- United States

- /

- Consumer Services

- /

- NasdaqGS:UDMY

Udemy (UDMY) Valuation: Reassessing Opportunity After Quarterly Profit Beat and Cautious Outlook

Reviewed by Simply Wall St

Udemy (UDMY) shares moved after the company released its third quarter results, with investors weighing a sizable improvement in adjusted profit against nearly unchanged sales. The company’s revenue outlook for the next quarter came in slightly below expectations.

See our latest analysis for Udemy.

Udemy’s share price has taken quite a hit over the past few months, sliding 23% in the last quarter alone and leaving its year-to-date share price return at -31%. Recent quarterly gains in earnings and the company’s completed buyback gave only a brief lift, as investor concerns about softer guidance and slowing sales have dominated the tone. With a one-year total shareholder return of -29% and three-year performance even lower, momentum is fading for now. However, Udemy’s shift to a recurring revenue model could change the narrative if margin improvements persist.

If Udemy’s story has you rethinking your portfolio, this could be the perfect moment to discover fast growing stocks with high insider ownership.

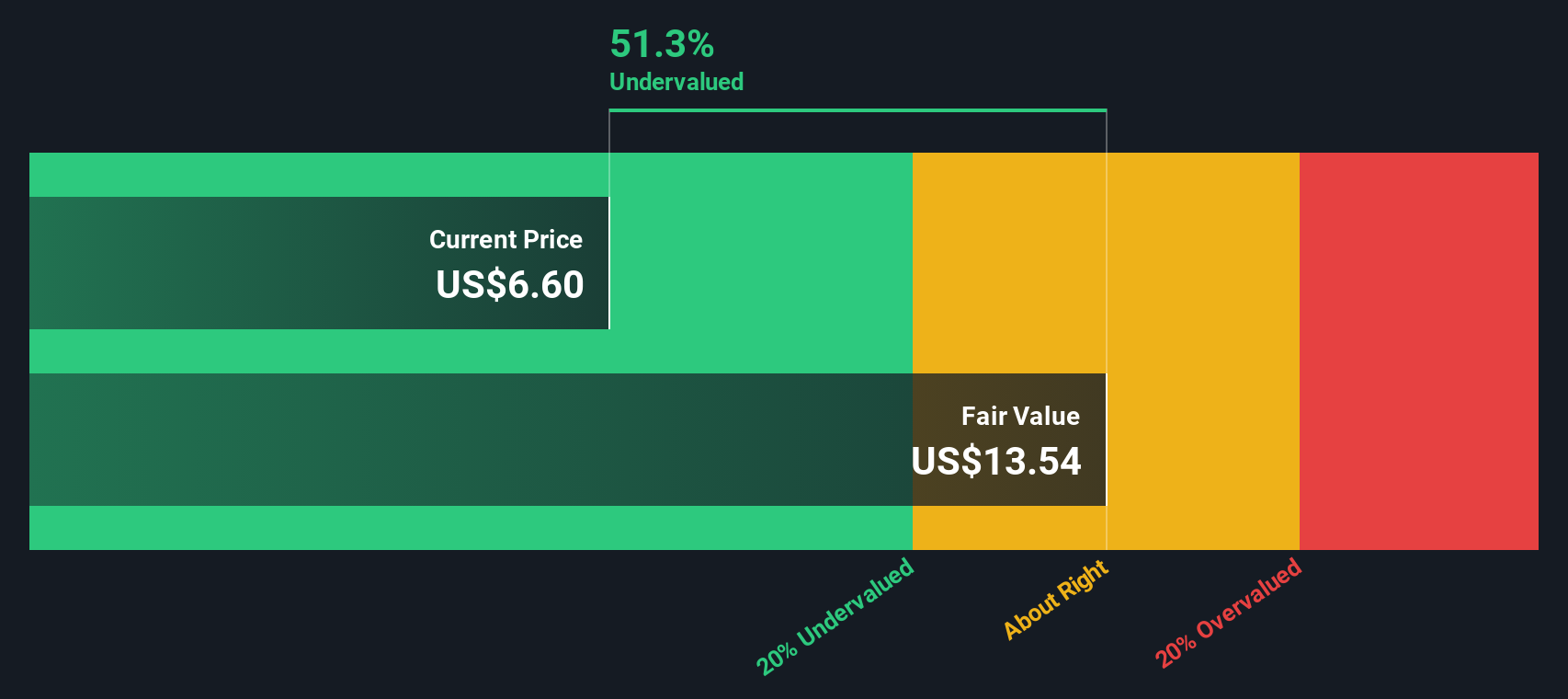

With profit surging while sales stay flat and guidance turns cautious, the key question for investors is whether Udemy’s depressed share price now reflects all the known risks, or if there could be a hidden buying opportunity as the market prices in future growth.

Most Popular Narrative: 44% Undervalued

Udemy's most widely followed narrative points to a fair value meaningfully above its recent close, setting the stage for a major disconnect if you buy the growth story. With the market pricing at $5.70 versus a narrative fair value near $10, this gap is grabbing investor attention.

*Strategic expansion in international markets, particularly through local partnerships in high-growth regions (e.g., Latin America, India, Japan) and region-specific market activation, is already producing double-digit ARR growth and higher retention rates in markets like Japan. This points towards strong long-term revenue diversification and lowered dependence on slower-growing North American markets.*

Wondering what’s fueling such a bold upside case? The real driver is an unexpectedly high profit margin turnaround, projected steady revenue gains, and a future earnings multiple normally reserved for market darlings. Find out which precise shifts in Udemy’s business model and financial forecasts are behind this aggressive valuation, and why the consensus could leave contrarians stunned.

Result: Fair Value of $10.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a sharp downturn in consumer revenue or increased competition in AI-powered learning could quickly weaken the case for a rebound in Udemy’s shares.

Find out about the key risks to this Udemy narrative.

Another View: DCF Model Offers Even Greater Upside

While multiple-based analysis suggests Udemy is reasonably valued compared to its industry, the SWS DCF model presents a different perspective. According to this approach, Udemy’s fair value could be as high as $13.92, making its current price appear especially cheap. Could the market be overlooking Udemy’s long-term cash flow growth potential?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Udemy Narrative

Prefer to chart your own course or back up your opinions with your own analysis? You can easily build your own perspective in minutes by using Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Udemy.

Looking for More Investment Ideas?

There’s a world of opportunity beyond Udemy, and using the Simply Wall Street Screener can help you get ahead of market trends before others catch on.

- Capitalize on the surging demand for machine learning by reviewing these 26 AI penny stocks shaking up education, healthcare, and finance.

- Grow your portfolio with consistent income by exploring these 22 dividend stocks with yields > 3% featuring yields above 3%, and see which stocks could boost your returns.

- Stay at the forefront of tech innovation by exploring these 28 quantum computing stocks leading the way in next-generation computing breakthroughs and new industry standards.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UDMY

Udemy

A learning company, that operates a marketplace platform for learning skills in North America, Europe, the Middle East, Africa, the Asia Pacific, and Latin America.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives