- United States

- /

- Consumer Services

- /

- NasdaqCM:OSW

A Look at OneSpaWorld (OSW) Valuation After Stifel Reaffirms Buy on In-Line Results and Operational Progress

Reviewed by Simply Wall St

OneSpaWorld Holdings (OSW) is back in focus after its latest quarterly results met expectations and highlighted smoother operations, reinforcing market confidence as cruise oversupply worries fade and spa demand holds steady.

See our latest analysis for OneSpaWorld Holdings.

The latest earnings and upbeat commentary have helped the stock regain its footing, with a solid year to date share price return and a standout three year total shareholder return suggesting momentum is quietly rebuilding as investors reassess the growth story and risk profile.

If OneSpaWorld’s steady demand has you thinking about what else could surprise on the upside, it might be worth exploring fast growing stocks with high insider ownership.

With the shares still trading at a discount to analyst targets despite steady growth in revenue and earnings, the key question now is whether OneSpaWorld remains mispriced or if the market is already factoring in its next leg of expansion.

Most Popular Narrative: 19.1% Undervalued

With OneSpaWorld last closing at $21.43 against a narrative fair value of $26.50, the story centers on steady growth and richer margins ahead.

Analysts are assuming OneSpaWorld Holdings's revenue will grow by 8.9% annually over the next 3 years. Analysts assume that profit margins will increase from 7.7% today to 9.3% in 3 years time.

Want to see why a modest growth profile still supports a premium earnings multiple and rising buybacks? The narrative focuses on compounding upgrades and disciplined capital returns, and explores which earnings and margin targets would need to be met for this valuation gap to close.

Result: Fair Value of $26.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent reliance on cruise demand and slower than expected benefits from AI and pre-cruise initiatives could delay the margin and growth inflection investors expect.

Find out about the key risks to this OneSpaWorld Holdings narrative.

Another Angle on Valuation

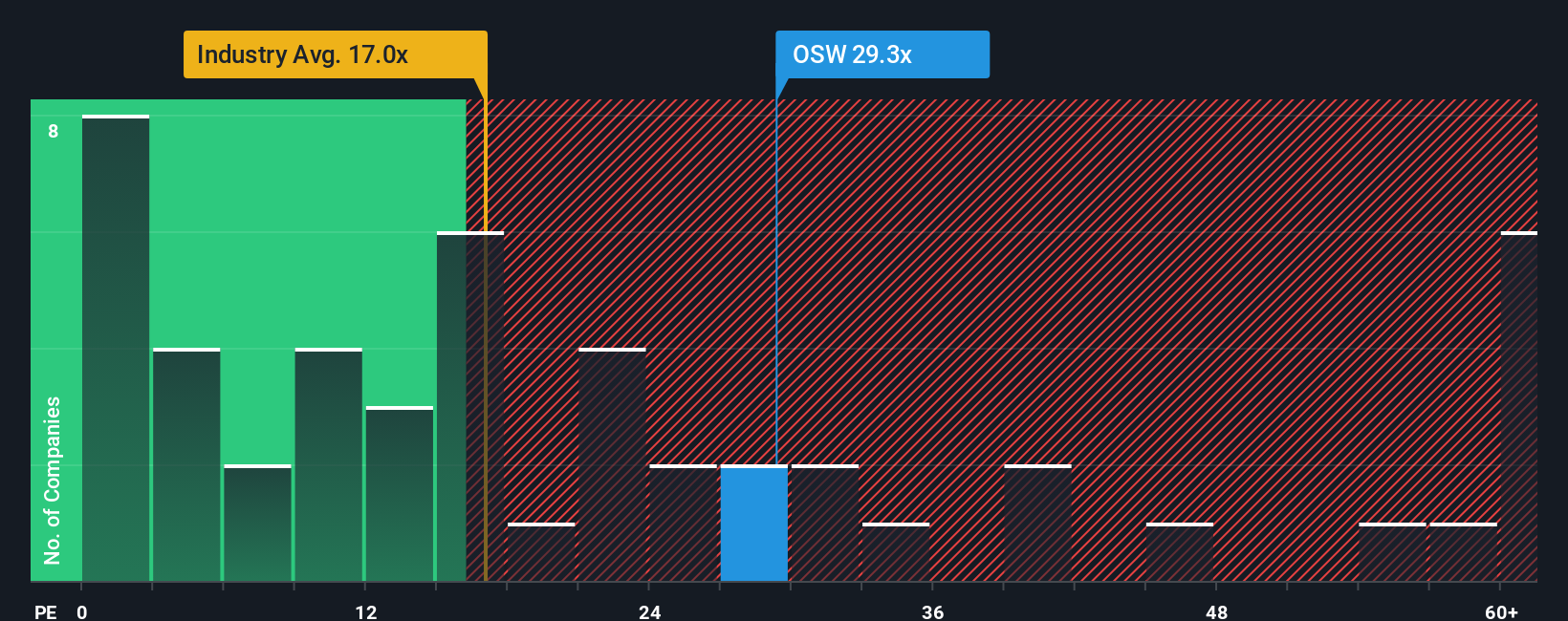

While the narrative fair value suggests upside, a simple earnings multiple tells a tougher story. OSW trades on 29.5 times earnings, versus a fair ratio of 18.9 times, 16.6 times for the wider Consumer Services group and 14.7 times for peers. This hints at downside risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own OneSpaWorld Holdings Narrative

If you are unconvinced by this view or simply prefer to dig into the numbers yourself, you can build a fresh story in minutes, Do it your way.

A great starting point for your OneSpaWorld Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next smart move by scanning fresh opportunities that match your style, sector preferences, and return goals using the Simply Wall Street Screener.

- Capture potential income streams by reviewing these 13 dividend stocks with yields > 3% that could strengthen your portfolio’s cash flow.

- Position yourself for tomorrow’s breakthroughs by targeting these 24 AI penny stocks shaping the next wave of intelligent technologies.

- Tilt the odds in your favor by screening these 918 undervalued stocks based on cash flows that may offer more upside than the market currently recognizes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:OSW

OneSpaWorld Holdings

Operates health and wellness centers onboard cruise ships and at destination resorts in the United States and internationally.

Flawless balance sheet with proven track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion