- United States

- /

- Hospitality

- /

- NasdaqGS:MLCO

Melco Resorts & Entertainment (NasdaqGS:MLCO) Valuation in Focus After Strong Earnings and International Expansion

Reviewed by Simply Wall St

Melco Resorts & Entertainment (MLCO) reported third quarter earnings that underscored strong momentum, with revenue and net income climbing higher than last year. The gains were powered by both gaming and non-gaming operations, as well as expanding markets.

See our latest analysis for Melco Resorts & Entertainment.

Backed by an impressive year-to-date share price return of 64.13%, Melco Resorts & Entertainment is clearly riding a wave of renewed optimism. The upbeat mood has built steadily, as investors have taken notice of accelerating momentum in both Macau and international operations, as reflected in robust 1-month and 7-day share price returns of 14.97% and 6.59% respectively. While its one-year total shareholder return of 48.04% is a strong showing, longer-term holders may still be underwater after a tough five years, as the total return remains negative over that period. Overall, confidence seems to be on the rise coming off the latest earnings beat and expansion news.

If Melco’s rebound has you looking for what’s next, now’s an ideal time to broaden your investing universe and discover fast growing stocks with high insider ownership

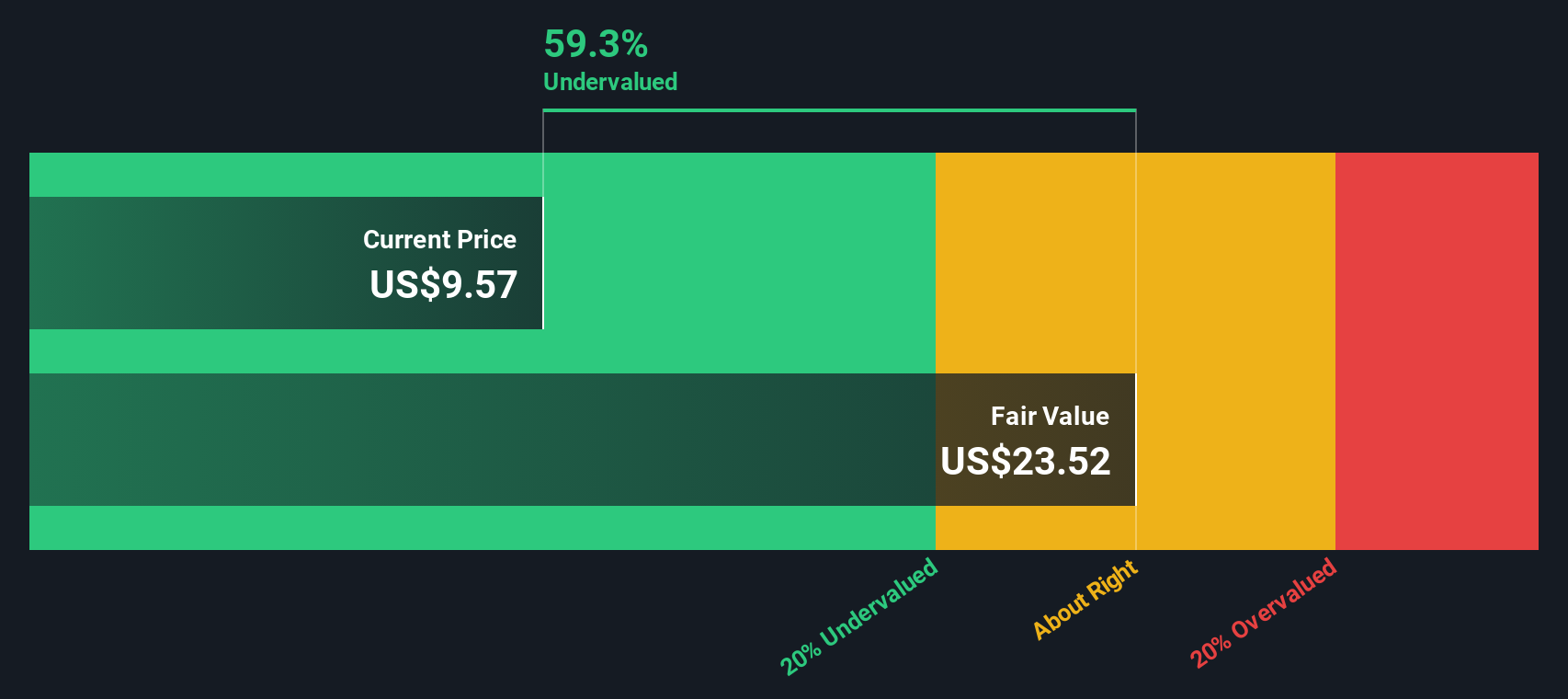

But with such strong gains in both operations and share price, investors may wonder whether Melco Resorts & Entertainment is still undervalued at current levels, or if the market has already factored in its future growth prospects.

Price-to-Earnings of 34x: Is it justified?

Melco Resorts & Entertainment is trading at a price-to-earnings (P/E) ratio of 34x, which is above the US Hospitality industry average of 21.1x and just above its estimated fair P/E ratio of 33x. With a last close of $9.06, the market appears to be placing a premium on Melco's earnings relative to most sector peers.

The price-to-earnings ratio measures how much investors are willing to pay for each dollar of company earnings. In hospitality, a high P/E can signal confidence in future profits and growth, especially for firms that have recently returned to profitability like Melco.

While the company’s recent shift to profitability and robust earnings growth outlook may justify a higher multiple, the current P/E could indicate the market expects future performance to remain strong. Relative to peers, Melco’s P/E is above the industry average, suggesting the stock trades at a substantial premium. Yet, compared to the fair P/E calculated through regression, it sits only slightly higher. This is a level the market could potentially move toward if forecasts are met.

Explore the SWS fair ratio for Melco Resorts & Entertainment

Result: Price-to-Earnings of 34x (OVERVALUED)

However, potential headwinds such as slower revenue growth or shifting market sentiment could temper Melco's bullish trajectory if fundamentals fail to impress investors.

Find out about the key risks to this Melco Resorts & Entertainment narrative.

Another View: Discounted Cash Flow Valuation

Looking beyond earnings multiples, the SWS DCF model suggests a very different story for Melco Resorts & Entertainment. According to this cash flow-based approach, shares are trading at a steep 58.5% discount to their estimated fair value of $21.84. This points to substantial upside if the cash flow forecasts are realistic. However, such a large gap could signal either a hidden bargain or reflect uncertainty about delivering on future growth.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Melco Resorts & Entertainment for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 885 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Melco Resorts & Entertainment Narrative

If you have a different perspective or want to dive deeper into the numbers yourself, you can easily craft your own narrative in just a few minutes. Do it your way

A great starting point for your Melco Resorts & Entertainment research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Take charge of your investment journey and stay ahead of the crowd by tapping into specialized stock ideas tailored for today’s dynamic market. These opportunities move quickly, so don’t let them pass you by.

- Grow your wealth with resilience by checking out these 16 dividend stocks with yields > 3%, featuring companies delivering reliable income and healthy yields above 3%.

- Ride the wave of innovation by uncovering tomorrow’s leaders with these 24 AI penny stocks, which includes firms shaping breakthroughs in artificial intelligence.

- Stay a step ahead and scoop up hidden gems with strong fundamentals by seeing these 885 undervalued stocks based on cash flows before others catch on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MLCO

Melco Resorts & Entertainment

Develops, owns, and operates casino gaming and resort facilities in Asia and Europe.

Good value with reasonable growth potential.

Market Insights

Community Narratives