- United States

- /

- Hospitality

- /

- NasdaqCM:SBET

SharpLink Gaming (SBET) Is Down 8.5% After Ethereum Pivot and Leadership Overhaul Has the Thesis Shifted?

Reviewed by Simply Wall St

- SharpLink Gaming, Inc. recently amended its Certificate of Incorporation, acquired nearly 18,700 additional Ethereum, and announced Joseph Chalom, previously a senior executive at BlackRock and digital assets expert, as new Co-CEO, while founder Rob Phythian transitions to President.

- This marks a significant shift in SharpLink’s business model, firmly focusing the company on digital assets and leveraging Chalom’s deep crypto industry experience.

- We’ll explore how SharpLink’s high-profile move into Ethereum and its leadership overhaul impact the company’s evolving investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is SharpLink Gaming's Investment Narrative?

The investment story for SharpLink Gaming has pivoted sharply, with the company’s sizeable Ethereum purchase and Co-CEO appointment of digital finance veteran Joseph Chalom signaling a decisive turn to crypto assets. Investors now need conviction in SharpLink’s ability to reinvent itself as a crypto-first enterprise after leaving its roots in sports betting technology behind. In the short term, Chalom’s arrival and the Ethereum-heavy treasury have acted as powerful market catalysts, fueling significant share price momentum. Yet, these moves also shift the risk profile: operational execution in the digital asset space brings greater volatility, questions around regulatory compliance, and challenges in generating stable cash flows. The company’s history of shareholder dilution and expensive valuation metrics remain unresolved, while its switch away from meaningful traditional revenue sources means near-term business fundamentals are still uncertain.

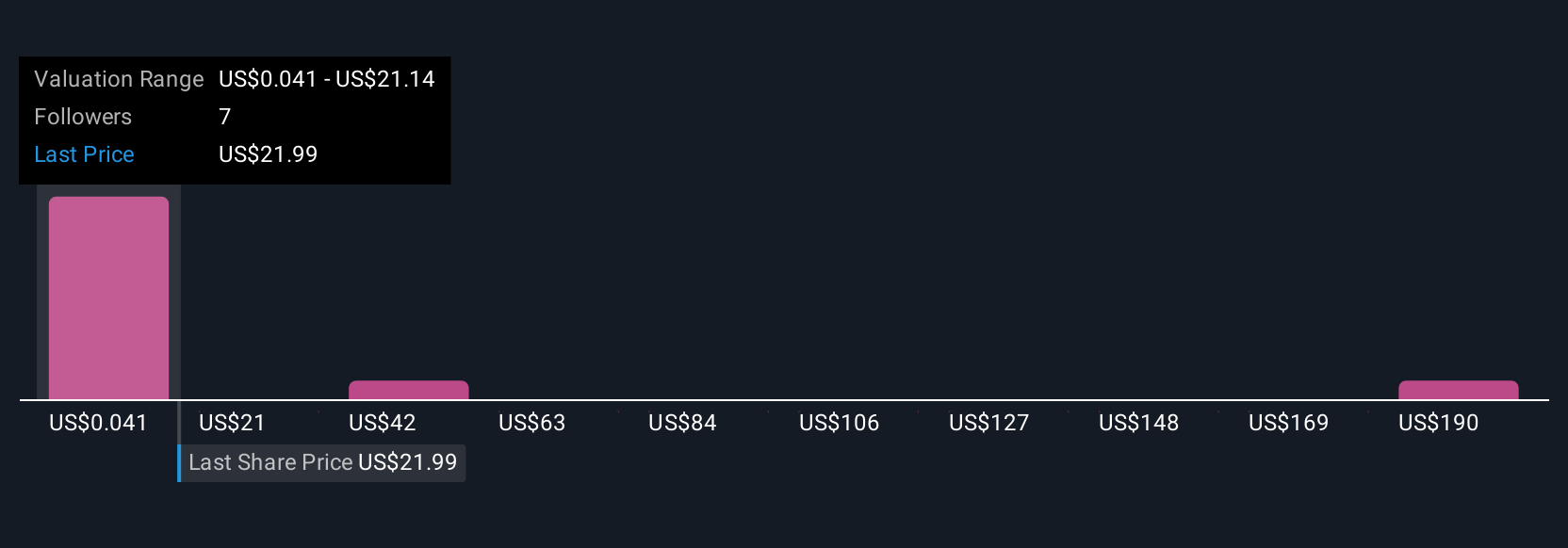

On the flipside, investors should look closely at the volatility and dilution risks that could influence outcomes. Upon reviewing our latest valuation report, SharpLink Gaming's share price might be too optimistic.Exploring Other Perspectives

Explore 8 other fair value estimates on SharpLink Gaming - why the stock might be worth less than half the current price!

Build Your Own SharpLink Gaming Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SharpLink Gaming research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free SharpLink Gaming research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SharpLink Gaming's overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SBET

SharpLink Gaming

An online performance marketing company, delivers fan activation solutions to its sportsbook and casino partners.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives