- United States

- /

- Consumer Services

- /

- NasdaqCM:SUPX

Will SuperX AI Technology (SUPX) Redefine Enterprise Infrastructure With Its Modular AI Factory Bet?

Reviewed by Sasha Jovanovic

- Earlier this month, SuperX AI Technology Limited launched the SuperX XN9160-B300 AI Server powered by NVIDIA's Blackwell GPU and unveiled the SuperX Modular AI Factory, a prefabricated data center solution designed for rapid, energy-efficient AI infrastructure deployment.

- These developments signal SuperX's ambition to redefine enterprise AI infrastructure by offering scalable, high-density solutions tailored for next-generation artificial intelligence and high-performance computing demands.

- We’ll examine how SuperX’s push into modular, high-performance AI infrastructure influences the company’s broader investment narrative.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is SuperX AI Technology's Investment Narrative?

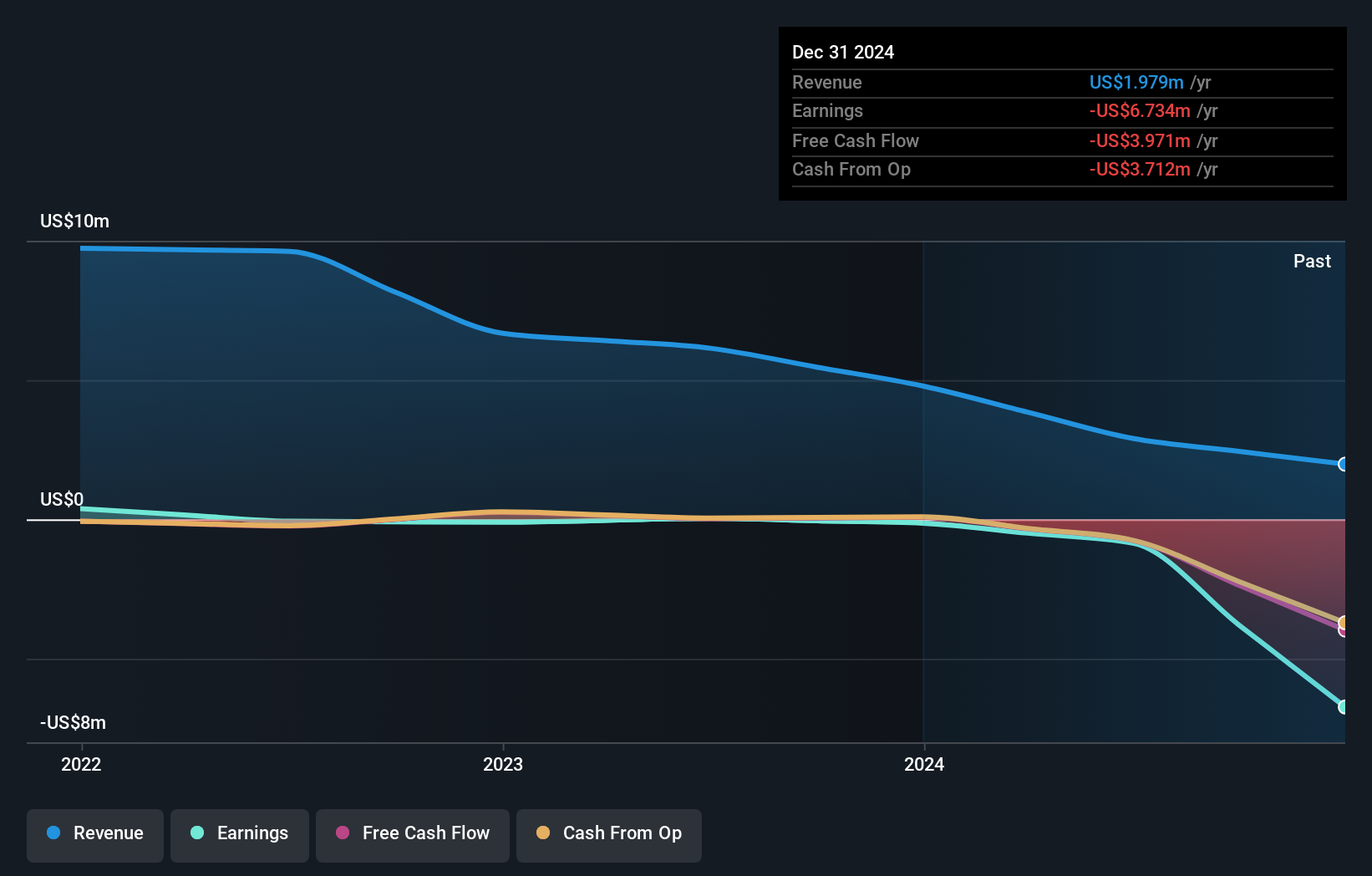

For investors considering SuperX AI Technology, the fundamental case rests on faith in the company’s ability to capture a critical share of next-generation AI data infrastructure. The launches of the SuperX XN9160-B300 AI Server and Modular AI Factory may shape the near-term view by addressing the urgent market demand for high-density, scalable AI solutions, possibly strengthening sentiment around SuperX's innovation pipeline. These releases could reframe the short-term catalysts, shifting attention to early adoption and new contract wins, but the company still faces significant risks: unprofitability, revenue contraction, substantial share dilution, and an inexperienced board and management team. While the market has reacted with a very large year-to-date price return, the absence of meaningful revenue growth and elevated valuation ratios serve as reminders that execution risk remains high and financial fundamentals have yet to support recent excitement. On the other hand, rapid expansion has brought a historically high level of board turnover and share dilution, something investors should be aware of.

Insights from our recent valuation report point to the potential overvaluation of SuperX AI Technology shares in the market.Exploring Other Perspectives

Explore 2 other fair value estimates on SuperX AI Technology - why the stock might be worth less than half the current price!

Build Your Own SuperX AI Technology Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SuperX AI Technology research is our analysis highlighting 4 important warning signs that could impact your investment decision.

- Our free SuperX AI Technology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SuperX AI Technology's overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SUPX

SuperX AI Technology

Provides AI infrastructure solutions for enterprises, research institutions, and cloud and edge computing deployments worldwide.

Flawless balance sheet with slight risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion