- United States

- /

- Hospitality

- /

- NasdaqGS:MLCO

Melco Resorts & Entertainment Limited's (NASDAQ:MLCO) P/S Still Appears To Be Reasonable

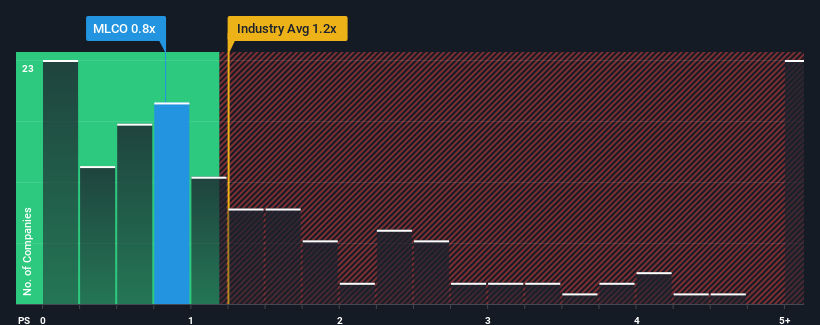

With a median price-to-sales (or "P/S") ratio of close to 1.2x in the Hospitality industry in the United States, you could be forgiven for feeling indifferent about Melco Resorts & Entertainment Limited's (NASDAQ:MLCO) P/S ratio of 0.8x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Melco Resorts & Entertainment

What Does Melco Resorts & Entertainment's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Melco Resorts & Entertainment has been doing relatively well. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Melco Resorts & Entertainment.Is There Some Revenue Growth Forecasted For Melco Resorts & Entertainment?

In order to justify its P/S ratio, Melco Resorts & Entertainment would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company grew revenue by an impressive 162% last year. The strong recent performance means it was also able to grow revenue by 191% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 11% per annum over the next three years. That's shaping up to be similar to the 12% per annum growth forecast for the broader industry.

In light of this, it's understandable that Melco Resorts & Entertainment's P/S sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

What We Can Learn From Melco Resorts & Entertainment's P/S?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

A Melco Resorts & Entertainment's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Hospitality industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Melco Resorts & Entertainment that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:MLCO

Melco Resorts & Entertainment

Develops, owns, and operates casino gaming and resort facilities in Asia and Europe.

Good value with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success