- United States

- /

- Hospitality

- /

- NasdaqGS:RRR

Does S&P 1000 Inclusion and Rate-Cut Hopes Reshape the Narrative for Red Rock Resorts (RRR)?

Reviewed by Sasha Jovanovic

- Red Rock Resorts, Inc. was recently added to the S&P 1000 index, reflecting its expanding profile within the broader market landscape.

- This milestone coincided with renewed investor optimism following remarks from a Federal Reserve official about potential interest rate cuts, underscoring the market's positive assessment of the company's Las Vegas operations and growth outlook.

- With the company’s S&P 1000 inclusion highlighting increased attention, we’ll examine how renewed rate-cut optimism influences Red Rock Resorts’ investment narrative.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Red Rock Resorts Investment Narrative Recap

Owning Red Rock Resorts means believing in the long-term strength of the Las Vegas locals market, the company's winning execution on property development, and a stable economic environment supporting discretionary spending. The addition to the S&P 1000 generated short-term interest in the stock, but does not fundamentally change the most immediate catalyst, the pace and impact of new property rollouts, or the key risk, which is the company's concentrated exposure to the Las Vegas region.

Among recent company updates, the ramp-up and strong results from new developments such as the Durango property have been especially relevant. These successful expansions are core to Red Rock’s strategy of increasing market share among locals, and help underpin the positive sentiment surrounding the company’s operational performance following its S&P 1000 inclusion.

However, in contrast to the positive near-term momentum, investors should be alert to how an unexpected downturn in the Las Vegas economy could leave Red Rock Resorts particularly exposed due to...

Read the full narrative on Red Rock Resorts (it's free!)

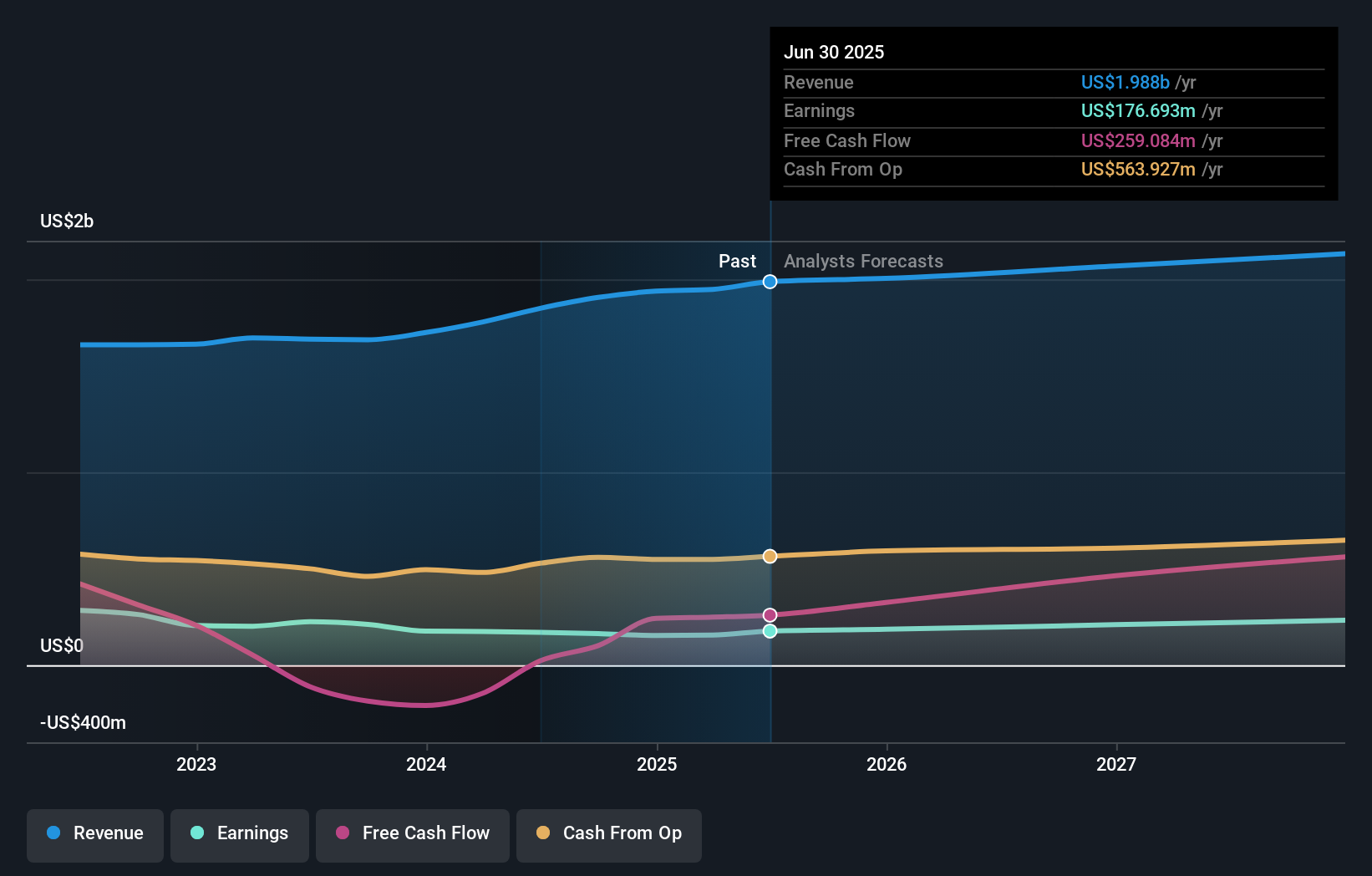

Red Rock Resorts is projected to reach $2.2 billion in revenue and $249.6 million in earnings by 2028. This outlook assumes a 2.9% annual revenue growth rate and a $72.9 million increase in earnings from the current $176.7 million level.

Uncover how Red Rock Resorts' forecasts yield a $65.77 fair value, a 13% upside to its current price.

Exploring Other Perspectives

One Simply Wall St Community valuation placed fair value at US$101.14 per share before the recent news, signaling sharp potential undervaluation. With Red Rock’s growth, especially from successful property launches, front of mind, consider how much investor assumptions about local market stability can influence future expectations.

Explore another fair value estimate on Red Rock Resorts - why the stock might be worth just $101.14!

Build Your Own Red Rock Resorts Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Red Rock Resorts research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Red Rock Resorts research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Red Rock Resorts' overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RRR

Red Rock Resorts

Through its interest in Station Casinos LLC, develops and manages casino and entertainment properties in the United States.

Undervalued with acceptable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success