- United States

- /

- Hospitality

- /

- NasdaqGS:PZZA

Evaluating Papa John’s (PZZA) Valuation Following Recent Share Price Momentum

Reviewed by Simply Wall St

See our latest analysis for Papa John's International.

After a challenging stretch, Papa John's share price has rebounded with a 22% gain over the last 90 days, suggesting renewed momentum. However, the 1-year total shareholder return is just 1%, which indicates that longer-term investors have seen only modest rewards even as recent performance has improved.

If you're curious where momentum is building across other corners of the market, now could be the perfect time to discover fast growing stocks with high insider ownership

With shares climbing in recent months but trading near analysts’ price targets, the key question is whether Papa John's is undervalued and poised for more upside, or if the market has already accounted for future growth in its price.

Most Popular Narrative: Fairly Valued

With Papa John’s shares closing at $51.59, the most widely followed narrative assigns a fair value of $52.10, almost identical to today’s trading price. This sets up a compelling comparison of consensus expectations versus the current market mood.

Papa John's strategic focus on product innovation and enhancing the menu with new offerings is expected to boost revenue growth by increasing customer engagement and driving higher ticket sales. The investment of up to $25 million in marketing, including CRM capabilities and the Papa Rewards loyalty program, aims to drive greater customer loyalty and frequency, which should positively impact revenue.

Want to unpack the numbers behind this razor-thin valuation gap? The narrative’s projection hinges on growth investments and a bold plan to drive margin gains. See exactly which business bets are set to move the needle.

Result: Fair Value of $52.10 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing declines in global restaurant sales or an increase in operating costs could quickly undermine the consensus outlook for Papa John's shares.

Find out about the key risks to this Papa John's International narrative.

Another View: SWS DCF Model Challenges the Fair Value Call

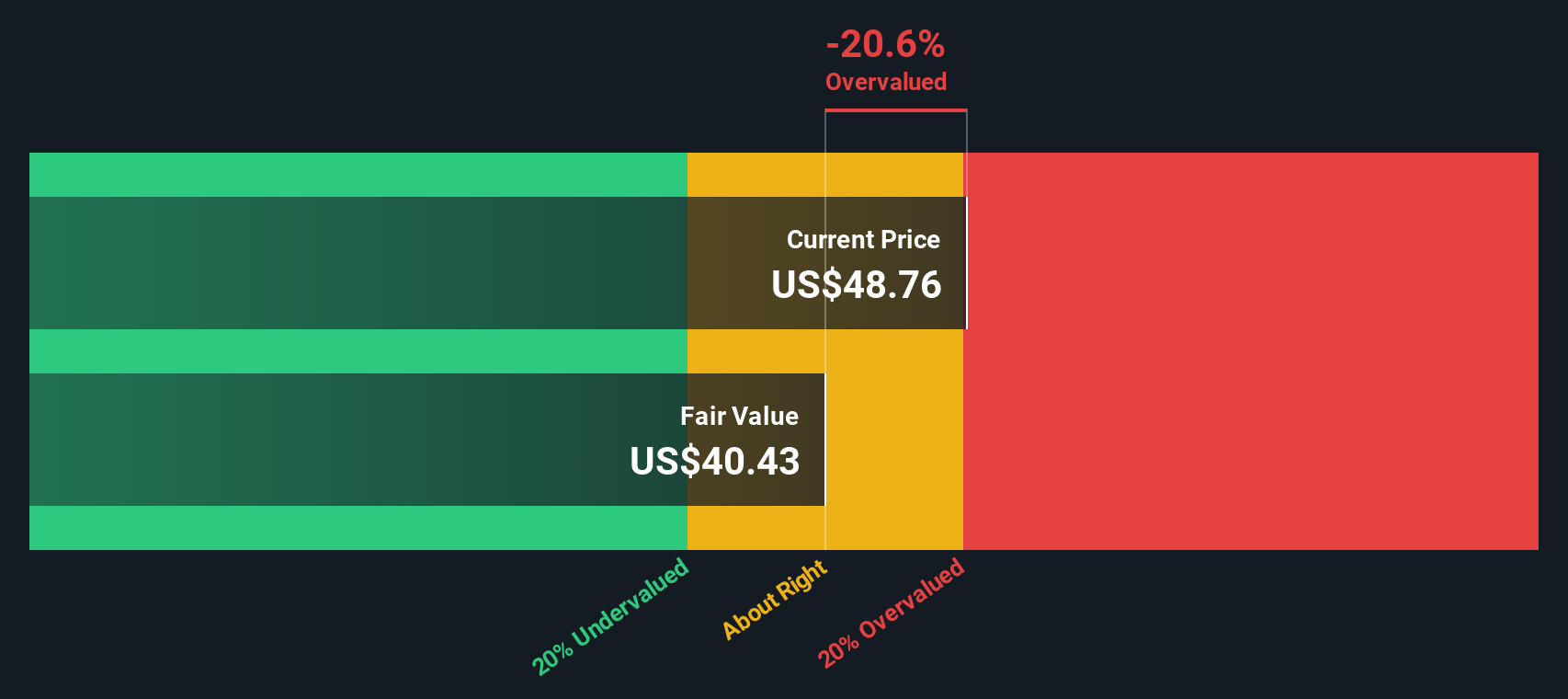

While traditional valuation points to a fair price, the SWS DCF model paints a more cautious picture. It calculates a fair value of $44.94, which is well below where shares currently trade. Does this suggest the market is more optimistic than future cash flows can justify?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Papa John's International Narrative

If you have a different perspective or want to investigate the figures for yourself, you can easily build your own view in just a few minutes with Do it your way.

A great starting point for your Papa John's International research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t wait on the sidelines while others are uncovering tomorrow’s winners. Make your next move count by targeting stocks with outstanding potential, financial resilience, and future-focused technology.

- Unlock portfolio growth by targeting high-yield opportunities. Your path to passive income starts with these 19 dividend stocks with yields > 3% offering strong yields and consistent payouts.

- Get ahead of market trends by hunting for untapped opportunities among these 870 undervalued stocks based on cash flows that may offer hidden value others have missed.

- Ride the wave of innovation by backing companies shaping the world of tomorrow. Let these 28 quantum computing stocks guide you to those driving quantum breakthroughs and industry disruption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PZZA

Papa John's International

Operates and franchises pizza delivery and carryout restaurants under the Papa Johns trademark in the United States, Canada, and internationally.

Average dividend payer with low risk.

Similar Companies

Market Insights

Community Narratives