- United States

- /

- Hospitality

- /

- NYSE:ARMK

Aramark (ARMK) Margins Improve to 1.8%, Reinforcing Bullish Narratives on Profitability

Reviewed by Simply Wall St

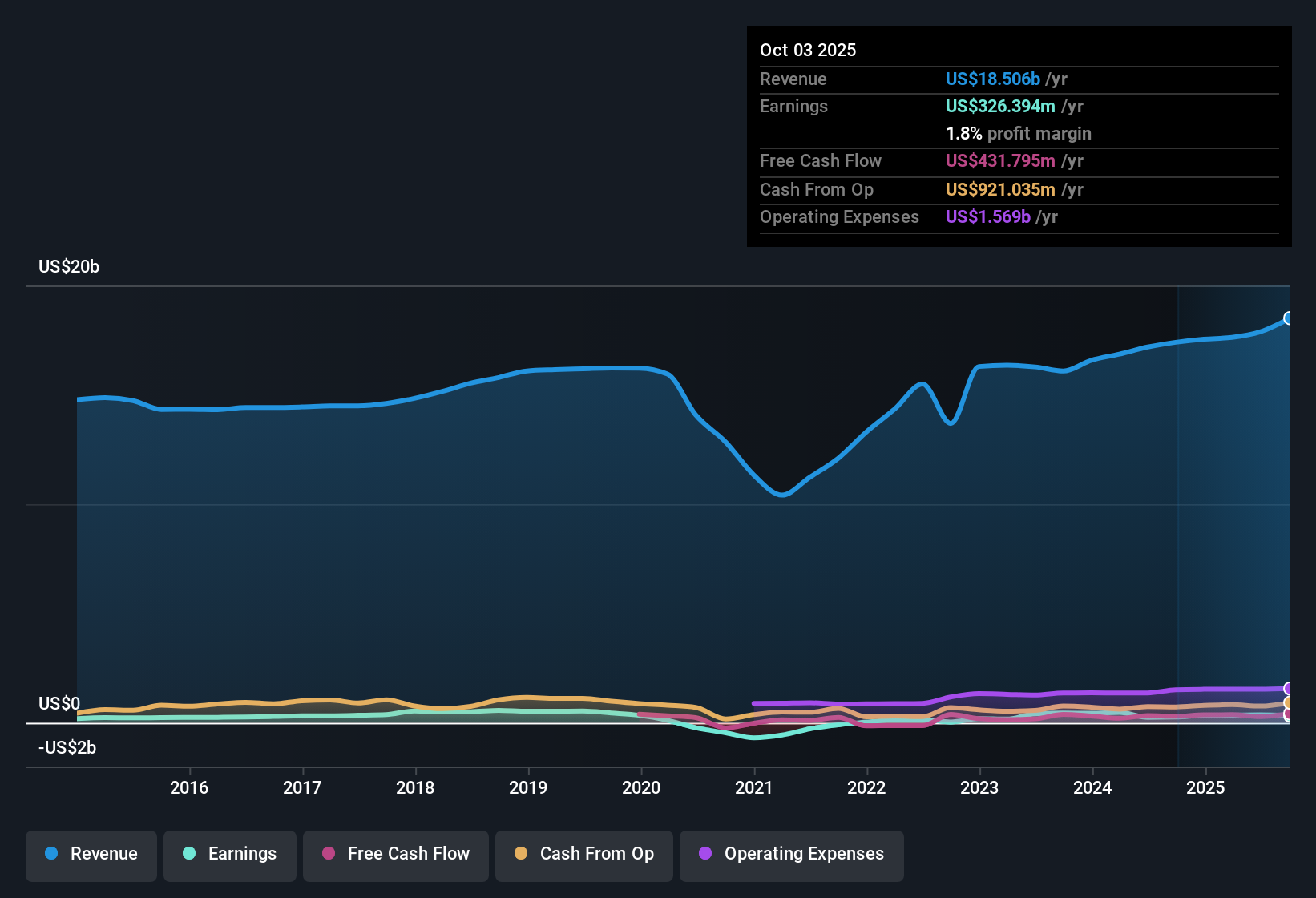

Aramark (ARMK) just posted its fourth quarter results for FY 2025, reporting revenue of $5.0 billion and basic EPS of $0.33, with net income at $87.1 million. Over the past year, the company has seen total revenue climb from $17.4 billion to $18.5 billion. EPS moved up from $1.00 to $1.24. Profit margins ticked up as well, setting up an interesting backdrop for investors weighing growth prospects against financial discipline.

See our full analysis for Aramark.Now, let's see how these numbers line up with the major narratives and expectations shaping market sentiment for Aramark.

See what the community is saying about Aramark

Margin Expansion: 1.8% Net Profit Beats Prior Year

- Net profit margins climbed to 1.8% for the trailing twelve months, up from 1.5% the prior year. This highlights a tangible improvement in operational efficiency.

- Consensus narrative notes that this progress is supported by technology investments and innovative, health-focused offerings. These factors are helping drive year-over-year adjusted operating income gains and positioning Aramark to capture more earnings as new sector contracts, such as Education and Healthcare, come online.

- Analysts highlight the 60 basis point margin boost as evidence that dynamic menu planning and supply chain upgrades are contributing to bottom-line growth. Elevated client retention in key markets signals durability.

- The improvement in net margin, though still thin for the sector, supports the consensus view that margin expansion is becoming a structural tailwind rather than a one-off gain.

It remains to be seen whether this performance can outpace industry competition given Aramark’s unique blend of innovation and sector diversification. 📈 Read the full Aramark Consensus Narrative. 📊 Read the full Aramark Consensus Narrative.

Share Price Tops DCF Fair Value by 18%

- Aramark's share price is $37.30, trading roughly 18% above its estimated DCF fair value of $31.73. It is still below the only permitted analyst price target figure of $44.60.

- Consensus narrative points out that while earnings are forecast to grow at a robust 20.3% per year, the current 30x P/E ratio is elevated for the US Hospitality sector. This suggests investors are pricing in rapid future improvement that has not yet reached the sector’s consistent long-term average.

- With forecasted earnings approaching $695 million by 2028 and shares expected to gradually trade on a lower future P/E, there is tension between current optimism and the rate at which fundamentals can catch up.

- The price-to-earnings premium over industry average keeps long-term focus on Aramark’s need to deliver profit growth and scale margin gains as expected.

Revenue Growth Lags Market, But Outlook Outpaces Sector

- Analysts expect Aramark’s revenue to rise by 5.8% per year, which is slower than the US market’s 10.5%. However, it still indicates stable top-line increases due to strategic contract wins and international expansion.

- Consensus narrative emphasizes that double-digit organic growth in regions like the UK, Chile, and Spain, paired with high client retention in Education, gives Aramark a diversification advantage not easily matched by US-centric peers.

- Despite the slower headline revenue growth, the consensus view sees ongoing sector expansion and urbanization in education and sports steadily fueling overall momentum for several years.

- Outperformance in high-retention segments helps mitigate exposure to cyclical end markets, reinforcing analysts’ positive outlook for future profit stability.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Aramark on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the figures? Add your viewpoint and shape the story in just a few minutes. Do it your way

A great starting point for your Aramark research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

While Aramark's revenue is growing, it lags the broader market and relies on optimistic projections to justify a stretched valuation multiple.

If you're concerned about paying a premium for uncertain growth, discover value-driven companies trading at compelling prices by checking out these 927 undervalued stocks based on cash flows now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ARMK

Aramark

Provides food and facilities services to education, healthcare, business and industry, sports, leisure, and corrections clients in the United States and internationally.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success