ratio represents what a reasonable PE multiple should be after accounting for factors such as projected earnings growth, industry norms, profit margins, company size, and specific risks. It offers a more nuanced benchmark than simple peer or industry comparisons and gives investors a valuation tailored to Bright Horizons’ unique business profile.

For Bright Horizons, the Fair Ratio is 26.4x. Based on its current fundamentals and outlook, that is the PE ratio you would expect to see. Comparing this with the company’s actual PE ratio of 34.2x, the stock appears to be overvalued using this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Bright Horizons Family Solutions Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let’s introduce you to Narratives. A Narrative is simply your story behind the numbers, combining your perspective about a company’s outlook with your own assumptions for future revenue, profit margins, and fair value. Narratives help you connect the dots between what’s happening in the business, your forecast for where it’s heading, and what price you think makes sense to pay.

Narratives make investing more accessible by letting you spell out your reasoning and then see exactly how changes in events, news, or earnings affect your story and the company’s Fair Value in real time. On Simply Wall St’s Community page, millions of investors are already using Narratives to compare their view to consensus and keep their thinking up to date whenever new information is available.

For example, two investors looking at Bright Horizons Family Solutions could see very different fair values. One may believe that future expansion and rising profits will justify a $160 share price, while another, concerned about lingering challenges, might see fair value closer to $104. Narratives let you track your own conviction and see when opportunities arise as the gap between Fair Value and the actual price changes.

Do you think there's more to the story for Bright Horizons Family Solutions? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bright Horizons Family Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BFAM

Bright Horizons Family Solutions

Provides early education and childcare, back-up care, educational advisory, and other workplace solutions services for employers and families in the United States, Puerto Rico, the United Kingdom, the Netherlands, Australia, and India.

Solid track record and fair value.

Similar Companies

Market Insights

Community Narratives