- United States

- /

- Hospitality

- /

- NasdaqCM:SBET

What Do Recent Price Swings Mean for SharpLink Gaming Stock in 2025?

Reviewed by Bailey Pemberton

If you’re wondering what to make of SharpLink Gaming right now, you definitely aren’t alone. Plenty of investors are eyeing the stock’s rollercoaster ride and asking whether the recent dip is a sign to jump in or stay far away. After a blowout run earlier this year, where the stock soared by 77.5% year-to-date, things have been choppier lately. Over the past week, shares lost 6.4%, while the last 30 days saw a deeper 16.2% slide. Even with this pullback, the one-year return still stands at a hefty 47.5% gain. However, the longer-term picture remains challenging, as the three-year return is down by 81.6%.

Some of these swings reflect shifting sentiment in the gaming and technology sector, as well as evolving investor appetite for riskier, growth-oriented names. SharpLink’s exposure to online betting, which continues to benefit from changes in regulations and growing user adoption in the US, has certainly stoked excitement. On the flip side, the volatility reminds us just how quickly these narratives can change.

When it comes to whether SharpLink Gaming looks undervalued right now, it scored a 2 out of 6 on our value checks. This means it meets the standard for undervaluation in only two categories. That number puts it in an interesting position: not a runaway bargain by traditional measures, yet not obviously overpriced either.

Here is a breakdown of what those valuation checks actually look like, so you can decide how much weight to give each one. And after that, stick around because there is one metric that might just reshape how you think about valuation altogether.

SharpLink Gaming scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: SharpLink Gaming Discounted Cash Flow (DCF) Analysis

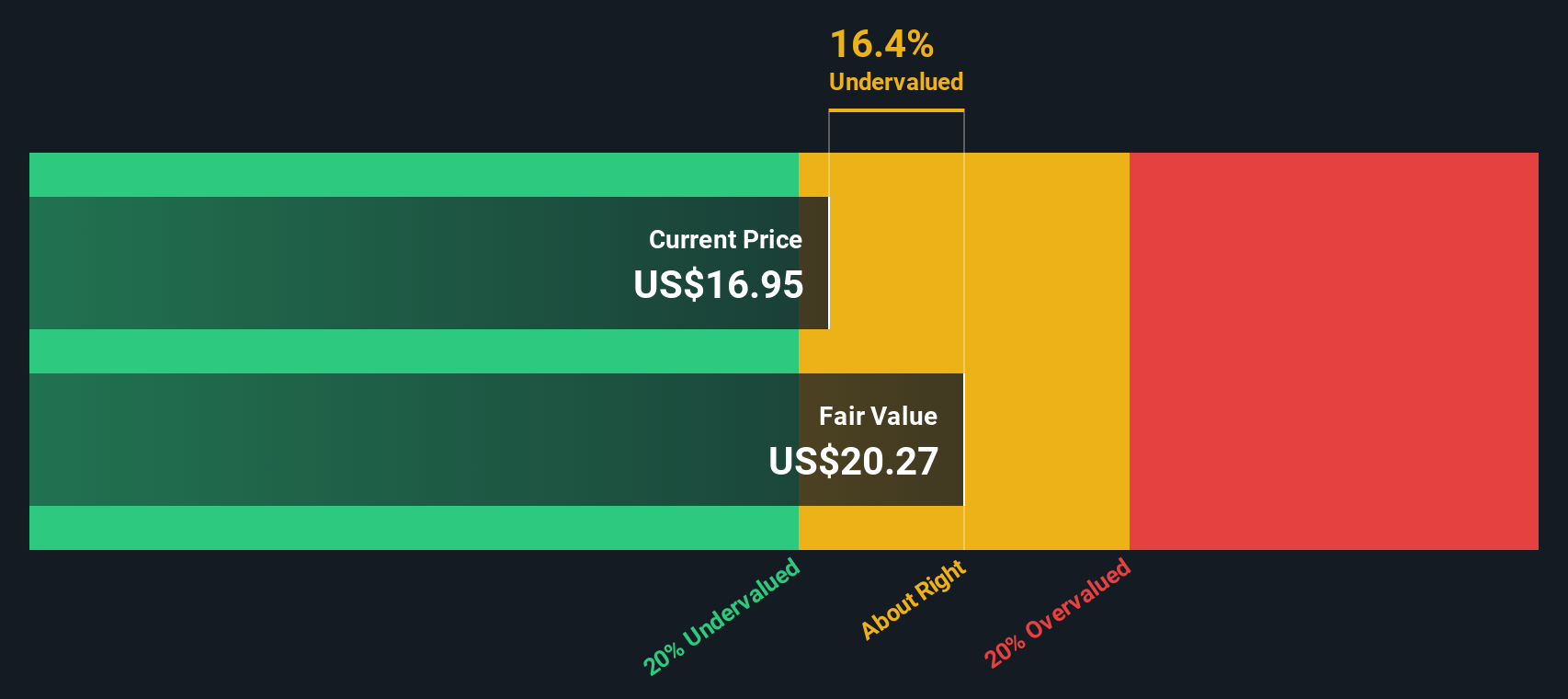

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting future cash flows and discounting them back to their value today. For SharpLink Gaming, this approach uses two stages of free cash flow to equity, spanning several years into the future.

Currently, SharpLink’s latest reported Free Cash Flow stands at -$4.0 Million. Forecasts by analysts anticipate that Free Cash Flow could rise sharply over the next decade, with a projection of $324.16 Million by 2035. Notably, these longer-term estimates beyond five years are extrapolated based on trends rather than direct analyst coverage.

According to the DCF model, the fair value of SharpLink stock is calculated at $20.33 per share. Given the current share price, this implies a significant 29.5% discount, suggesting the stock is substantially undervalued relative to its projected future cash flows.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests SharpLink Gaming is undervalued by 29.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

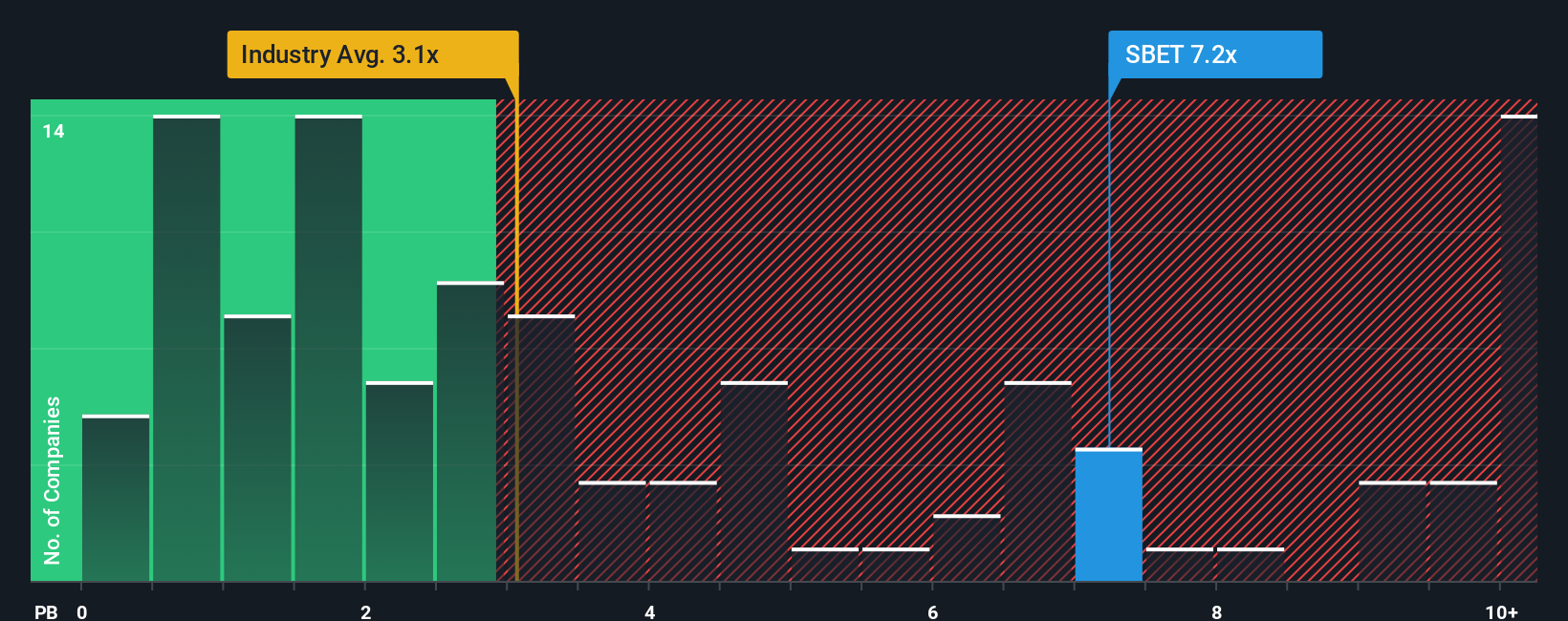

Approach 2: SharpLink Gaming Price vs Book

Another key way to value SharpLink Gaming is using the Price-to-Book (P/B) ratio, which is especially suitable for companies that may not be consistently profitable. The P/B ratio compares a company's market value to its actual net asset value, making it a useful metric for businesses in industries where physical assets or tangible book value matter.

Market participants tend to assign a higher or lower P/B ratio depending on growth prospects and the level of risk in the business. Generally, companies expected to grow quickly and steadily, or with significant intangible value, will trade at a premium. Conversely, elevated risk or uncertain outlooks can push the ratio lower.

SharpLink Gaming currently trades at a price-to-book ratio of 6.12x. This is significantly higher than the hospitality industry average of 2.89x, and well above the peer average of 1.98x. On the surface, that suggests a premium valuation, possibly due to anticipated growth or perceived advantages.

However, Simply Wall St's Fair Ratio goes a step further by incorporating industry dynamics, company-specific growth forecasts, profit margins, market cap, and unique risk factors. Instead of just comparing with the average peer or the wider industry, the Fair Ratio provides a more nuanced, tailored benchmark of where the multiple should reasonably sit.

When contrasting SharpLink’s actual P/B ratio of 6.12x with the Fair Ratio, the numbers diverge markedly. This represents a premium valuation relative to what factors like growth expectations and risk imply, indicating the shares are trading at an overvalued level.

Result: OVERVALUED

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your SharpLink Gaming Narrative

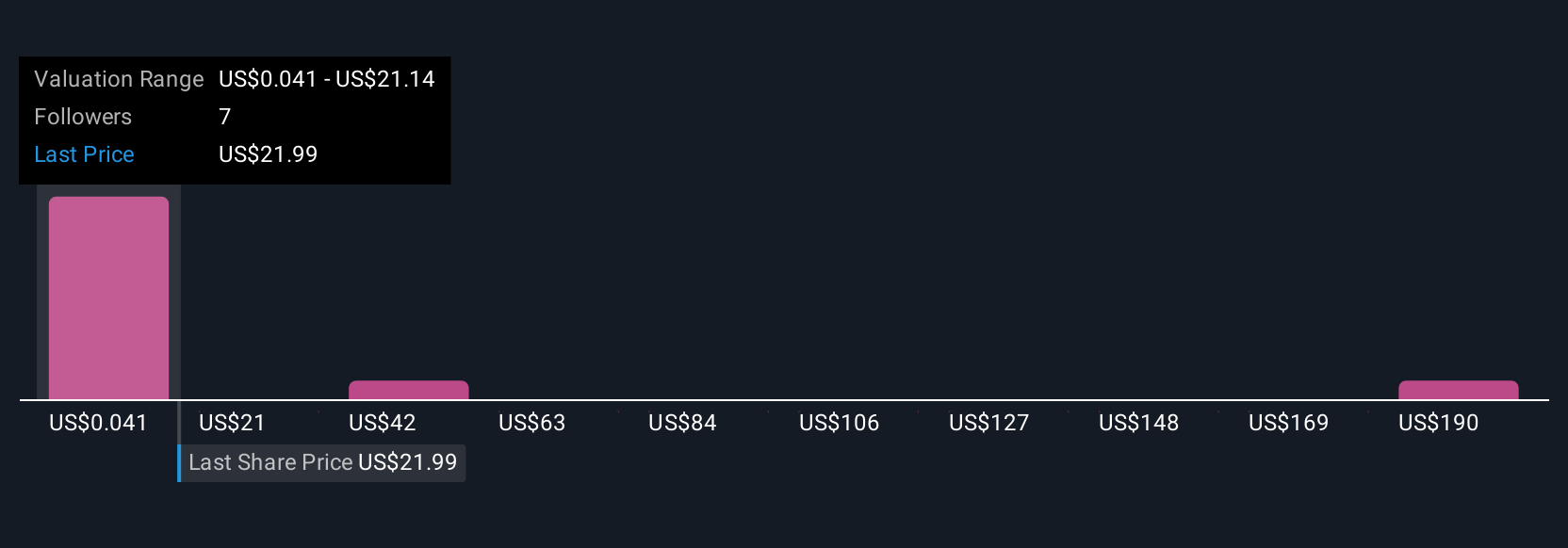

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your own story about a company, where you lay out your perspective behind the numbers, including your assumptions for future revenue, earnings, margins and the resulting fair value. Narratives connect a company’s story to a realistic financial forecast, then directly to an actionable fair value, making your investment thesis clear and structured.

With Simply Wall St’s Narratives, available right within the Community page and used by millions of investors, you can identify whether SharpLink Gaming or any company is a buy or sell by comparing your Fair Value to the current market price. Even more, Narratives update dynamically as new news or earnings come out, so your view stays relevant and up to date. For example, some investors believe SharpLink Gaming is worth as much as $40 per share, while others have a more cautious outlook closer to $10, based on their own forecasts and market outlooks.

Narratives make it easy for anyone to combine insight, forecasting, and conviction into a decision, so you are never just relying on a stock’s price, but on your own informed perspective.

Do you think there's more to the story for SharpLink Gaming? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SBET

SharpLink Gaming

Engages in developing a treasury strategy centered on Ether.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion