- United States

- /

- Consumer Services

- /

- NYSE:ATGE

Adtalem Global Education (NYSE:ATGE): Assessing Valuation as AI Credentials Program with Google Cloud Draws Focus Before Earnings

Reviewed by Simply Wall St

Adtalem Global Education (NYSE:ATGE) has drawn investor interest ahead of its upcoming earnings, but the company’s newly announced AI credentials program for healthcare professionals, launched in partnership with Google Cloud, is also an intriguing development.

See our latest analysis for Adtalem Global Education.

Adtalem’s headline-making push into AI education arrives as the company’s stock consolidates impressive multi-year gains, despite a sharp pullback in the past week. The healthcare educator’s total shareholder return stands at an outstanding 71.75% over the past year and a remarkable 461.91% over five years. This highlights the momentum driving long-term investors, even as short-term volatility increases with recent news and anticipation around earnings.

If the AI credentials launch has you thinking about innovation in education and healthcare, now is the perfect opportunity to see what other healthcare leaders are building. See the full list for free.

With shares trading at a discount to analyst targets and future growth anticipated from both AI-driven initiatives and earnings momentum, the big question remains: is Adtalem still undervalued, or has the market already priced in these opportunities?

Price-to-Earnings of 22x: Is it justified?

Adtalem Global Education trades at a price-to-earnings ratio of 22x, which puts its valuation above the industry standard and most peers at the recent close of $141.04 per share. This signals the market’s willingness to pay a premium for the company’s growth and profitability profile, but also raises questions about whether this premium is fully justified compared to alternatives.

The price-to-earnings (P/E) ratio reflects how much investors are willing to pay for each dollar of current earnings. For a company in the education services space, this metric highlights market expectations about earnings stability and future growth. These two factors are often impacted by regulatory risk and cyclical enrollment trends.

Currently, Adtalem’s P/E stands above both its industry average (19.3x) and the peer average (17.5x). Despite its strong recent earnings growth, the market could be overestimating the company’s ability to maintain or accelerate this trend. When compared to its estimated fair price-to-earnings ratio of 23.5x, however, the stock looks much closer to reasonable value. This implies further upside is possible should performance continue on its current path.

Explore the SWS fair ratio for Adtalem Global Education

Result: Price-to-Earnings of 22x (ABOUT RIGHT)

However, unpredictable regulatory changes or a slowdown in enrollment growth could challenge Adtalem’s current momentum and impact future performance.

Find out about the key risks to this Adtalem Global Education narrative.

Another View: DCF Model Points to Considerable Upside

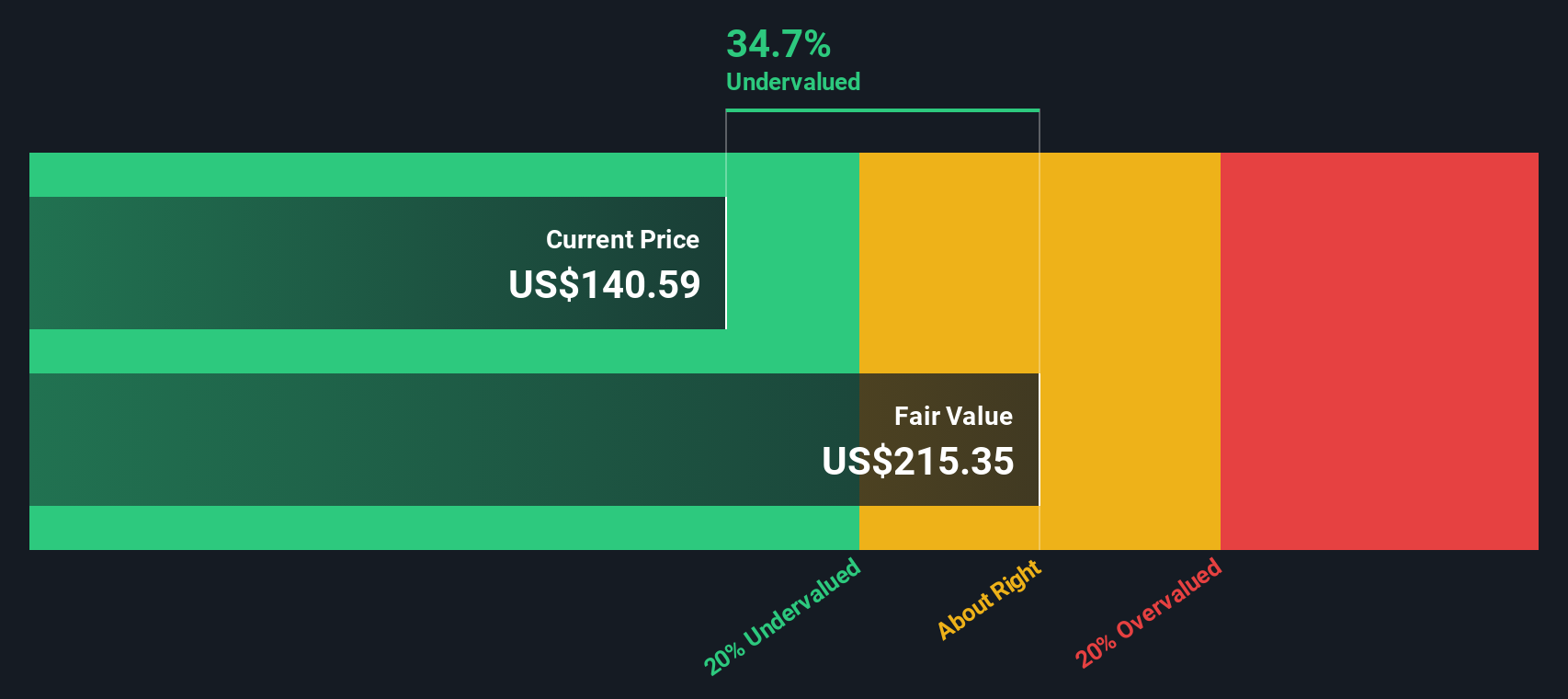

While valuations based on price-to-earnings show Adtalem close to fair value, our DCF model offers a sharply different perspective. The SWS DCF model estimates Adtalem’s fair value at $211.66 per share, which is 33% above the current price. This highlights a potential undervaluation that multiples may overlook. Could the market be underestimating Adtalem's long-term cash flows?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Adtalem Global Education for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Adtalem Global Education Narrative

If you would rather examine the figures and develop your own perspective, you can easily generate a personalized narrative in just a few minutes. Do it your way

A great starting point for your Adtalem Global Education research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for More Smart Investing Moves?

Thousands of investors are already finding their next big opportunity using Simply Wall Street’s powerful Screener. Don’t let another market winner pass you by. These handpicked ideas could change your portfolio’s outlook.

- Accelerate your search for tomorrow’s tech leaders and gain an edge by checking out these 26 AI penny stocks setting the pace in artificial intelligence innovation.

- Secure reliable income streams by reviewing these 21 dividend stocks with yields > 3% offering strong yields and robust fundamentals for consistent long-term returns.

- Get ahead of market shifts and uncover value with these 855 undervalued stocks based on cash flows packed with promising stocks priced below their true potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ATGE

Adtalem Global Education

Provides healthcare education in the United States, Barbados, St.

Solid track record and good value.

Market Insights

Community Narratives