- United States

- /

- Consumer Services

- /

- NasdaqGS:STRA

Does Strategic Education’s Recent Rebound Signal a Mispriced Opportunity in 2025?

Reviewed by Bailey Pemberton

- If you have been wondering whether Strategic Education is quietly turning into a value opportunity or just another value trap, you are not alone. This is exactly what we are going to unpack.

- The stock has crept up 2.7% over the last week and 7.2% over the last month, yet it is still down 13.2% year to date and 15.9% over the past year. This combination signals a mix of recovery potential and lingering market skepticism.

- Recent attention has focused on Strategic Education's position in the evolving online and working adult education space, as investors reassess which education providers can sustain enrollment and pricing power. At the same time, regulatory shifts and changing employer demand for credentials have kept the sector in the spotlight and added extra nuance to how markets are pricing education stocks.

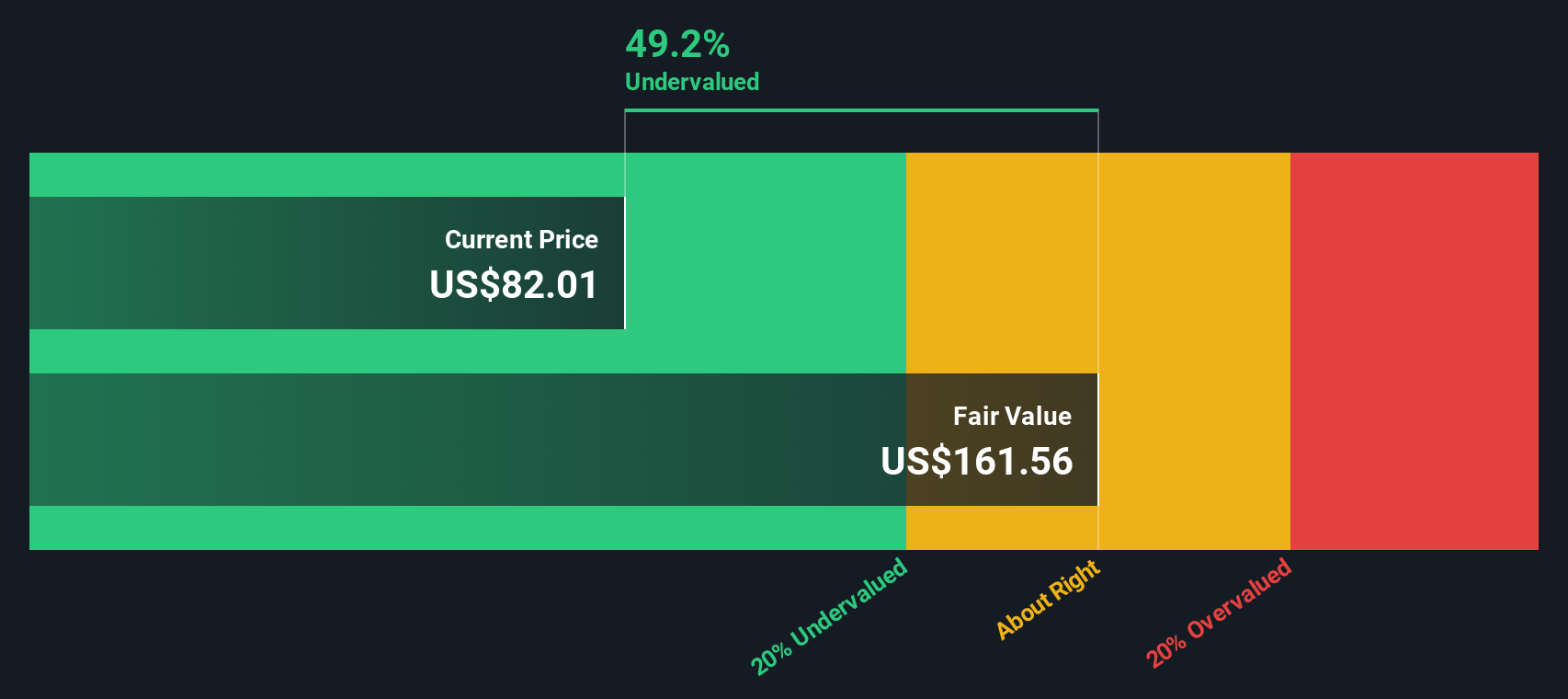

- On our checks, Strategic Education scores a 5 out of 6 on valuation, suggesting it screens as undervalued on most metrics. You can see the detailed breakdown in its valuation score.

Find out why Strategic Education's -15.9% return over the last year is lagging behind its peers.

Approach 1: Strategic Education Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth by projecting its future cash flows and discounting them back to today, using a rate that reflects risk and the time value of money.

For Strategic Education, the latest twelve month Free Cash Flow is about $132.6 million. Analysts and internal estimates see this rising gradually, with projected Free Cash Flow of around $176.4 million by 2035, based on a two stage Free Cash Flow to Equity framework. Near term figures are supported by analyst forecasts, while the outer year projections are extrapolated from these trends.

When all those expected cash flows are discounted back, the DCF model points to an intrinsic value of roughly $144.54 per share. This is about 44.5% above the current market price, which suggests that the market is pricing Strategic Education at a substantial discount to its estimated long term cash generating potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Strategic Education is undervalued by 44.5%. Track this in your watchlist or portfolio, or discover 906 more undervalued stocks based on cash flows.

Approach 2: Strategic Education Price vs Earnings

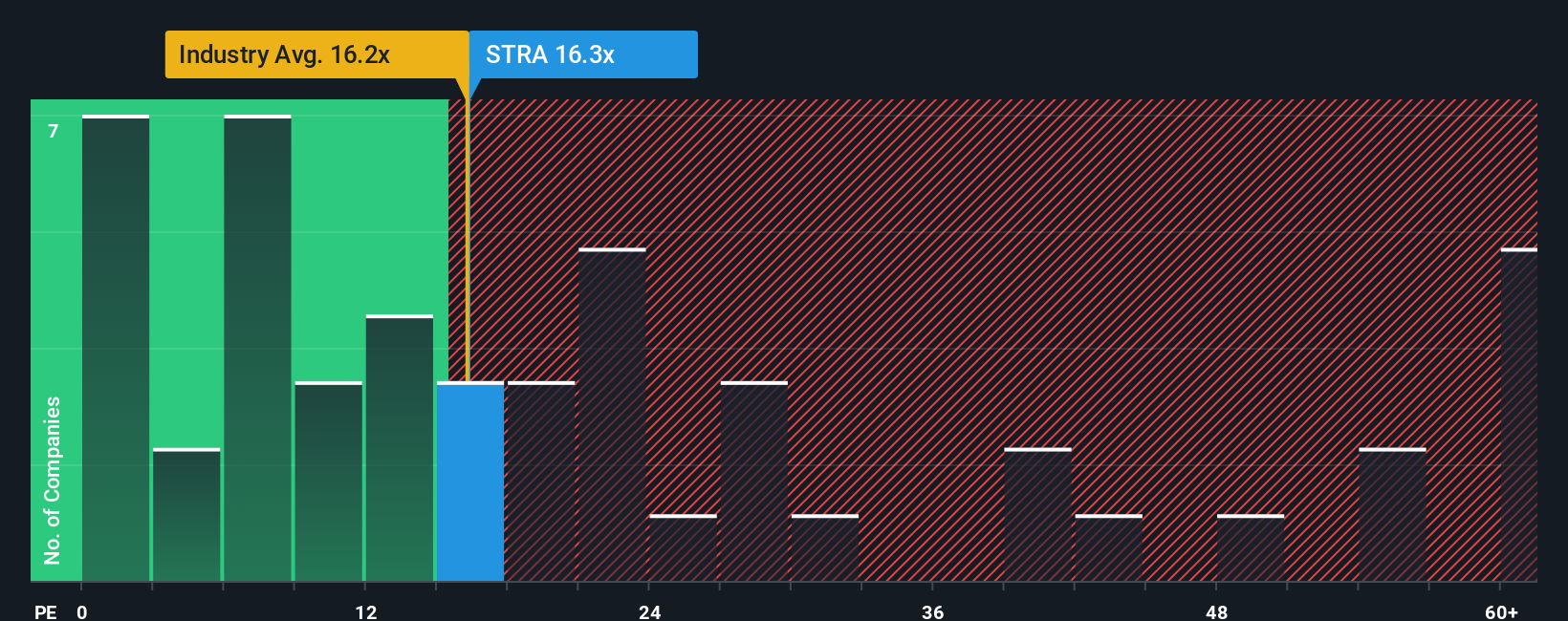

For a consistently profitable company like Strategic Education, the Price to Earnings ratio is a natural yardstick because it directly links what investors are paying for each dollar of current earnings. The higher the expected growth and the lower the perceived risk, the more investors are usually willing to pay. This typically translates into a higher, but still reasonable, PE ratio.

Strategic Education currently trades on a PE of about 16.3x, which is broadly in line with the wider Consumer Services industry average of roughly 16.1x, but meaningfully below the peer group average of around 21.7x. To refine this view, Simply Wall St calculates a proprietary Fair Ratio of 20.6x, which reflects what the multiple should be once you factor in the company’s earnings growth outlook, profitability, risk profile, industry and market cap.

This Fair Ratio is more informative than a simple peer or industry comparison because it adjusts for differences in quality and risk instead of assuming every education stock deserves the same multiple. With the current PE at 16.3x versus a Fair Ratio of 20.6x, the shares appear attractively priced on an earnings basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

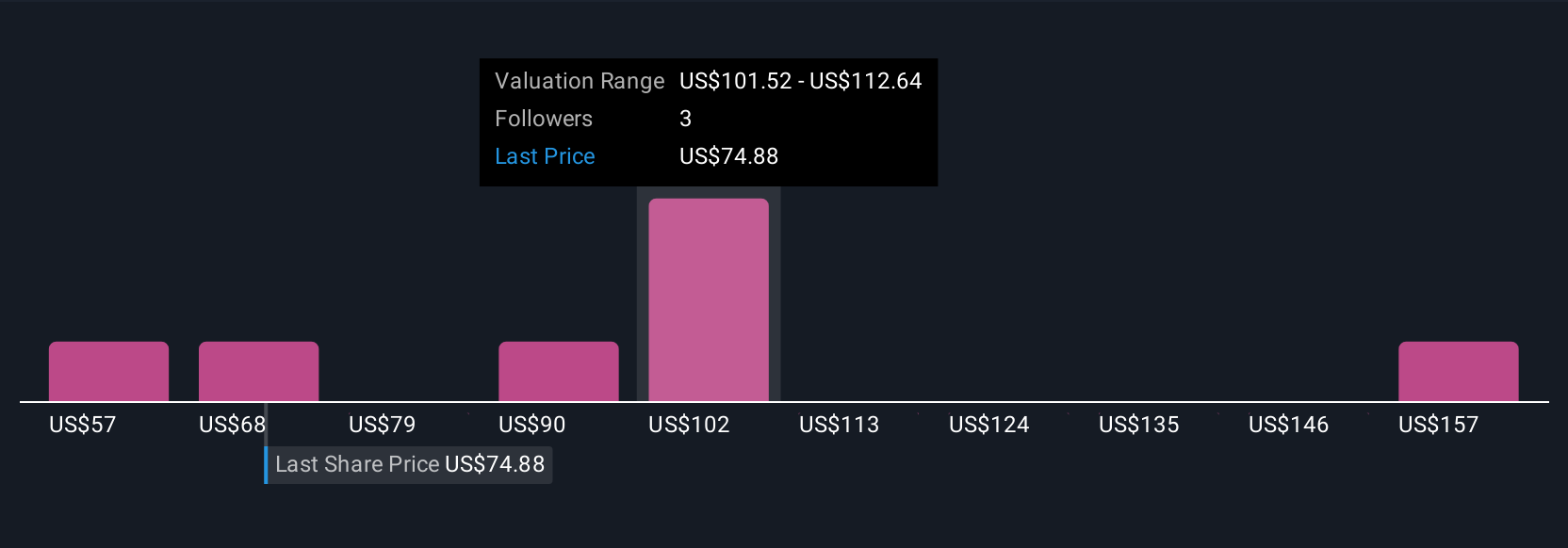

Upgrade Your Decision Making: Choose your Strategic Education Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, simple stories you create about Strategic Education that connect your view of its future enrollment, margins and growth to a set of forecasts and a Fair Value estimate on Simply Wall St’s Community page. This helps you quickly see whether your Fair Value is above or below today’s price, updating automatically as new earnings, news or regulatory developments come in. It also makes it clear how two investors can both look at the same company and reach different yet coherent conclusions. For example, one bullish Narrative might weight faster revenue growth from corporate partnerships, higher long term profit margins and a richer future PE multiple to support a Fair Value closer to the upper end of recent targets around $120 per share. A more cautious Narrative might lean on slower revenue growth, margin pressure from scholarships and tighter regulation to anchor a Fair Value nearer the low end around $97 per share. This gives you a structured, dynamic way to decide how you view the stock’s attractiveness over time.

Do you think there's more to the story for Strategic Education? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:STRA

Strategic Education

Provides education services through campus-based and online post-secondary education, and programs to develop job-ready skills.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026