- United States

- /

- Hospitality

- /

- NasdaqGS:RRR

Is Red Rock Resorts' (RRR) Bigger Buyback a Sign of Confidence in Long-Term Growth?

Reviewed by Sasha Jovanovic

- Red Rock Resorts recently reported its third-quarter 2025 results, revealing US$475.57 million in revenue and US$42.25 million in net income, and announced a cash dividend increase to US$0.26 per share alongside an expanded US$900 million share buyback program now running until the end of 2027.

- These moves emphasize both a stronger financial performance and a larger commitment to shareholder returns through increased dividends and accelerated share repurchases.

- We'll explore how Red Rock Resorts' earnings growth and larger buyback authorization influence the company's future outlook and investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Red Rock Resorts Investment Narrative Recap

To be a shareholder in Red Rock Resorts, you need to believe in the long-term potential of the Las Vegas locals market and the company’s ability to grow market share by expanding and upgrading its properties amid demographic changes. The recent quarterly results and capital return announcements may reinforce confidence in steady earnings growth, but do not materially change the key short-term catalyst, successful execution of property expansions, nor do they lessen the biggest risk, which is significant exposure to local economic cycles.

Among the recent announcements, the US$900 million share buyback program extension is most relevant, as it highlights the company’s increased commitment to returning capital to shareholders even as it faces ongoing capital expenditure demands from property developments. This creates a balance that closely ties recent news to Red Rock’s ability to generate future free cash flow while investing in growth and shareholder returns.

By contrast, investors should not overlook ongoing risks tied to capital-intensive projects and how delays or rising costs...

Read the full narrative on Red Rock Resorts (it's free!)

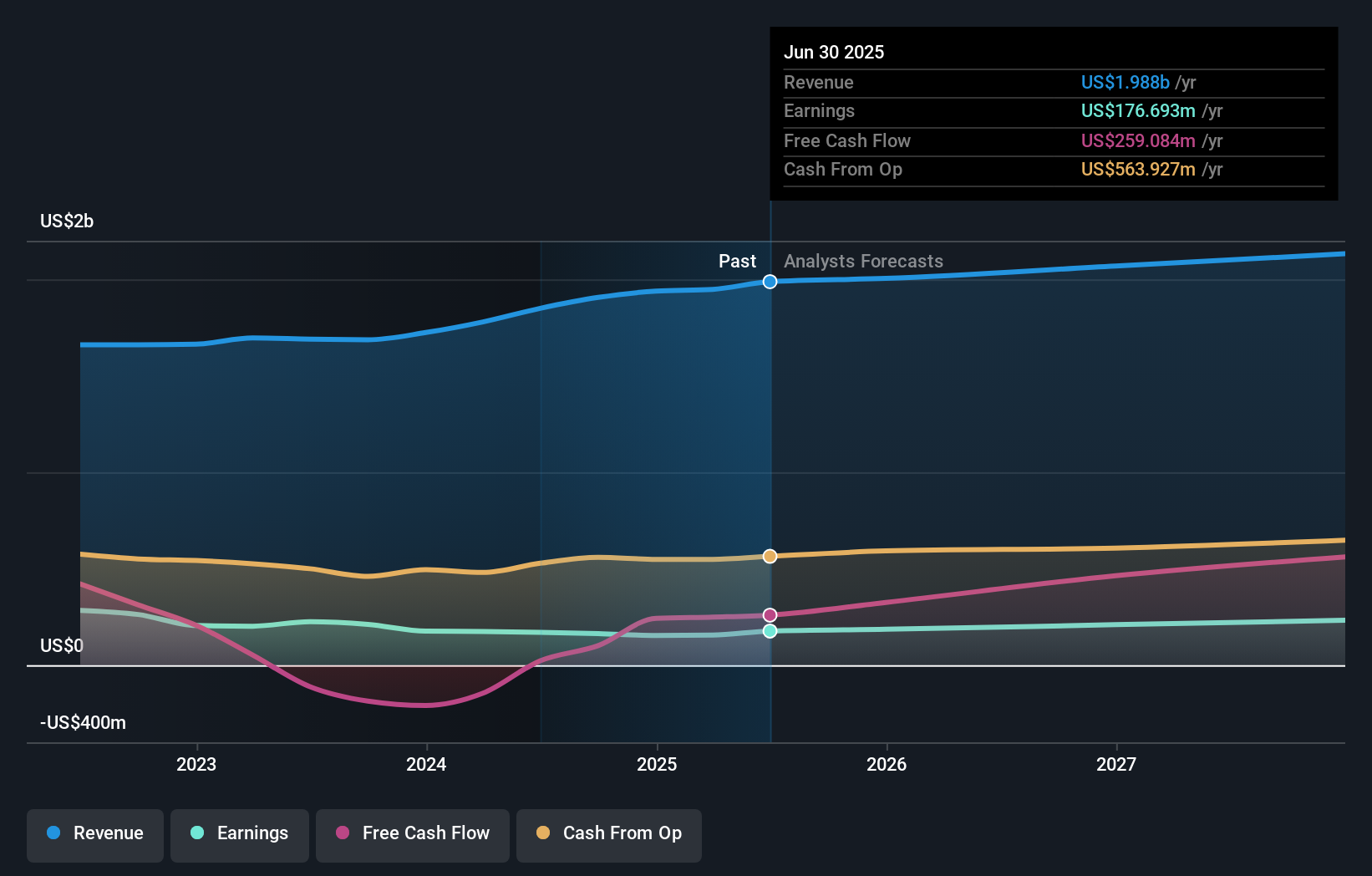

Red Rock Resorts is projected to reach $2.2 billion in revenue and $249.6 million in earnings by 2028. This outlook assumes a 2.9% annual revenue growth rate and a $72.9 million increase in earnings from the current $176.7 million.

Uncover how Red Rock Resorts' forecasts yield a $64.08 fair value, a 20% upside to its current price.

Exploring Other Perspectives

Only one fair value estimate from the Simply Wall St Community places Red Rock Resorts at US$97.68 per share. This is considerably higher than current prices but earnings growth remains closely linked to the successful ramp-up of new property expansions; explore how others interpret these factors.

Explore another fair value estimate on Red Rock Resorts - why the stock might be worth as much as 83% more than the current price!

Build Your Own Red Rock Resorts Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Red Rock Resorts research is our analysis highlighting 5 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Red Rock Resorts research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Red Rock Resorts' overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RRR

Red Rock Resorts

Through its interest in Station Casinos LLC, develops and manages casino and entertainment properties in the United States.

Very undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives