- United States

- /

- Hospitality

- /

- NYSE:ACEL

Accel Entertainment (ACEL) Net Profit Margin Decline Challenges Bullish Narratives

Reviewed by Simply Wall St

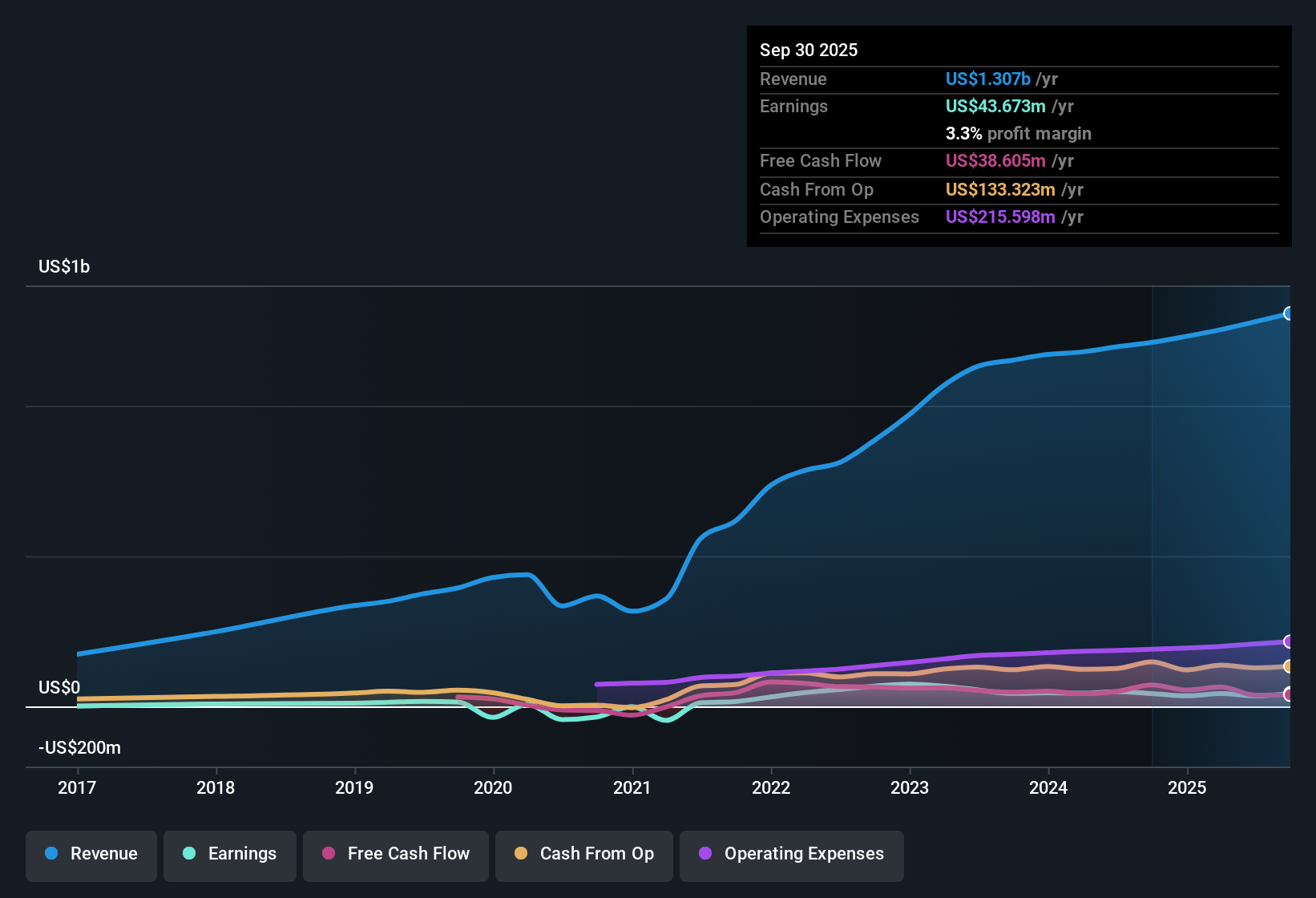

Accel Entertainment (ACEL) reported a net profit margin of 2.8%, down from last year’s 4.1%. Despite achieving an impressive annualized earnings growth rate of 28.9% over the last five years, earnings turned negative in the most recent year, halting positive profit momentum. With revenue projected to grow at 3.8% per year and a price-to-earnings ratio of 24.3x, which is above the US Hospitality industry average, the numbers paint a more cautious outlook, especially given the stock trades above its estimated fair value of $7.4.

See our full analysis for Accel Entertainment.Next, we will stack up these results against the widely followed narratives and test if the latest stats reinforce or challenge prevailing market views.

See what the community is saying about Accel Entertainment

Margin Expansion Targets Face Growing Competitive Pressures

- Analysts expect profit margins to climb from 2.8% today to 7.2% in three years, indicating a strong focus on operational efficiency and scale improvements.

- According to the analysts' consensus view, rising consumer demand, ongoing geographic expansion, and investments in player engagement tech are positioned to drive margin gains and offset competitive threats.

- Margin improvement assumptions hinge on expanding into new markets and increasing terminal numbers. These catalysts depend on successful execution amid growing competition from both established and emerging gaming operators.

- Regulatory approvals, such as allowances for more machines per location in Louisiana, offer room for higher recurring fees. However, integrating acquisitions and optimizing utilization remain critical to achieving projected efficiencies.

- To see how the latest numbers shake up the consensus view and what it could mean for Accel's next big moves, read the full analyst breakdown here. 📊 Read the full Accel Entertainment Consensus Narrative.

Illinois Dependence Heightens Downside Risk

- Revenue and operating margin remain highly reliant on Illinois, exposing the company to significant earnings swings and legislative shifts that could directly impact profitability.

- Bears argue this heavy geographic concentration threatens near-term stability and long-term growth, especially if location-specific risks like customer losses or declining Nevada revenues persist.

- The recent drop in net profit margin from 4.1% to 2.8% suggests pressures may already be materializing. This sharpens focus on how quickly Accel can diversify earnings streams beyond its core markets.

- Ongoing capital spending needs for expansion and property upgrades add to execution risk. Underperformance could further weigh on margins and free cash flow.

Valuation Premium Versus Industry and Fair Value

- The current share price of $10.14 stands well above the DCF fair value estimate of $7.40 and results in a 24.3x price-to-earnings ratio, which is higher than the industry average but below direct peers.

- Analysts' consensus suggests that to justify the $16.00 price target, Accel would need to achieve $1.5 billion in revenues and $107.3 million in earnings by 2028, easing down to an 18.0x PE. This path depends on delivering projected growth while mitigating competitive and concentration risks.

- While sector multiples remain supportive, slower forecasted revenue growth of 3.8% per year versus the broader US market's 10.5% adds pressure for consistent outperformance or evidence of sustained margin expansion to warrant the premium valuation.

- Trading above both fair value and industry average raises the stakes for execution. Any slip in delivering on margin expansion could trigger a re-rating toward the sector mean.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Accel Entertainment on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a distinct take on these results? Take just a few minutes to build your own story and share how you interpret the data. Do it your way

A great starting point for your Accel Entertainment research is our analysis highlighting 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite past growth, Accel Entertainment’s slim profit margins, valuation premium, and reliance on one state could put future returns at risk if execution falters.

Focus on greater value and less market risk by scanning these 836 undervalued stocks based on cash flows to find companies offering strong fundamentals without the worry of overpaying or stretched expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ACEL

Accel Entertainment

Operates as a distributed gaming and local entertainment operator in the United States.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives