- United States

- /

- Hospitality

- /

- NasdaqGS:MMYT

MakeMyTrip (NasdaqGS:MMYT): Assessing Valuation After 30% Year-to-Date Decline and Recent Double-Digit Drop

Reviewed by Simply Wall St

MakeMyTrip (NasdaqGS:MMYT) shares have seen significant movement recently, drawing investor attention toward its current valuation. With a year-to-date slide of more than 30%, some market participants are reassessing the travel platform's outlook.

See our latest analysis for MakeMyTrip.

The recent drop in MakeMyTrip’s share price, including a steep 10.25% decline in a single day, is part of a sharper downward trend that now totals a 30% slide year-to-date. Even so, with a robust 3-year total shareholder return of 183% and a five-year gain topping 319%, the long-term growth story remains impressive, even as near-term momentum fades and investors rethink valuation and expectations.

If MakeMyTrip’s volatility has you scanning the horizon for other opportunities, it could be the perfect moment to discover fast growing stocks with high insider ownership

With MakeMyTrip’s stock now trading at a steep discount to analyst estimates, the big question is whether the recent slump presents a genuine buying opportunity or if the market has already taken all future growth into account.

Most Popular Narrative: 33% Undervalued

MakeMyTrip's last close of $80.75 sits well below the narrative's fair value estimate, setting up a striking gap between current sentiment and long-term potential. This wide disconnect brings fresh urgency to understand the bold growth blueprint behind the valuation.

Ongoing investment in product innovation, particularly in AI-powered personalization and user experience improvements, positions MakeMyTrip for higher conversion rates, better customer retention, and ultimately supports expanding net margins through improved operating leverage. Increasing integration of ancillary services (hotels, home stays, experiences, insurance, and ground transport) creates diversified and higher-margin revenue streams, which are showing high double-digit growth and driving improvements in overall net margins and adjusted operating profit.

Curious what powerful growth projections justify a fair value far above today’s price? The narrative hinges on big leaps in future margins, revenue, and earnings, which is not typical for the industry. Craving the story behind those ambitious forecasts? Click through to unlock the full narrative and see how valuation expectations stack up.

Result: Fair Value of $121 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition and persistently high customer acquisition costs could challenge MakeMyTrip’s ability to maintain its growth and profitability in the coming years.

Find out about the key risks to this MakeMyTrip narrative.

Another View: High Multiple, High Hurdles

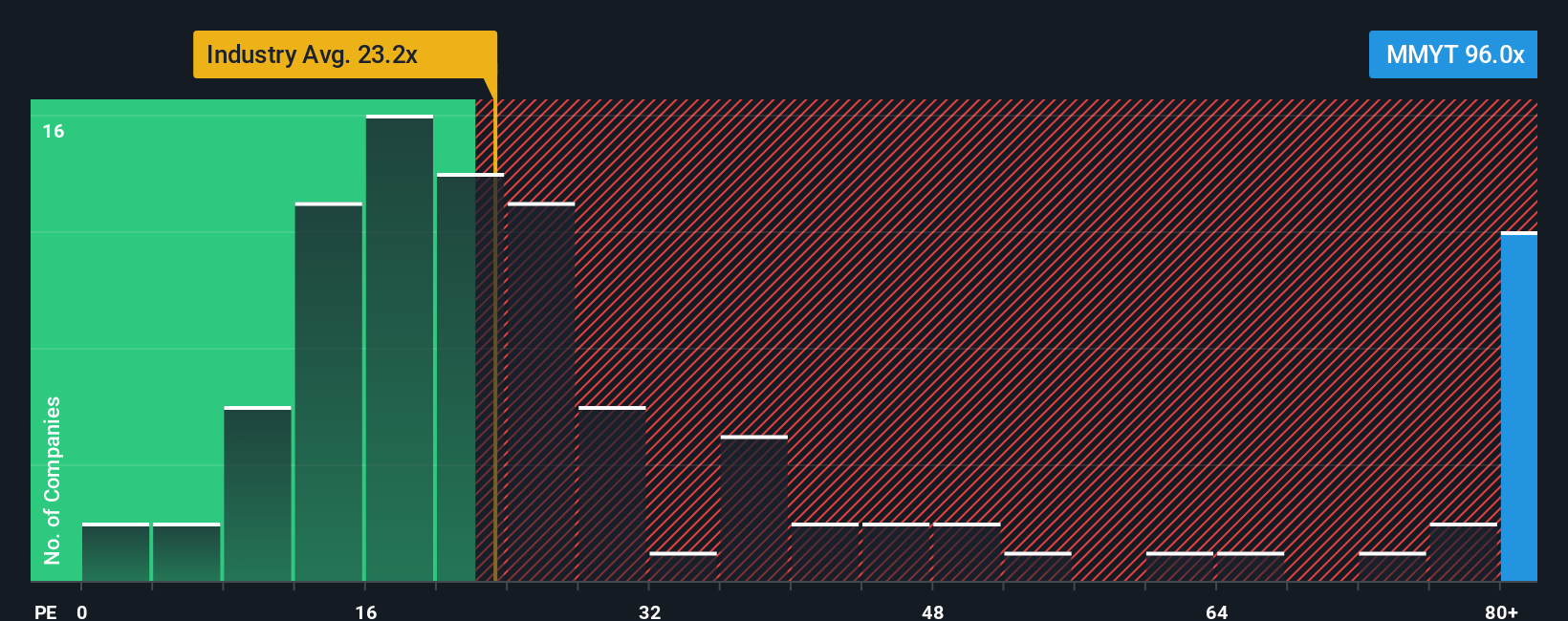

While analyst consensus points to upside, MakeMyTrip currently trades at a price-to-earnings ratio of 76.8x, much higher than both its industry average of 24.1x and the peer group at 19.8x. Even compared to its fair ratio of 44.4x, the stock looks pricey. This large gap suggests investors may be paying up for growth that has already been factored in. Could high expectations leave little room for future upside, or is the long runway ahead worth the premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MakeMyTrip Narrative

If this perspective does not align with your own view or you prefer charting a unique path, dive into the data and develop your own insights in just a few minutes. Do it your way

A great starting point for your MakeMyTrip research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Opportunities are everywhere if you know where to look. Take charge and target the stocks that could energize your portfolio with high-impact returns.

- Tap into breakthrough innovation by checking out these 26 AI penny stocks, enhancing industries with artificial intelligence solutions, automation, and smarter platforms.

- Grow your passive income by reviewing these 21 dividend stocks with yields > 3%, offering yields above 3%, letting your investments work harder for you.

- Ride the next wave in finance by exploring these 81 cryptocurrency and blockchain stocks, at the forefront of blockchain and digital asset transformation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MMYT

MakeMyTrip

Operates as a travel service provider in India, the United States, Singapore, Malaysia, Thailand, the United Arab Emirates, Peru, Colombia, Vietnam, Cambodia, and Indonesia.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives