- United States

- /

- Consumer Services

- /

- NYSE:ADT

The Bull Case For ADT (ADT) Could Change Following Major Equity Offering and Strong Earnings Report

Reviewed by Simply Wall St

- In late July 2025, ADT Inc. completed a large follow-on equity offering of 71,000,000 shares, raising US$590.01 million, reported second-quarter earnings with higher revenue and net income, provided updated full-year guidance, affirmed its dividend, and concluded a significant share buyback program.

- These events underline a period of active capital management, as ADT both returned capital to shareholders and raised new equity, while announcing improved financial performance and future expectations.

- Let's examine how ADT's simultaneous equity raise and strong earnings report may influence its longer-term investment outlook.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 25 best rare earth metal stocks of the very few that mine this essential strategic resource.

ADT Investment Narrative Recap

ADT’s investment case centers on the company’s ability to defend and expand its core subscriber base while positioning for long-term growth in smart home security and recurring revenues. The recent equity raise and strong earnings report do not materially change ADT’s most immediate catalyst, capital structure management, nor do they immediately resolve the ongoing risks of debt constraints and competitive pressure from lower-cost DIY options.

Among the latest announcements, the completed US$590.01 million equity offering stands out. This move significantly refreshes the company’s balance sheet as it wraps up a major buyback, tying directly into core questions about ADT’s debt management, flexibility for investment, and how well it can support future cash flow and shareholder returns amid evolving industry challenges.

However, it’s worth highlighting for investors that despite these positive signals, the persistent risk regarding ADT’s high debt levels remains one to watch...

Read the full narrative on ADT (it's free!)

ADT's outlook foresees $5.7 billion in revenue and $857.3 million in earnings by 2028. This is based on an annual revenue growth rate of 3.8% and a $217.3 million increase in earnings from the current $640.0 million.

Uncover how ADT's forecasts yield a $9.38 fair value, a 12% upside to its current price.

Exploring Other Perspectives

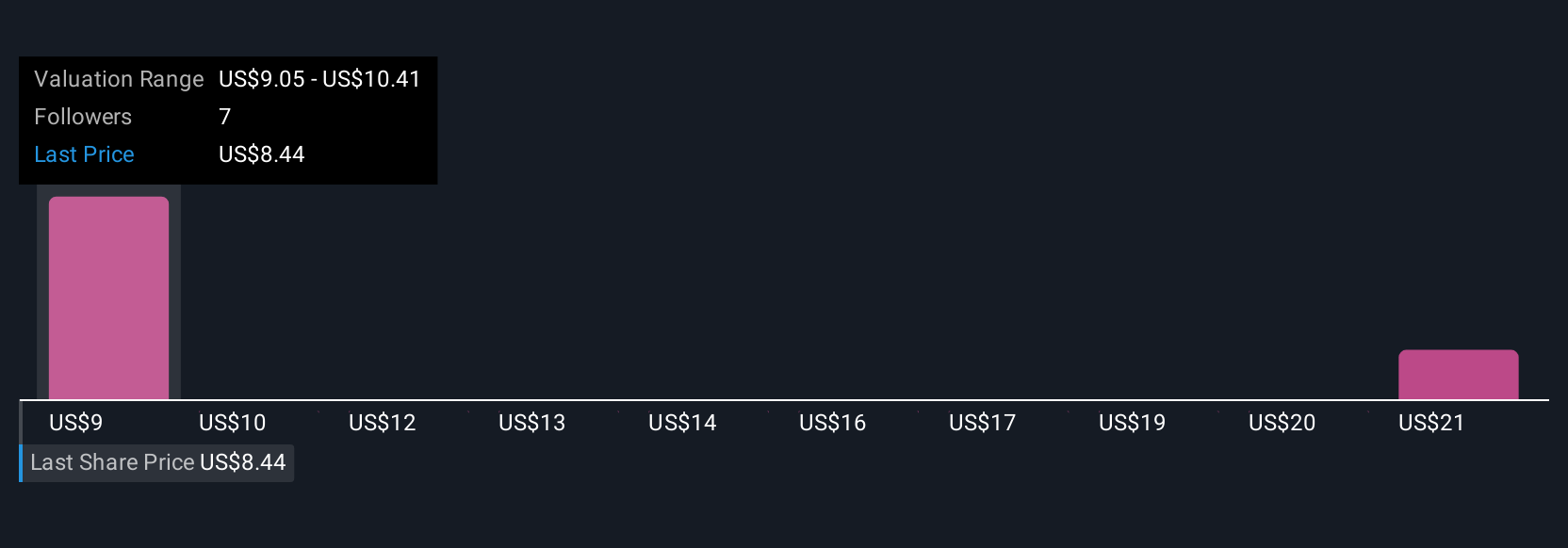

Three distinct fair value estimates from the Simply Wall St Community range from US$9.05 to US$20.63 per share. While opinions are diverse, debt pressure continues to influence the company’s financial flexibility and could shape future expectations, consider exploring several viewpoints for a fuller picture.

Explore 3 other fair value estimates on ADT - why the stock might be worth over 2x more than the current price!

Build Your Own ADT Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ADT research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ADT research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ADT's overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ADT

ADT

Provides security, interactive, and smart home solutions in the United States.

Undervalued with acceptable track record.

Similar Companies

Market Insights

Community Narratives