- United States

- /

- Hospitality

- /

- NasdaqGS:SBUX

Starbucks’ (NASDAQ:SBUX) 100% Return Could Be Coming At A Cost

When you think of places to drink coffee, Starbucks ( Nasdaq:SBUX ) is probably in the top five places that come to mind. Its name has become synonymous with the highly addictive beverage that so many of us drink daily, thanks to its global brand and over 30,000 stores worldwide.

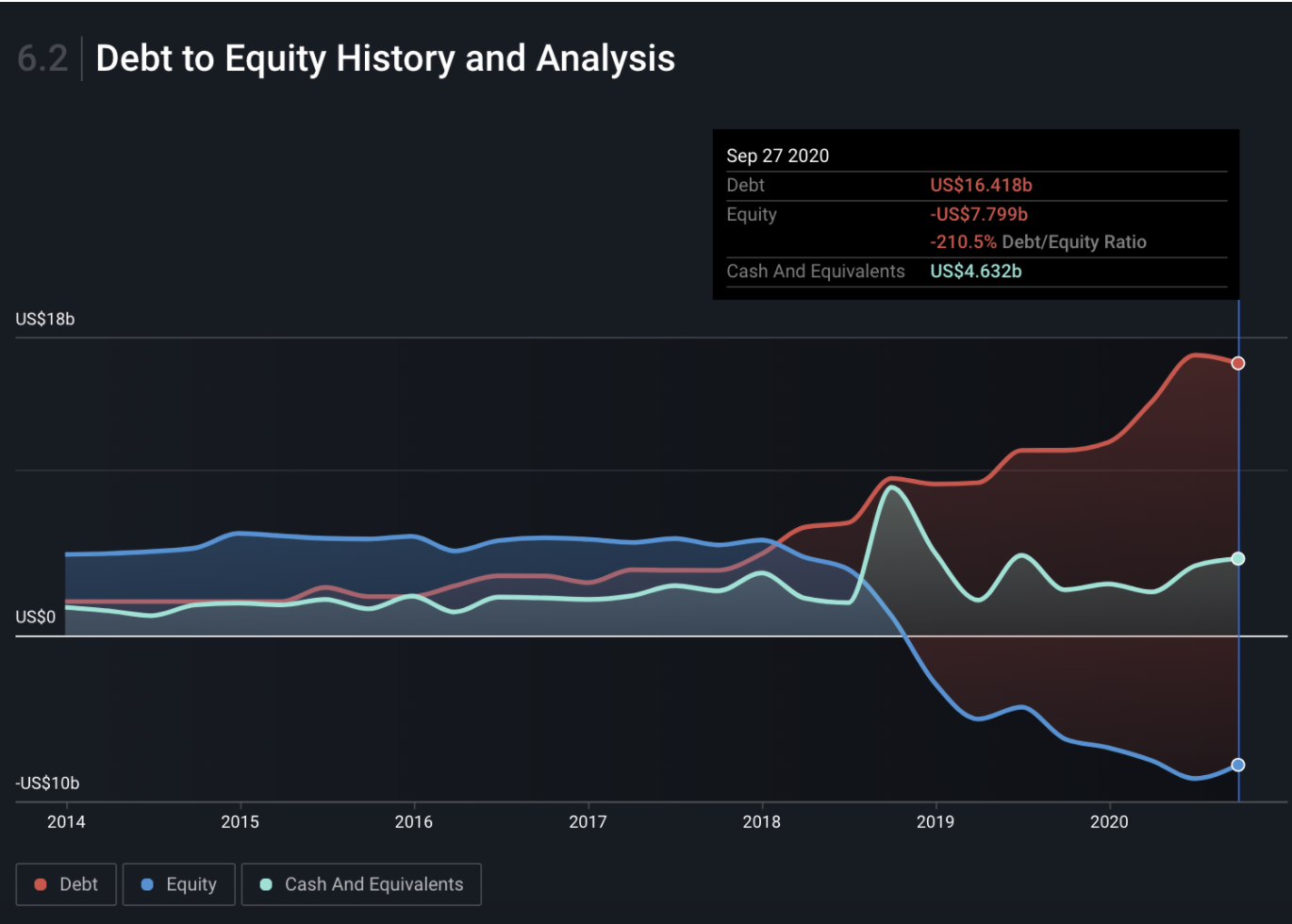

However, when you think of leveraged companies, Starbucks likely isn’t high up on your list, but the company’s balance sheet would indicate it should be. Since the start of 2018, the company’s debt has increased from around $5bn to over $16bn as of their latest quarterly report.

This has raised some eyebrows because it’s partly responsible for the company’s shareholder equity plunging into the negative, which can be a big red flag for investors. Let’s delve a bit deeper and see how it got there, why Starbucks might have got itself into this situation and if shareholders should be concerned.

Negative Shareholders Equity

For starters, when shareholder's equity is negative, it means that the company’s total liabilities are higher than its total assets, at a particular point in time. This can occur due to a number of reasons, but in Starbucks’ case, it appears to be from two in particular. Firstly, a lot of leverage and secondly, paying out more than it has earned.

To begin with, in terms of leverage, the company has around $37.2bn in total liabilities and only $29.4bn in total assets. So we can see straight away that if the company needed to liquidate all of its assets to pay all of its obligations, it would come up $7.8bn short. Or in other words, in a worst-case scenario, shareholders would be left with nothing. Now, we’re not saying that will occur, it’s just worth raising to emphasize that the company currently owes more than the total value of its assets.

Below you can see a chart of Starbucks’ debt to equity ratio, which outlines how this ratio has changed drastically since early 2017.

To see our full analysis of the company’s balance sheet, check out our company report .

NASDAQGS:SBUX - Debt to Equity ratio as at 30 September 2020

Should we be worried about the debt?

The majority of the company’s liabilities, around $30bn, come from its long-term obligations, which include long-term debt, deferred revenue, and operating leases for their stores. So let's look at each one to see how much of a burden they are and if they’re worth worrying about.

Firstly, long term debt . As seen in the chart above, Starbucks has ramped up its leverage over the last few years, and its long-term debt obligations now sit at $14.6bn, when they used to be $2.3bn back in 2015. This huge 6 fold increase can tell us that the company feels comfortable issuing debt liberally and does not mind the increased costs that come with it. This comfort probably comes from the fact that the interest expense to service this debt is quite manageable. Over the last 12 months, the interest expense was only $427m, which is well covered by EBIT (Earnings Before Interest and Tax), even with earnings being severely impacted by COVID.

Secondly, in terms of the company’s long term deferred revenue , it consists solely of a deal that Starbucks did with Nestle as part of the Global Coffee Alliance in late 2018. This deal means Nestle can market, sell and distribute Starbucks consumer packaged goods. Starbucks was paid an upfront royalty of $6.7bn and the company will record it in equal amounts as other revenue over the life of the deal, which according to Starbucks’ annual report, is 40 years. This will mean the deferred revenue liability will reduce by around $175m per year for the next 38 years. So for a long term obligation, as long as Starbucks is able to continue providing Nestle with access to intellectual property and products for future resale, we wouldn’t be too concerned about this liability.

Finally, in regards to operating leases , Starbucks leases many types of properties, from retail stores, roasting, distribution and warehouse facilities, to office spaces for corporate admin purposes. As of September 2020, the company recorded $7.6bn in its long-term operating lease liabilities, which would be for the total rent due on all of these premises for the remainder of the leases after the next 12 months. Considering Starbucks has over 30,000 retail stores globally, this $7.6bn figure doesn’t seem too burdensome. Especially because even excluding the other property types mentioned above, this liability equates to roughly $233,000 per retail store, which are all likely to be multi-year leases. So to us this relatively large obligation doesn’t raise any red flags, it’s more just the nature of a business with many rental agreements.

So despite the fact that liabilities outweigh assets, the situation actually looks ok with the factors we’ve considered above. The primary concern we have is the long term debt. Why would the company raise so much cash in such a short period of time?

Bringing future returns forward?

To understand why, it helps to look at the second point mentioned, which is that the company has been paying out more than it has earned.

This can be attributed to the company’s generous buybacks and dividends. Despite only earning a total of $9.03bn net income over the 3 years to September 30 2020, the company has paid out $5.4bn in dividends and spent $19bn buying back company stock in that time.

While this has probably pleased many shareholders because it’s resulted in a nearly 100% total return (including dividends) in just over 2 years, it is not sustainable in our view.

NasdaqGS:SBUX - Latest share price and events over the last 3 years to 30 Nov 2020.

It’s similar to taking a shot of adrenaline. While it might feel amazing now, there will be a comedown, it’s just a matter of when.

Likewise, in the short term, there’s little concern of consequences, but longer-term there can be issues. It ultimately means that rather than the business growing organically and driving share price appreciation naturally (which it still is to a degree), a large portion of the returns have been driven by a shrinkage of shares outstanding (20% reduction in 3 years), which itself has been funded by borrowing money.

In line with that, it’s worth noting that management may be incentivized to take on this debt thanks to how the Starbucks incentive plan is structured. Part of the plan requires earnings per share (EPS) growth over 3 years and stock price performance relative to the S&P 500 to meet certain criteria before management can receive restricted stock units.

So to reach these targets, management might ask themselves two questions: What’s one way to generate EPS growth and share price appreciation? Answer: Buy back stock (it will decrease the number of shares outstanding and all else being equal, the EPS and share price will also rise). Second question: How do you buy back a lot of stock if you don’t have enough retained earnings or cash flow to do so? Answer: take on debt.

When we know how management is incentivized, it helps us understand why they might make certain decisions. As Charlie Munger once said: “Show me the incentive and I will show you the outcome”.

We have details on management compensation, including insider buying and selling in our company report that you’ll probably find interesting.

So should we be concerned?

While Starbucks is a great business in many aspects that we haven’t covered here, we have some concerns around capital allocation. Essentially, we believe that Starbucks is choosing higher returns today, at the cost of safety and sustainability tomorrow. The increased liabilities and generous returns to shareholders have been the driving force behind the company going into negative shareholder equity, which is not sustainable in the long term. While the debt currently seems maintainable, the returns to shareholders do not. In our view, either the company has to increase its earnings significantly to cover the dividends and buybacks into the future, or cuts have to be made. Either way, shareholders should be wary of extrapolating the last few years of performance into the future.

Speaking of future performance, we have collated all the forecasts of the analysts who cover Starbucks, and you can find their revenue and earnings estimates in our company report.

Promoted

When trading Starbucks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers . You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account.

Neither Simply Wall St analyst Michael Paige nor Simply Wall St hold any position in any of the companies mentioned. This article is general in nature. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly . Alternatively, email editorial-team@simplywallst.com.

Michael Paige

Michael is the Content Lead at Simply Wall St. With over 9 years of experience analysing and researching companies, Michael contributes to the creation of our analytical content and has done so as an equity analyst since 2020. He previously worked as an Associate Adviser at Ord Minnett, helping build and manage clients' portfolios, and has been investing personally since 2015.

About NasdaqGS:SBUX

Starbucks

Operates as a roaster, marketer, and retailer of coffee worldwide.

Average dividend payer low.

Similar Companies

Market Insights

Community Narratives