- United States

- /

- Hospitality

- /

- NasdaqCM:SERV

Serve Robotics (SERV) Expands with Uber Eats in Chicago—Is Its National Rollout Strategy Gaining Traction?

Reviewed by Sasha Jovanovic

- Serve Robotics Inc. recently launched its sidewalk delivery robot service in the Chicago metro area, expanding into the Midwest through its partnership with Uber Eats and bringing contact-free delivery to 14 neighborhoods across the city.

- This marks a significant step in Serve's goal to deploy 2,000 AI-powered delivery robots nationwide by the end of 2025, as it integrates into Chicago’s robust urban and dining infrastructure.

- We'll explore how entering Chicago's extensive delivery market through Uber Eats adds a new dimension to Serve Robotics' investment narrative.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

What Is Serve Robotics' Investment Narrative?

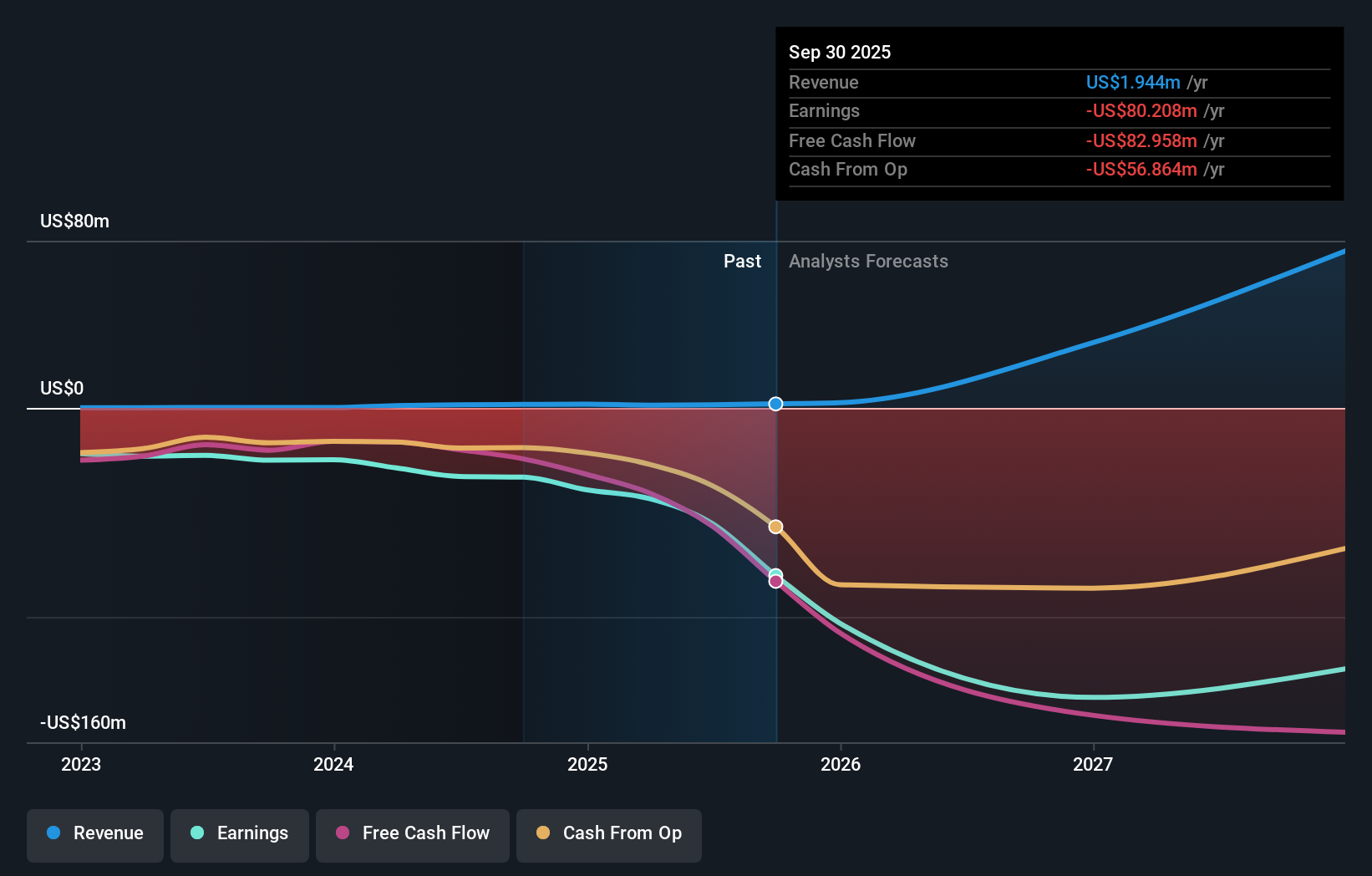

For Serve Robotics, the big picture that investors must get comfortable with is the company's ambitious vision for nationwide robot-powered delivery at scale, supported by rapid market entry and key partnerships. The recent move into Chicago shifts the short-term catalyst conversation: this isn’t just another city, it’s a densely populated metro with a strong food delivery culture and logistical complexity. If Serve’s robots can perform effectively in Chicago, it bolsters the credibility of their 2,000-robot target and backs up management’s assurances about hitting aggressive revenue goals. However, the risks also evolve. Serve is still unprofitable with mounting losses, ongoing share dilution and a volatile share price despite impressive recent price gains. The Chicago launch increases operational exposure, and any setbacks, whether in robot reliability, regulatory friction or partnership execution, could quickly temper enthusiasm. So, while Chicago creates a potentially meaningful catalyst, it raises the stakes for execution at a crucial moment in the company’s expansion.

But, investors should also be alert to ongoing dilution risks.

Exploring Other Perspectives

Explore 14 other fair value estimates on Serve Robotics - why the stock might be worth as much as 22% more than the current price!

Build Your Own Serve Robotics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Serve Robotics research is our analysis highlighting 1 key reward and 6 important warning signs that could impact your investment decision.

- Our free Serve Robotics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Serve Robotics' overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SERV

Serve Robotics

Designs, develops, and operates low-emission robots that serve people in public spaces for food delivery activity in the United States.

Flawless balance sheet with medium-low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion