- United States

- /

- Hospitality

- /

- NasdaqGS:MCRI

Monarch Casino & Resort (MCRI): A Fresh Look at Valuation After Bet Monarch’s NFL Promo Launch

Reviewed by Simply Wall St

Monarch Casino & Resort (MCRI) just launched a new campaign with its Bet Monarch app, offering -105 spreads on all NFL regular season games. This move is intended to draw in more sports bettors and grow Monarch’s digital presence.

See our latest analysis for Monarch Casino & Resort.

The buzz around Monarch’s Bet Monarch offer has helped keep momentum going, with the share price up 2.09% in a day and 4.90% over the past week. Despite a modest pullback in recent months, total shareholder return over the past year stands at an impressive 14.86%, and those who stuck with the stock for five years have seen their investments more than double. The company’s upward trend, along with new digital bets like this NFL initiative, suggests optimism is building among investors.

If you’re weighing what else is gaining traction in the market, now is a smart moment to broaden your search and discover fast growing stocks with high insider ownership

With the stock’s momentum still strong, the key question remains: Is Monarch Casino & Resort trading at an attractive discount, or is the market already factoring in the company’s future growth, leaving little room for upside?

Price-to-Earnings of 20.9x: Is it justified?

Monarch Casino & Resort is trading at a price-to-earnings ratio of 20.9x, aligning closely with peers and industry benchmarks. This suggests the market sees its recent growth as largely realized.

The price-to-earnings (P/E) ratio compares a company’s current share price to its per-share earnings. It is a widely used metric for valuing businesses in the hospitality sector, where profitability and growth expectations can rapidly shift, especially after new initiatives such as digital betting expansion.

Monarch’s current P/E ratio of 20.9x stands just below the US Hospitality industry average of 21.2x and notably below the peer average of 24.6x. However, it is higher than the estimated fair P/E of 16.8x. This may indicate an expectation for persistent outperformance or a premium placed on its growth potential. If the market recalibrates toward this fair ratio, Monarch’s valuation could see downward pressure.

Explore the SWS fair ratio for Monarch Casino & Resort

Result: Price-to-Earnings of 20.9x (ABOUT RIGHT)

However, a slowdown in revenue growth or market volatility could challenge the optimistic outlook and prompt a reassessment of Monarch’s current valuation.

Find out about the key risks to this Monarch Casino & Resort narrative.

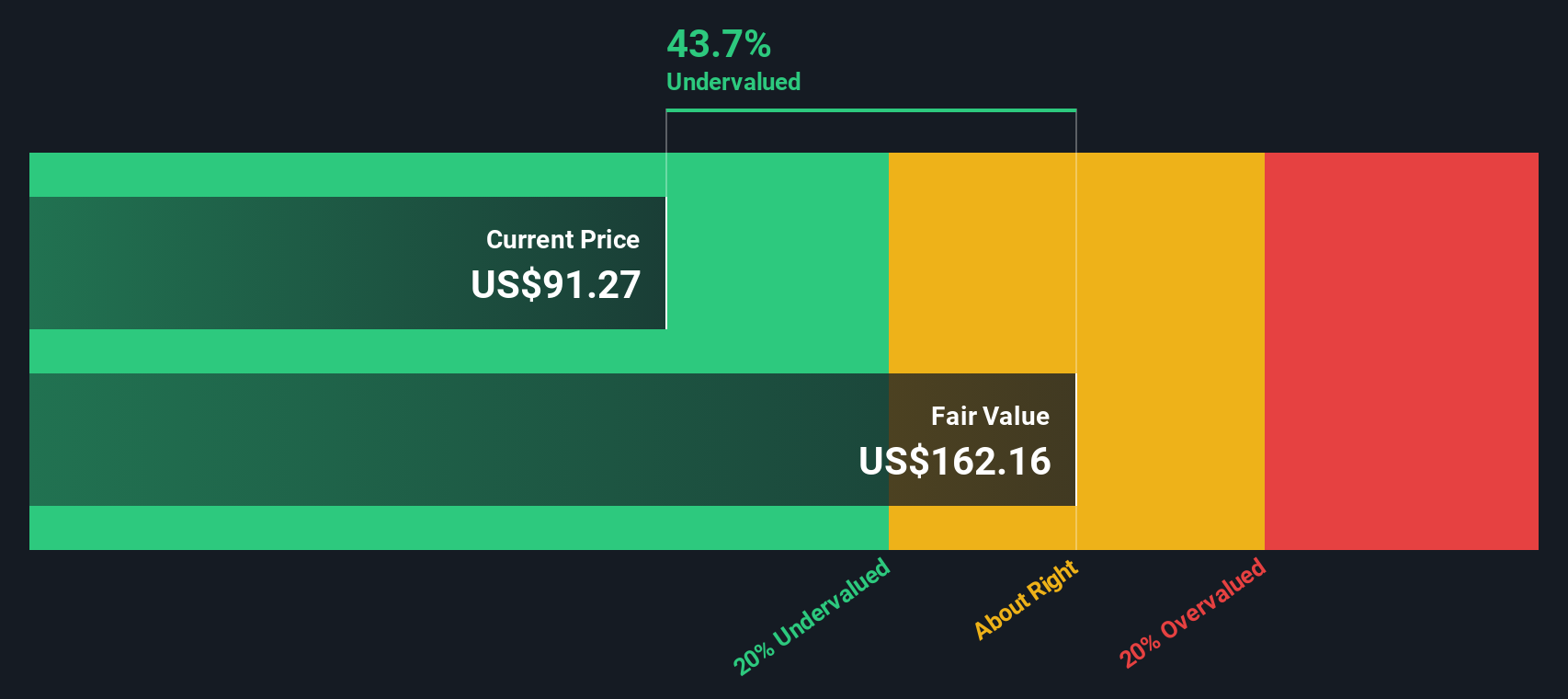

Another View: Discounted Cash Flow Model Points to Undervaluation

While the price-to-earnings ratio suggests Monarch Casino & Resort is priced fairly, our SWS DCF model presents a very different perspective. The DCF analysis estimates a fair value of $162.61 per share, indicating that Monarch might be trading at a considerable 41.8% discount. Could the market be overlooking this opportunity, or is there a reason for the gap?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Monarch Casino & Resort for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 863 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Monarch Casino & Resort Narrative

If you see things differently, or want to dive deeper into the numbers on your own, you can shape your own perspective in just a few minutes. Do it your way

A great starting point for your Monarch Casino & Resort research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never limit themselves to just one opportunity. Take charge of your portfolio and uncover stocks that are shaping tomorrow’s market trends. Missing out could mean watching from the sidelines while others get ahead.

- Fuel your growth strategy by targeting high-potential companies with these 863 undervalued stocks based on cash flows based on strong cash flow signals.

- Maximize your income stream and stability with these 16 dividend stocks with yields > 3% offering yields above 3% to boost your returns.

- Capitalize on the massive potential of artificial intelligence with these 24 AI penny stocks driving the next wave of innovation and technological leadership.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MCRI

Monarch Casino & Resort

Through its subsidiaries, owns and operates hotels and casinos.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives