- United States

- /

- Hospitality

- /

- NasdaqGS:WEN

Does Wendy's Recent 49% Stock Drop Signal an Opportunity in 2025?

Reviewed by Bailey Pemberton

- Thinking about whether Wendy's is a deal or a dud? You're not alone, especially if you're hunting for value picks with potential for a rebound.

- The stock has taken a sizable hit lately, falling 7.0% in the past week and finishing 2024 so far down nearly 49%.

- Fueling investor discussions recently, news of increased competition in the fast food space and shifting consumer trends has put the spotlight on Wendy's strategy. Headlines have focused on the company's efforts to refresh its menu and ramp up international growth, which could help explain some of the recent share price moves.

- By our count, Wendy's earns a valuation score of 5 out of 6 for being undervalued. This is solidly above average, but will it hold up under more scrutiny? Let's dig into the nuts and bolts of how Wendy's is being valued right now, and at the end, we'll show you a smarter way to look at value than just by the numbers.

Find out why Wendy's's -51.7% return over the last year is lagging behind its peers.

Approach 1: Wendy's Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a classic valuation tool. It projects a company's future cash flows and then discounts them back to today's value, providing an estimate of what the business is truly worth right now. This approach helps investors assess whether a stock is priced attractively given expected performance.

For Wendy's, the most recent reported Free Cash Flow stands at $250.6 million. Looking ahead, analysts see modest growth, with projections of Free Cash Flow reaching $253 million by 2027. Beyond these expert estimates, further growth in the following years is extrapolated. Simply Wall St suggests Free Cash Flow could reach about $306 million in 2035.

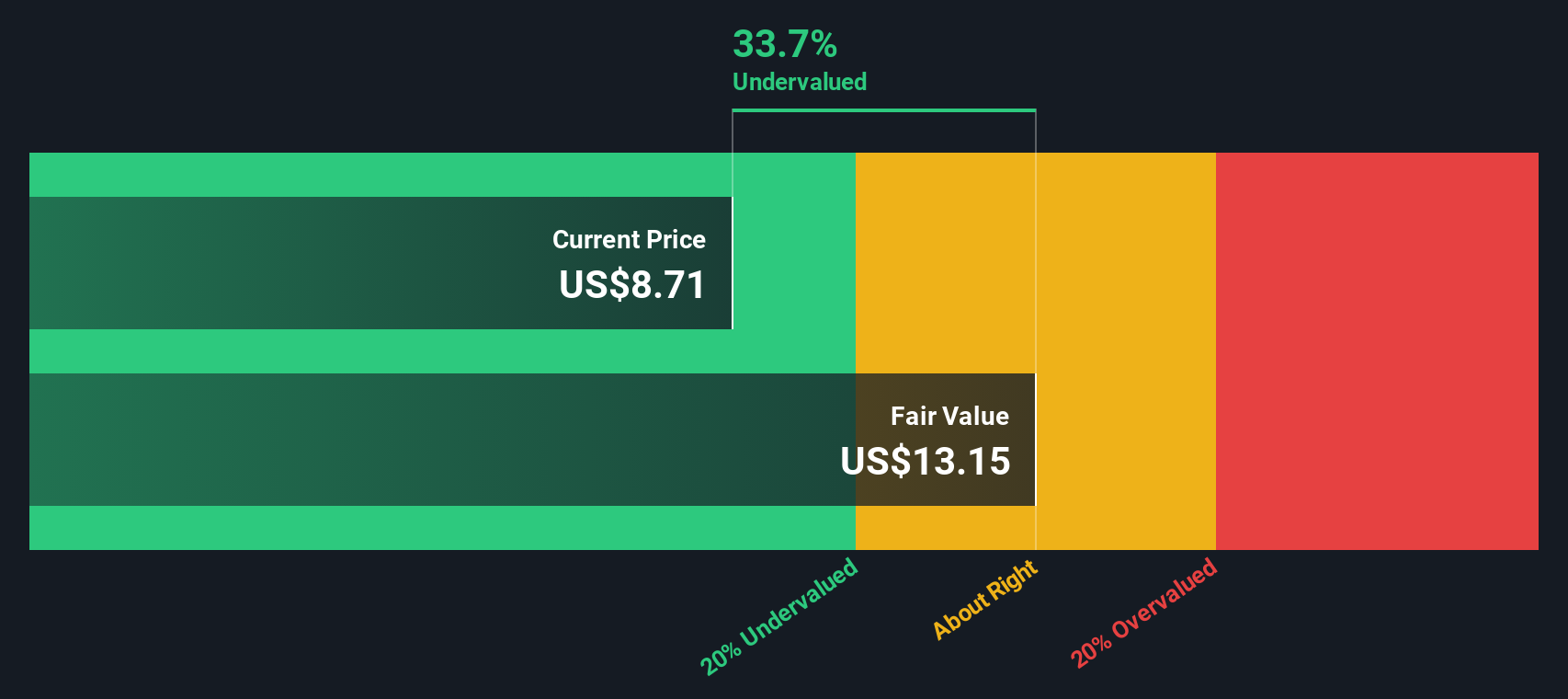

Taking into account all these projected future cash flows and applying the appropriate discount rates, the DCF model arrives at an estimated intrinsic value for Wendy's stock of $13.22 per share. When compared to the current share price, the analysis suggests the stock is trading at a 37.7% discount to its fair value. This result indicates the market may be undervaluing Wendy's future earnings potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Wendy's is undervalued by 37.7%. Track this in your watchlist or portfolio, or discover 908 more undervalued stocks based on cash flows.

Approach 2: Wendy's Price vs Earnings

The Price-to-Earnings (PE) ratio is often the go-to method for valuing profitable companies like Wendy's, as it directly relates the stock price to the company’s earnings power. A lower PE ratio can signal the stock is cheap compared to its earnings, while a higher PE might indicate optimism or higher growth expectations.

The "normal" or fair PE ratio for a company is influenced by factors such as its growth prospects and risk profile. Companies with strong earnings growth or stable business models generally deserve higher PE ratios, while riskier or slower-growing firms trade at lower multiples.

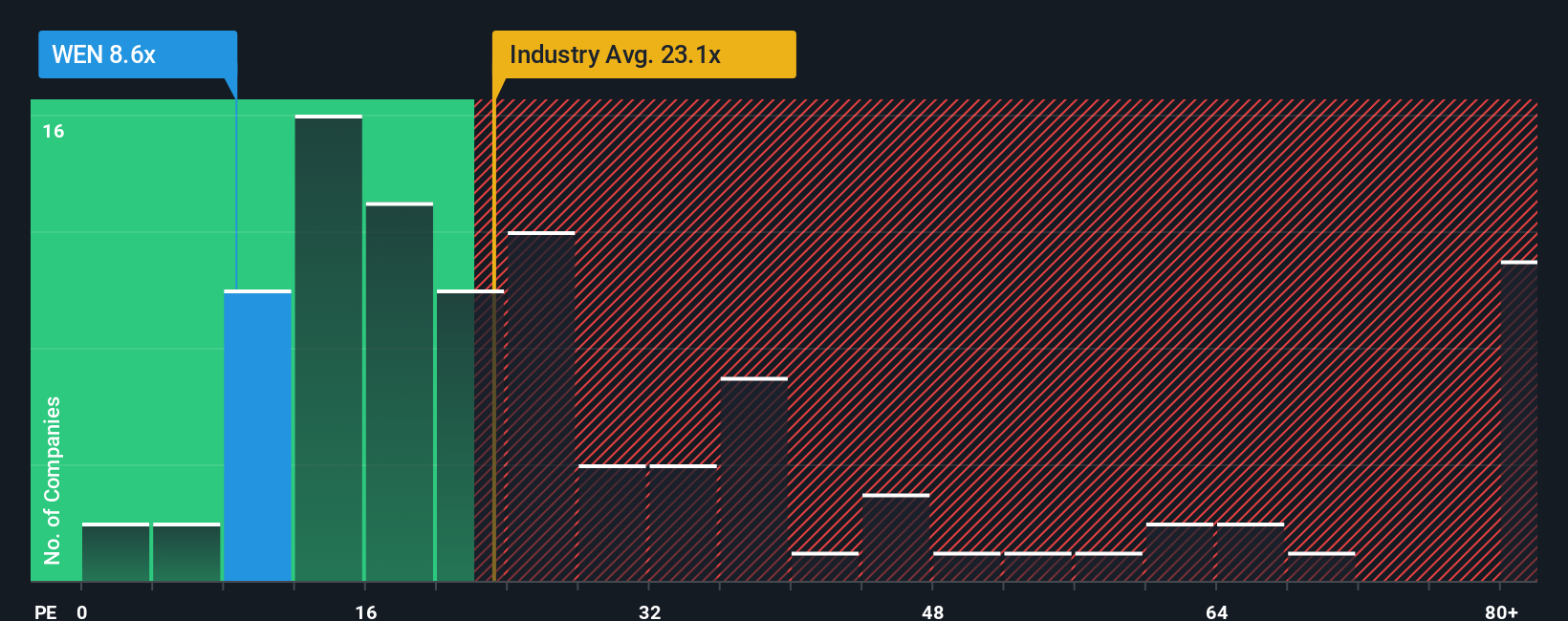

Wendy's currently trades at a PE ratio of 8.4x. This is much lower than both the average for its hospitality industry peers at 18.9x and the industry average itself, which sits even higher at 20.8x. At first glance, this significant discount could suggest the stock is undervalued, but raw PE comparisons can be misleading.

Simply Wall St's proprietary "Fair Ratio" is designed to reflect what Wendy’s true PE should be, considering not just peer or industry averages, but also its expected earnings growth, profit margins, risks, industry dynamics, and size. This makes it a more comprehensive benchmark compared to simply comparing ratios side by side.

For Wendy's, the Fair Ratio is estimated at 15.0x, well above its actual PE of 8.4x. This wide gap highlights a strong case that Wendy's is currently trading at a bargain price relative to its expected performance and risk profile.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1421 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Wendy's Narrative

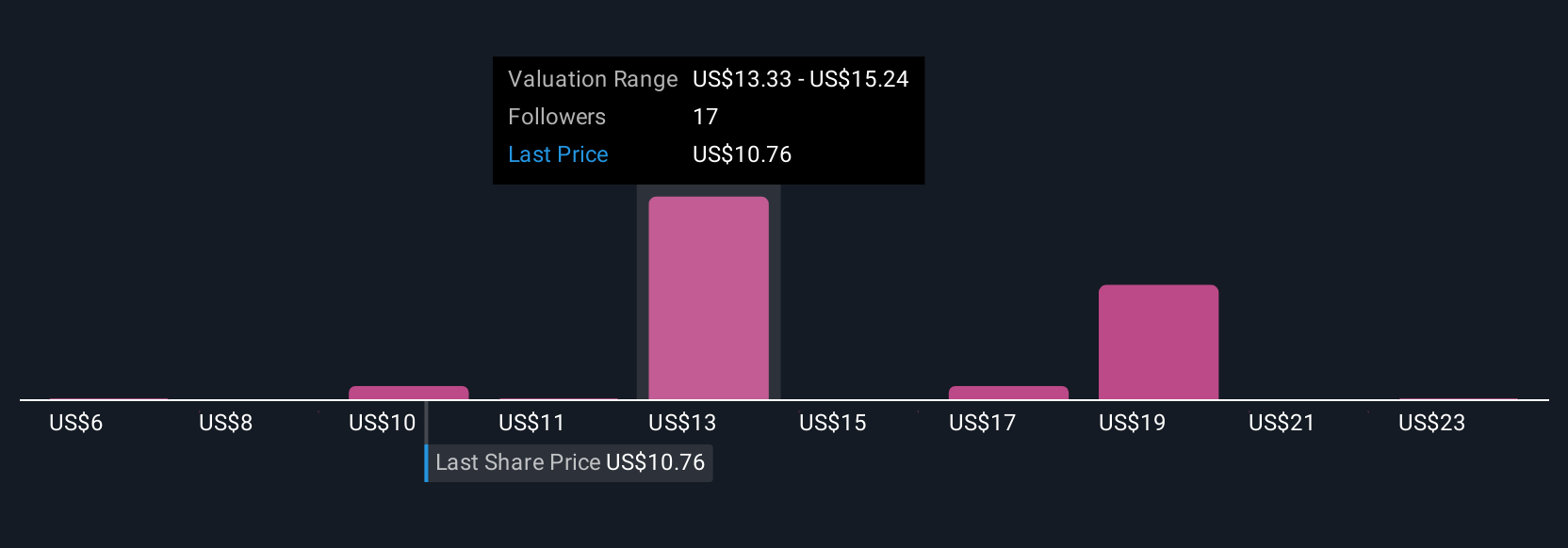

Earlier, we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative connects the story you believe about a company, such as your perspective on Wendy’s digital strategy or menu innovation, to your own financial forecast. This results in a personal estimate of fair value. Instead of relying only on industry averages or static models, Narratives make it simple for anyone to blend their insights on future revenue, profit margins, and risks into a dynamic valuation.

On Simply Wall St’s platform, Narratives are accessible to millions of investors via the Community page. This empowers you to see how others are interpreting the company’s potential alongside your own. Narratives help you decide when to buy or sell by continually comparing your personal Fair Value to the latest Price, and they update automatically as fresh news or earnings are released, so your analysis stays relevant.

For example, with Wendy’s, some investors have developed bullish Narratives, expecting strong margin growth and pricing shares as high as $18.50. More cautious Narratives price in risk from weak consumer trends and estimate fair value closer to $10.00. Whichever story you believe, Narratives let you invest with confidence and clarity, matching your decisions to your unique outlook on Wendy’s future.

Do you think there's more to the story for Wendy's? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wendy's might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WEN

Wendy's

Operates as a quick-service restaurant company in the United States and internationally.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives