- United States

- /

- Hospitality

- /

- NasdaqGS:RRR

Red Rock Resorts (RRR): Evaluating Valuation After Recent Shift in Share Price Momentum

Reviewed by Simply Wall St

Red Rock Resorts (RRR) shares have experienced a downward trend over the past month, even though the stock has recorded a year-to-date gain of 22%. Investors are taking a closer look at the company’s longer-term growth metrics in light of recent price changes.

See our latest analysis for Red Rock Resorts.

Red Rock Resorts’ share price momentum has cooled recently, with a 7.9% drop over the past month and a 1.0% dip in the last trading day, despite a strong 22% year-to-date share price return and an impressive 203% total shareholder return over five years. While the past week and month reflected some volatility, the longer-term trajectory still suggests investors have recognized its growth story. However, near-term enthusiasm might be fading as some reassess the risk and reward balance at current levels.

If you’re curious what other compelling opportunities are out there, broaden your view with our pick of fast growing stocks with high insider ownership.

With Red Rock Resorts now trading roughly 20% below its average analyst price target and boasting solid growth numbers, the question remains: is there an attractive entry point here, or is future upside already factored in?

Most Popular Narrative: 16.9% Undervalued

With the most widely referenced narrative placing Red Rock Resorts’ fair value at $65.85, the latest closing price of $54.71 appears discounted versus expectations. The stage is set for debate: are the company’s ambitious development plans enough to justify the optimism?

The successful rollout and ramp-up of new properties like Durango, combined with major upgrades to existing properties in rapidly growing neighborhoods, are enabling Red Rock Resorts to attract younger demographics and higher-value guests, expanding market share and supporting both revenue and margin expansion.

Want to see what’s stirring analyst excitement? There’s a bold future profit target built into this price, fueled by projections few would expect for a regional gaming stock. Uncover the growth stories and financial leaps hidden in the complete narrative; curiosity pays off here.

Result: Fair Value of $65.85 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, results remain sensitive to any slowdown in Las Vegas locals’ demand or further project delays. These factors could quickly alter this upbeat outlook.

Find out about the key risks to this Red Rock Resorts narrative.

Another View: What About Multiples?

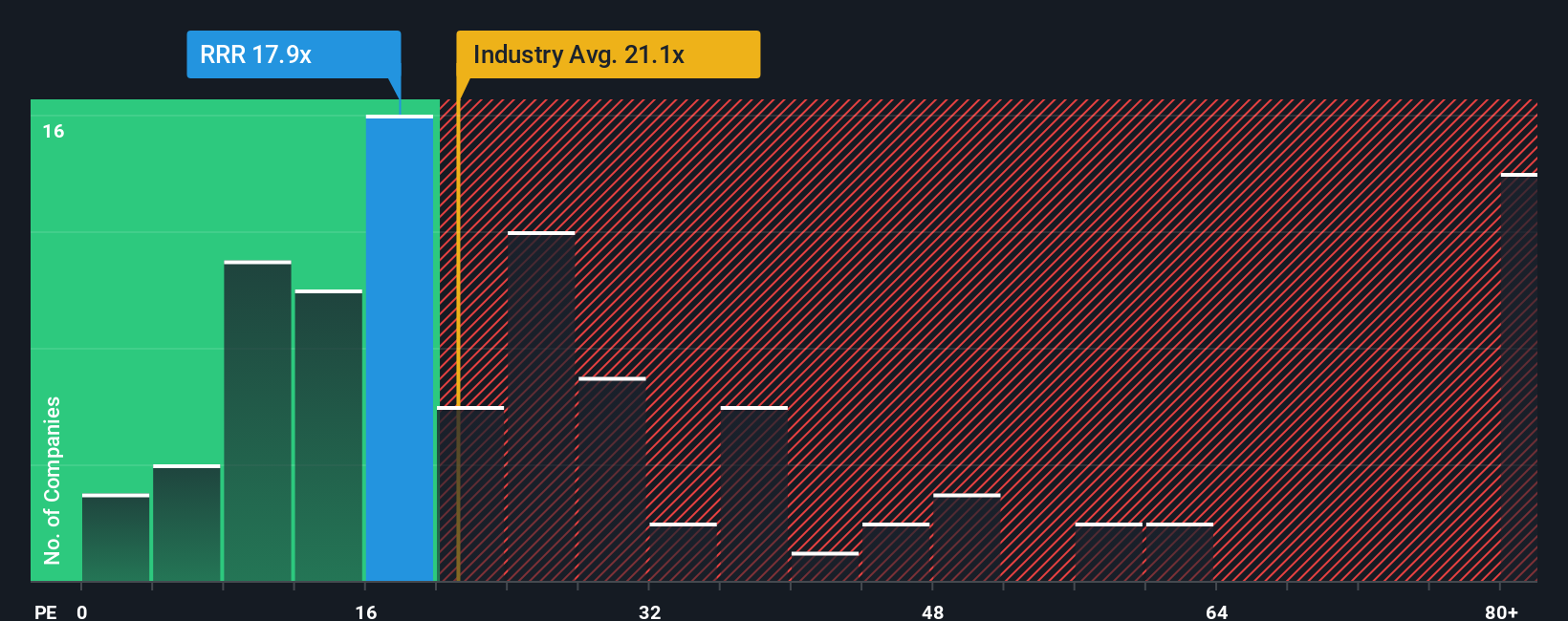

Looking at Red Rock Resorts through the lens of price-to-earnings, the company trades at 17x earnings, just above the peer average of 16.7x but well below the US Hospitality industry at 20.8x. The fair ratio is estimated at a much higher 21.2x, suggesting potential room for upside, but also exposing investors to risk if sentiment shifts. Does this signal a hidden value opportunity, or a warning that the wider market is not yet convinced?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Red Rock Resorts Narrative

If the conclusions above do not reflect your perspective or you would rather draw your own from the data, you can craft a personal narrative in just a few minutes. Do it your way

A great starting point for your Red Rock Resorts research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Make your next move count by seizing fresh opportunities across different sectors. These handpicked lists are packed with stocks many investors overlook. Fast track your research and unlock potential you will not want to miss.

- Start building income with reliable payouts by tapping into these 15 dividend stocks with yields > 3% that consistently offer yields above 3%, making your money work harder for you.

- Experience innovation up close and get ahead of market trends with these 27 AI penny stocks as artificial intelligence transforms entire industries before your eyes.

- Ride the crypto wave and stay ahead of financial disruption through these 81 cryptocurrency and blockchain stocks at the forefront of blockchain and digital finance revolutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RRR

Red Rock Resorts

Through its interest in Station Casinos LLC, develops and manages casino and entertainment properties in the United States.

Undervalued with acceptable track record.

Similar Companies

Market Insights

Community Narratives