- United States

- /

- Hospitality

- /

- NasdaqGS:PZZA

A Look at Papa John's (PZZA) Valuation Following Major Executive Leadership Changes

Reviewed by Simply Wall St

Papa John's International (PZZA) has shuffled its top executive team, promoting Ravi Thanawala to Chief Financial Officer and President, North America. The move puts Thanawala in charge of regional operations and strategy development.

See our latest analysis for Papa John's International.

The management shake-up comes as Papa John's works to steady its business following a difficult year for shareholders. The 1-day share price return of 4.41% hints at optimism around the leadership news, but longer-term momentum has faded, with a 1-year total shareholder return of -15.69% and a 5-year total shareholder return of -43.83%. In short, performance has lagged and investors are hoping these changes can mark a turning point.

If today’s executive moves have you rethinking your own strategy, it could be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With the stock trading below analyst price targets and recent earnings showing mixed signals, investors may wonder if this is a genuine buying opportunity or if the market is already accounting for all foreseeable improvement.

Most Popular Narrative: 18% Undervalued

Papa John's is trading well below the widely followed fair value estimate, which adds interest to the recent management changes and speculation in the market.

The company’s sustained operational momentum is viewed as a sign that management’s current strategies are starting to yield returns. This could underpin future growth and earnings stability.

Ever wonder what financial levers could justify a premium above today’s price? There is a hidden interplay of profit margins and forward earnings forecasts in this narrative. Hungry for specifics? Uncover which bold analyst assumptions and operational benchmarks might tip the scales in Papa John’s next valuation chapter.

Result: Fair Value of $49.30 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing deal speculation and lackluster revenue growth could quickly upend expectations. This reminds investors that the outlook remains anything but certain.

Find out about the key risks to this Papa John's International narrative.

Another View: Price-Based Valuation Raises Caution

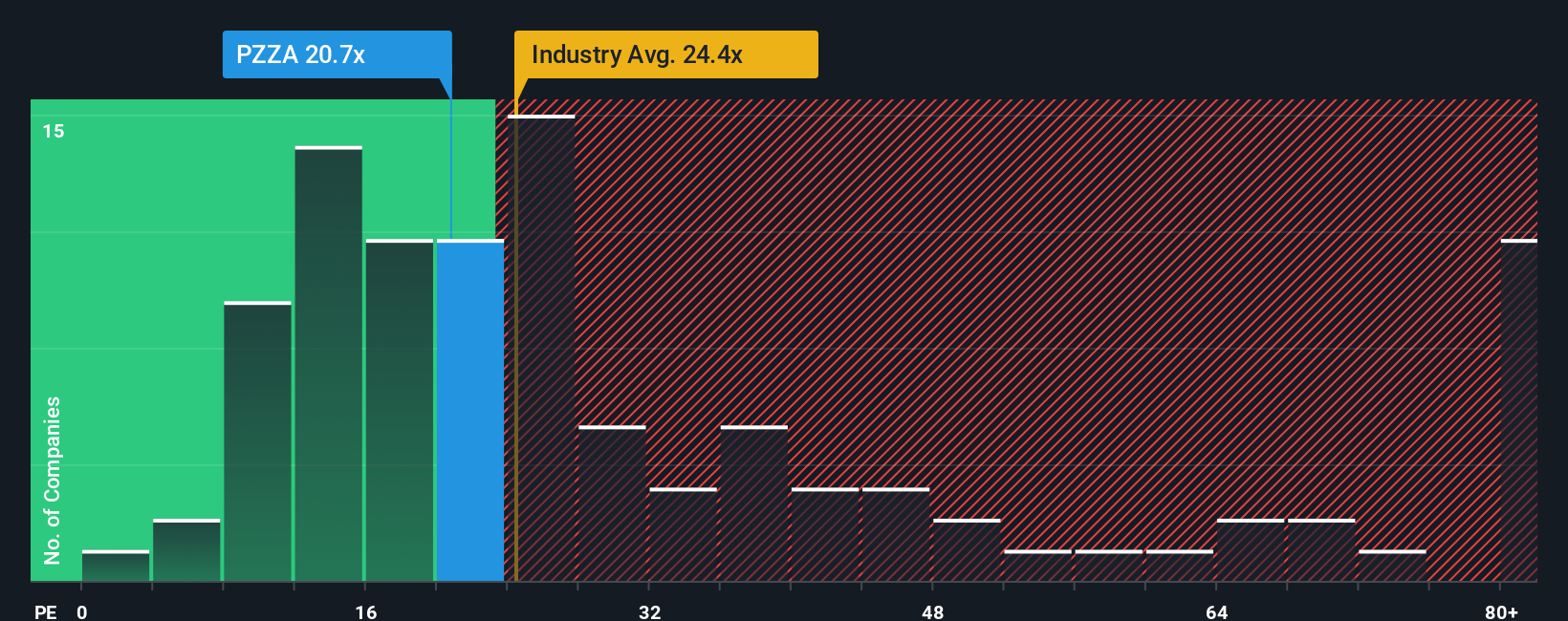

Looking through the lens of price-to-earnings, Papa John's currently trades at 35.3 times earnings. This is not just higher than the Hospitality industry average of 20.7, but also above both the peer average of 13.3 and its fair ratio of 34.1. That gap may signal overstretched expectations. Could this premium persist, or do investors risk a pullback?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Papa John's International Narrative

If you have a different perspective or want to run your own numbers, you can easily build your own view in just a few minutes. Do it your way

A great starting point for your Papa John's International research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Make your next move count by searching beyond the obvious. Highly-rated investment opportunities are just waiting to be found, but you have to know where to look.

- Unlock growth potential by targeting these 918 undervalued stocks based on cash flows. This screener offers rare value gems that the market might be overlooking right now.

- Tap into passive income streams through these 17 dividend stocks with yields > 3%. This option features companies with solid yields over 3% and steady payout histories.

- Ride the momentum of technological breakthroughs by checking out these 25 AI penny stocks. This list is packed with innovators driving artificial intelligence forward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PZZA

Papa John's International

Operates and franchises pizza delivery and carryout restaurants under the Papa Johns trademark in the United States, Canada, and internationally.

Average dividend payer with slight risk.

Market Insights

Community Narratives