- United States

- /

- Consumer Services

- /

- NasdaqCM:SUPX

Is SuperX AI Technology (SUPX) Building a Lasting Edge With Its Modular AI Data Center Strategy?

Reviewed by Sasha Jovanovic

- SuperX AI Technology Limited has unveiled its Modular AI Factory and XN9160-B300 AI Server, integrating rapid-deployment modular data center solutions with next-generation NVIDIA Blackwell GPU-powered servers for high-performance AI workloads.

- This dual launch positions SuperX as a potential influencer in AI infrastructure, emphasizing extreme compute scalability and rapid implementation across sectors like finance, science, and large-scale AI models.

- We'll explore how SuperX's leap to prefabricated modular AI data centers shapes its investment narrative and sector influence.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is SuperX AI Technology's Investment Narrative?

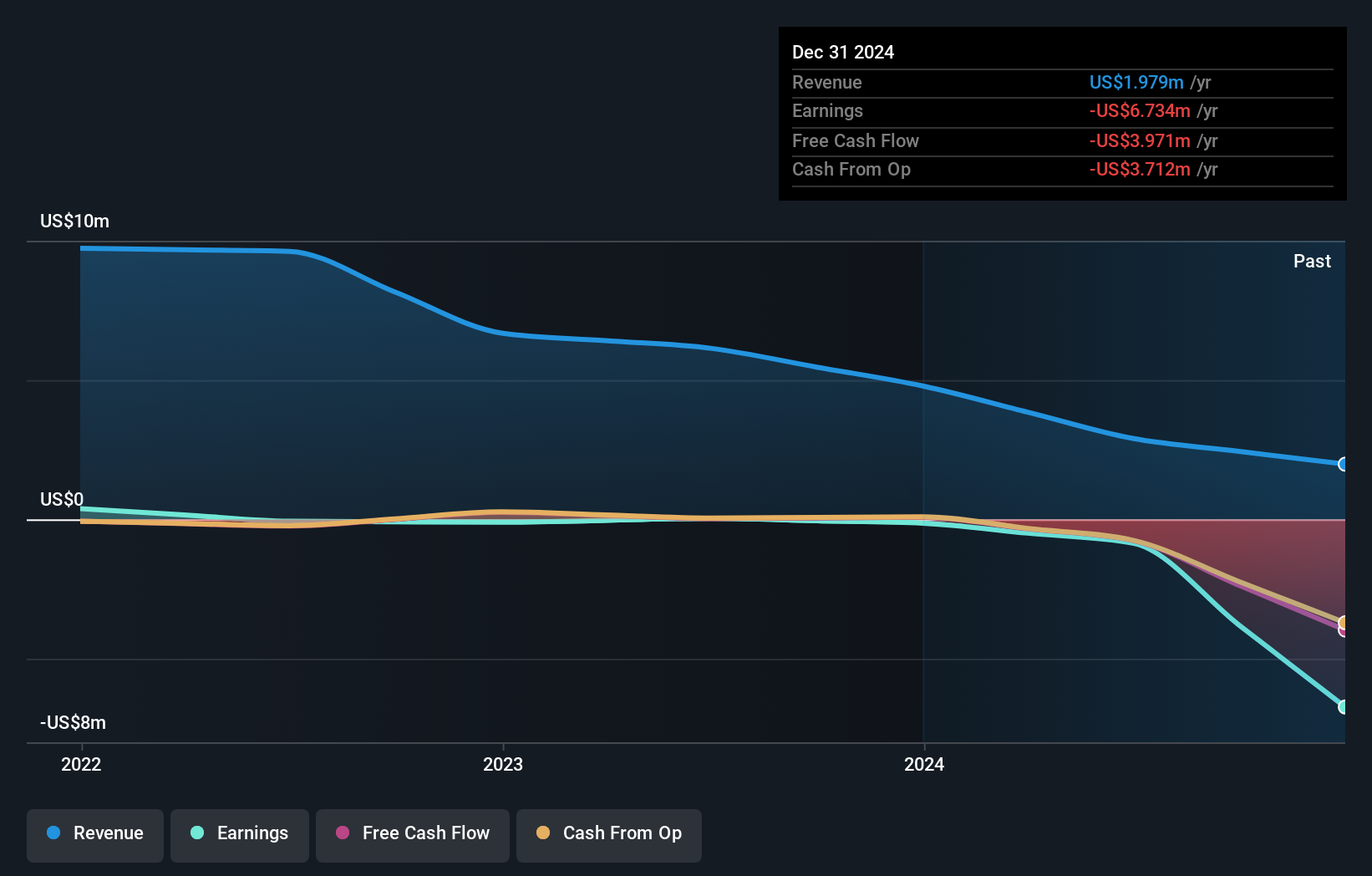

For anyone looking at SuperX AI Technology as a shareholder, the big picture is about believing in the urgent shift to modular, factory-built AI infrastructure that can be deployed in months instead of years. The company's rapid launch of both the SuperX Modular AI Factory and the XN9160-B300 AI Server powered by NVIDIA's Blackwell GPU answers a distinct market need for faster, more scalable, and energy efficient deployment of high-performance AI workloads. These launches directly address SuperX’s most important catalyst: its potential to become a standard-setter in next generation data centers. However, the biggest risks haven’t entirely disappeared, SuperX is still unprofitable, has a high price-to-book ratio, a volatile share price, and an inexperienced board and management team. While these launches could trigger short-term excitement and reposition the risk-reward balance, the fundamental financial risk profile remains largely unchanged for now, especially given the company’s loss history and recent shareholder dilution. The real impact will depend on execution and whether these innovations translate to sustainable revenue.

But even breakthrough tech can't erase concerns about sustained losses and high valuation. Upon reviewing our latest valuation report, SuperX AI Technology's share price might be too optimistic.Exploring Other Perspectives

Explore 2 other fair value estimates on SuperX AI Technology - why the stock might be worth as much as $0.12!

Build Your Own SuperX AI Technology Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SuperX AI Technology research is our analysis highlighting 4 important warning signs that could impact your investment decision.

- Our free SuperX AI Technology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SuperX AI Technology's overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 32 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SUPX

SuperX AI Technology

Through its subsidiary, OPS Interior Design Consultant Limited, provides interior design, fit-out, and maintenance services to residential and commercial clients in the interior design market in Hong Kong.

Flawless balance sheet with slight risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026