- United States

- /

- Hospitality

- /

- NasdaqGS:MCRI

AAA Four Diamond Award Could Be a Game Changer for Monarch Casino & Resort (MCRI)

Reviewed by Sasha Jovanovic

- Earlier this month, Monarch Casino Resort Spa was awarded the prestigious AAA Four Diamond hotel designation, a first for the property since opening its 23-story tower in 2021.

- This accolade highlights Monarch’s progression in service quality, setting it apart in a highly competitive hospitality sector.

- We’ll examine how the Four Diamond designation could shape Monarch’s investment narrative through its enhanced guest experience focus.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

What Is Monarch Casino & Resort's Investment Narrative?

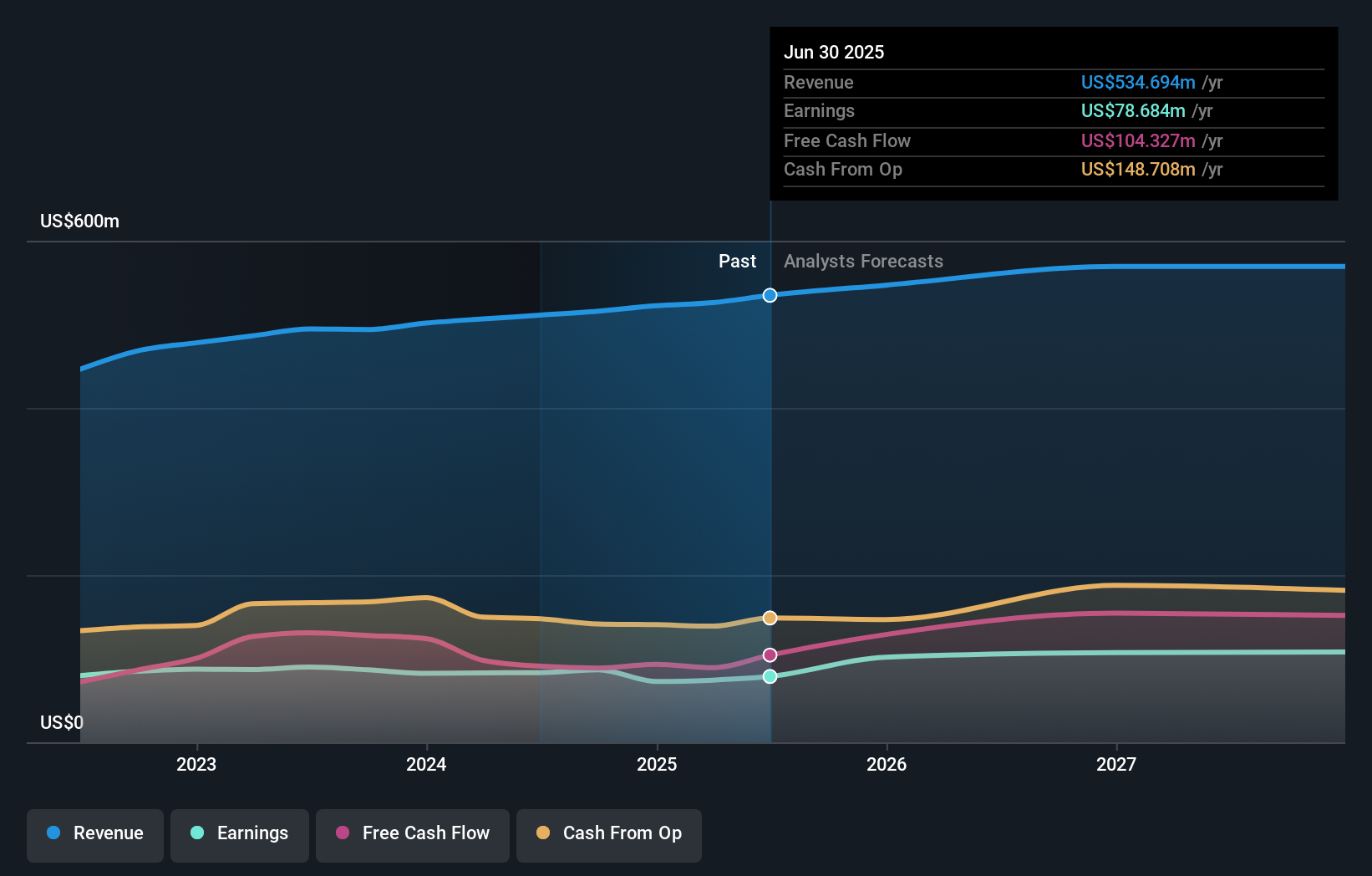

The core belief underpinning Monarch Casino & Resort as an investment hinges on its ability to translate operational quality, evidenced now by its new AAA Four Diamond designation, into sustainable financial performance and competitive standing. The recent award is a high-profile endorsement of Monarch’s guest experience focus, but given recent price movements showing little reaction, it may serve more as a gradual, longer-term catalyst rather than an immediate needle-mover for the stock. Historically, fundamentals such as steady revenue growth, healthy buybacks, and consistent dividends have been at the heart of its appeal, while risks have included flat earnings momentum, relatively high valuation multiples, and governance flagged by limited board refreshment. The Four Diamond recognition could help support occupancy and pricing power, potentially easing concerns about growth pace and providing management an additional lever amid cost pressures and industry turnover. Yet, investors still need to weigh muted forecast revenue growth and the lagging return on equity against these newer positives.

In contrast, slow revenue growth compared to the broader market remains an issue to watch.

Exploring Other Perspectives

Explore 2 other fair value estimates on Monarch Casino & Resort - why the stock might be worth as much as 71% more than the current price!

Build Your Own Monarch Casino & Resort Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Monarch Casino & Resort research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Monarch Casino & Resort research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Monarch Casino & Resort's overall financial health at a glance.

No Opportunity In Monarch Casino & Resort?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MCRI

Monarch Casino & Resort

Through its subsidiaries, owns and operates hotels and casinos.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives