- United States

- /

- Hospitality

- /

- NYSE:ARMK

Aramark (ARMK): Exploring Whether Steady Three‑Year Gains Still Leave Upside in the Valuation

Reviewed by Simply Wall St

Aramark (ARMK) has quietly outperformed the broader market over the past 3 years, and that steady climb is getting harder for investors to ignore as its core food and facilities business scales.

See our latest analysis for Aramark.

Over the past year Aramark’s share price return has been modest, but its roughly 31 percent three year total shareholder return shows that steady execution and easing risk concerns have been rewarded over time.

If Aramark’s measured momentum has you thinking about what else is quietly compounding, now is a good moment to explore fast growing stocks with high insider ownership.

With revenue and earnings still growing and the stock trading below consensus targets despite a negative intrinsic value signal, investors face a key question: is Aramark undervalued or is the market already pricing in its future growth?

Most Popular Narrative Narrative: 14.9% Undervalued

With Aramark last closing at $37.97 against a narrative fair value near $44.60, the spread points to meaningful upside if assumptions hold.

Significant investments in technology and AI for dynamic menu planning, supply chain efficiency, and contract management are driving measurable margin expansion, with AOI increasing 60 bps year over year, and expected to continue boosting net margins and profitability over time.

Curious how steady contract wins, rising margins, and a leaner share count combine into that upside case? The narrative leans on ambitious growth, higher profitability, and a richer future earnings multiple, but the exact mix of assumptions might surprise you. Want to see the full financial roadmap behind that valuation gap?

Result: Fair Value of $44.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent labor cost pressures and ongoing contract timing delays could quickly erode margin gains and undermine the carefully staged ramp in earnings for FY26.

Find out about the key risks to this Aramark narrative.

Another View: Rich On Earnings

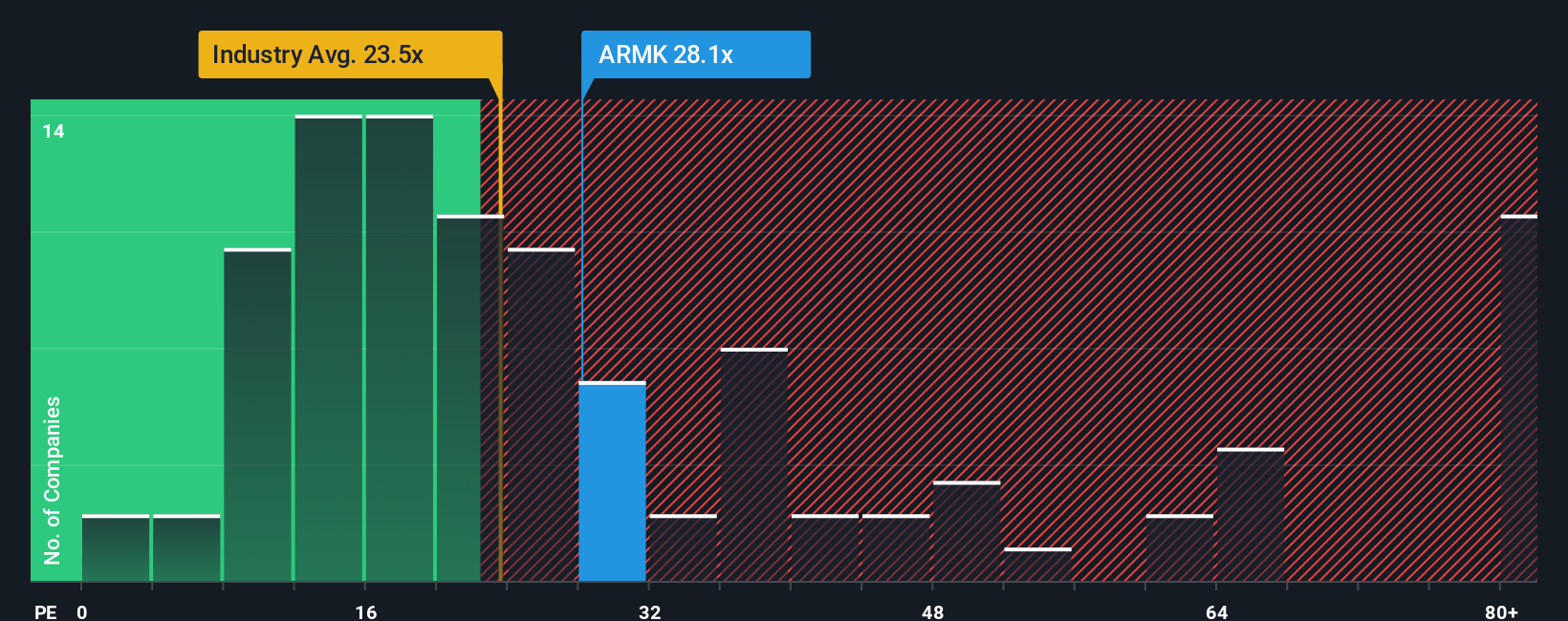

That 14.9 percent upside from the narrative fair value sits awkwardly against Aramark’s current earnings valuation. On a price to earnings ratio of about 30.6 times, the stock trades well above the Hospitality industry near 23.4 times and a fair ratio closer to 24.3 times, which implies the market already prices in a lot of future progress. If sentiment cools before earnings catch up, how comfortable are you holding that multiple risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Aramark Narrative

If you see the story differently or want to test your own assumptions against the numbers, you can quickly craft a custom viewpoint yourself: Do it your way.

A great starting point for your Aramark research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, give yourself the edge by lining up your next opportunity with targeted screens that spotlight different ways to grow and protect your capital.

- Capture potential mispricings by reviewing these 914 undervalued stocks based on cash flows that the market may be overlooking despite strong cash flow support.

- Position for structural change by scanning these 24 AI penny stocks harnessing artificial intelligence to reshape industries and earnings power.

- Boost your income strategy by checking out these 12 dividend stocks with yields > 3% that can add resilient yield to your portfolio while rates and inflation keep shifting.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ARMK

Aramark

Provides food and facilities services to education, healthcare, business and industry, sports, leisure, and corrections clients in the United States and internationally.

Proven track record second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion