- United States

- /

- Consumer Services

- /

- NasdaqCM:OSW

The Bull Case For OneSpaWorld Holdings (OSW) Could Change Following Analyst Upgrades Ahead of Q3 Earnings

Reviewed by Sasha Jovanovic

- OneSpaWorld Holdings Ltd is set to announce its Q3 2025 earnings on October 29, with analysts having recently raised revenue estimates for both 2025 and 2026.

- This wave of renewed optimism is further reflected in a strong consensus from brokerage firms, offering insights into how investor outlook has shifted ahead of the earnings release.

- With analyst upgrades signaling greater confidence in future performance, let's assess how these developments might reshape OneSpaWorld's investment narrative.

The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

OneSpaWorld Holdings Investment Narrative Recap

To be a shareholder in OneSpaWorld Holdings, you need to believe in the resilient, long-term growth of the cruise-based wellness experience, supported by rising demand for onboard health and lifestyle services worldwide. The recent analyst upgrades and higher revenue estimates for 2025 and 2026 may boost optimism, but they do not materially change the biggest short-term catalyst (upcoming earnings) or the key risk: OneSpaWorld's exposure to fluctuations in global cruise passenger volumes.

One of the recent announcements most relevant to the current outlook is the company's continued payment of quarterly dividends, with the latest scheduled for September 3, 2025. This consistent cash return signals management's confidence in operational stability, which is particularly meaningful as investors weigh OneSpaWorld's ability to balance growth investments with shareholder rewards amid evolving industry dynamics.

In contrast, investors should also be aware of the ongoing risk related to the company's high fixed shipboard labor costs if cruise traffic unexpectedly declines, as this could...

Read the full narrative on OneSpaWorld Holdings (it's free!)

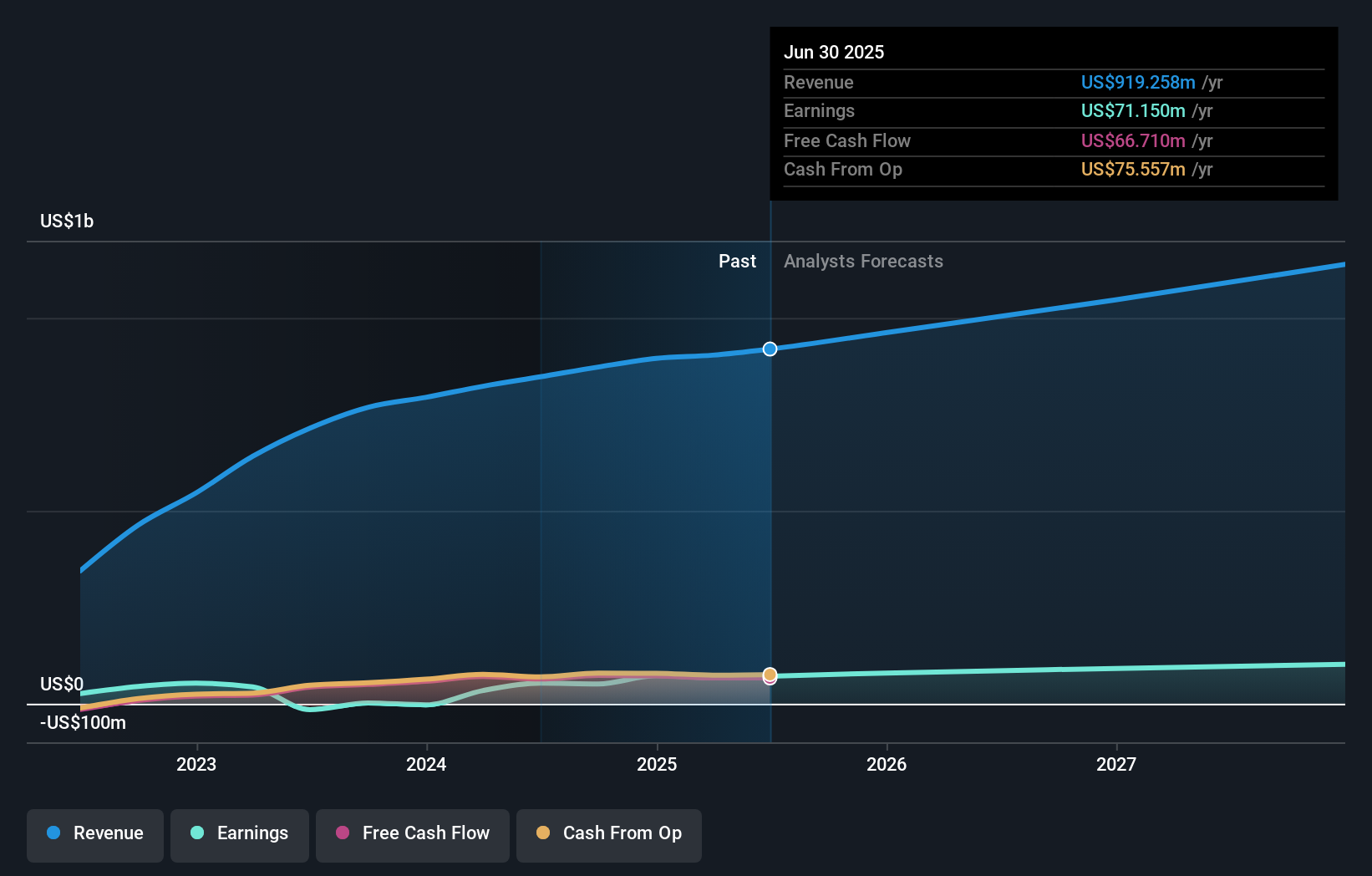

OneSpaWorld Holdings is projected to reach $1.2 billion in revenue and $110.6 million in earnings by 2028. This outlook is based on an anticipated 8.9% annual revenue growth rate and a $39.5 million increase in earnings from the current $71.1 million.

Uncover how OneSpaWorld Holdings' forecasts yield a $24.67 fair value, a 16% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community users set fair values between US$18.82 and US$24.67, based on 2 separate forecasts. As you compare these with the potential impact of cruise sector volatility on OneSpaWorld’s future returns, consider how much individual viewpoints can differ.

Explore 2 other fair value estimates on OneSpaWorld Holdings - why the stock might be worth 12% less than the current price!

Build Your Own OneSpaWorld Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your OneSpaWorld Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free OneSpaWorld Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate OneSpaWorld Holdings' overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:OSW

OneSpaWorld Holdings

Operates health and wellness centers onboard cruise ships and at destination resorts in the United States and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives