- United States

- /

- Consumer Services

- /

- NasdaqCM:WAFU

We're Not Worried About Wah Fu Education Group's (NASDAQ:WAFU) Cash Burn

Just because a business does not make any money, does not mean that the stock will go down. By way of example, Wah Fu Education Group (NASDAQ:WAFU) has seen its share price rise 578% over the last year, delighting many shareholders. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

In light of its strong share price run, we think now is a good time to investigate how risky Wah Fu Education Group's cash burn is. In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

Check out our latest analysis for Wah Fu Education Group

How Long Is Wah Fu Education Group's Cash Runway?

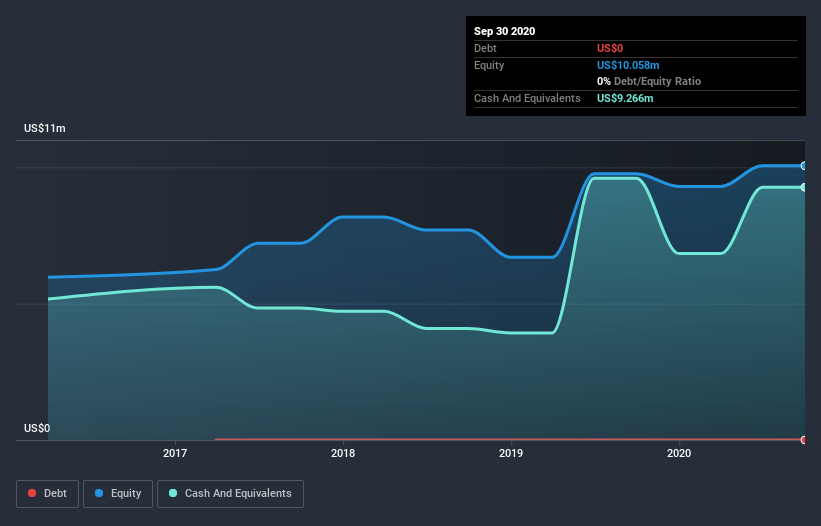

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. In September 2020, Wah Fu Education Group had US$9.3m in cash, and was debt-free. Importantly, its cash burn was US$278k over the trailing twelve months. That means it had a cash runway of very many years as of September 2020. While this is only one measure of its cash burn situation, it certainly gives us the impression that holders have nothing to worry about. You can see how its cash balance has changed over time in the image below.

Is Wah Fu Education Group's Revenue Growing?

We're hesitant to extrapolate on the recent trend to assess its cash burn, because Wah Fu Education Group actually had positive free cash flow last year, so operating revenue growth is probably our best bet to measure, right now. We think that it's fairly positive to see that revenue grew 50% in the last twelve months. In reality, this article only makes a short study of the company's growth data. You can take a look at how Wah Fu Education Group is growing revenue over time by checking this visualization of past revenue growth.

How Hard Would It Be For Wah Fu Education Group To Raise More Cash For Growth?

Notwithstanding Wah Fu Education Group's revenue growth, it is still important to consider how it could raise more money, if it needs to. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Many companies end up issuing new shares to fund future growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Wah Fu Education Group's cash burn of US$278k is about 0.5% of its US$55m market capitalisation. That means it could easily issue a few shares to fund more growth, and might well be in a position to borrow cheaply.

How Risky Is Wah Fu Education Group's Cash Burn Situation?

As you can probably tell by now, we're not too worried about Wah Fu Education Group's cash burn. In particular, we think its cash runway stands out as evidence that the company is well on top of its spending. And even its cash burn relative to its market cap was very encouraging. Taking all the factors in this report into account, we're not at all worried about its cash burn, as the business appears well capitalized to spend as needs be. On another note, Wah Fu Education Group has 3 warning signs (and 1 which is a bit unpleasant) we think you should know about.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

When trading Wah Fu Education Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Wah Fu Education Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:WAFU

Wah Fu Education Group

Through its subsidiaries, provides online exam preparation services and related technology solutions in the People’s Republic of China.

Mediocre balance sheet with very low risk.

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success