- United States

- /

- Consumer Services

- /

- NasdaqGS:LOPE

Grand Canyon Education (LOPE): Evaluating Valuation Following CIO Transition

Reviewed by Simply Wall St

Grand Canyon Education (LOPE) recently announced that Kathy J. Claypatch has resigned from her role as Chief Information Officer. For investors, leadership transitions in key operational areas often invite fresh attention to the company’s direction and digital strategy.

See our latest analysis for Grand Canyon Education.

Even with some changes in leadership, Grand Canyon Education's shares have climbed in recent months. The company notched a 29.8% share price return in the past quarter and delivered an impressive 63.7% total shareholder return over the last year. That kind of momentum signals that investors are optimistic about the company’s direction, both in the short and long run.

If you're interested in finding more opportunities with similar growth stories, consider expanding your search to fast growing stocks with high insider ownership.

With the stock up sharply over the past year but trading just below analyst price targets, investors now face a key question: is Grand Canyon Education’s strong performance fully reflected in its current price, or is there still meaningful upside?

Most Popular Narrative: 8.6% Undervalued

The narrative’s fair value estimate stands notably above Grand Canyon Education’s last close of $218.35, suggesting a material disconnect between price and fundamentals. A bold set of growth drivers appears to be shaping this positive outlook. Here is one of the main reasons analysts remain constructive.

• Accelerating adoption and expansion of fully online programs, including strong enrollment growth among both adult learners and younger, traditional-aged students pursuing flexible online degrees, is driving double-digit online enrollment growth (10%+ YoY) and broadening GCE's addressable market, directly supporting future revenue growth.

Wondering what projections back up that headline figure? The analysts behind this narrative are betting on a potent mix of enrollment expansion, margin improvement, and buoyant future earnings. If you want to know which assumptions are supercharging their fair value calculation, take a closer look before the consensus shifts.

Result: Fair Value of $239 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a continued decline in traditional student enrollments or persistent pressure on revenue per student could challenge this optimistic outlook.

Find out about the key risks to this Grand Canyon Education narrative.

Another View: Signals from the Price-to-Earnings Ratio

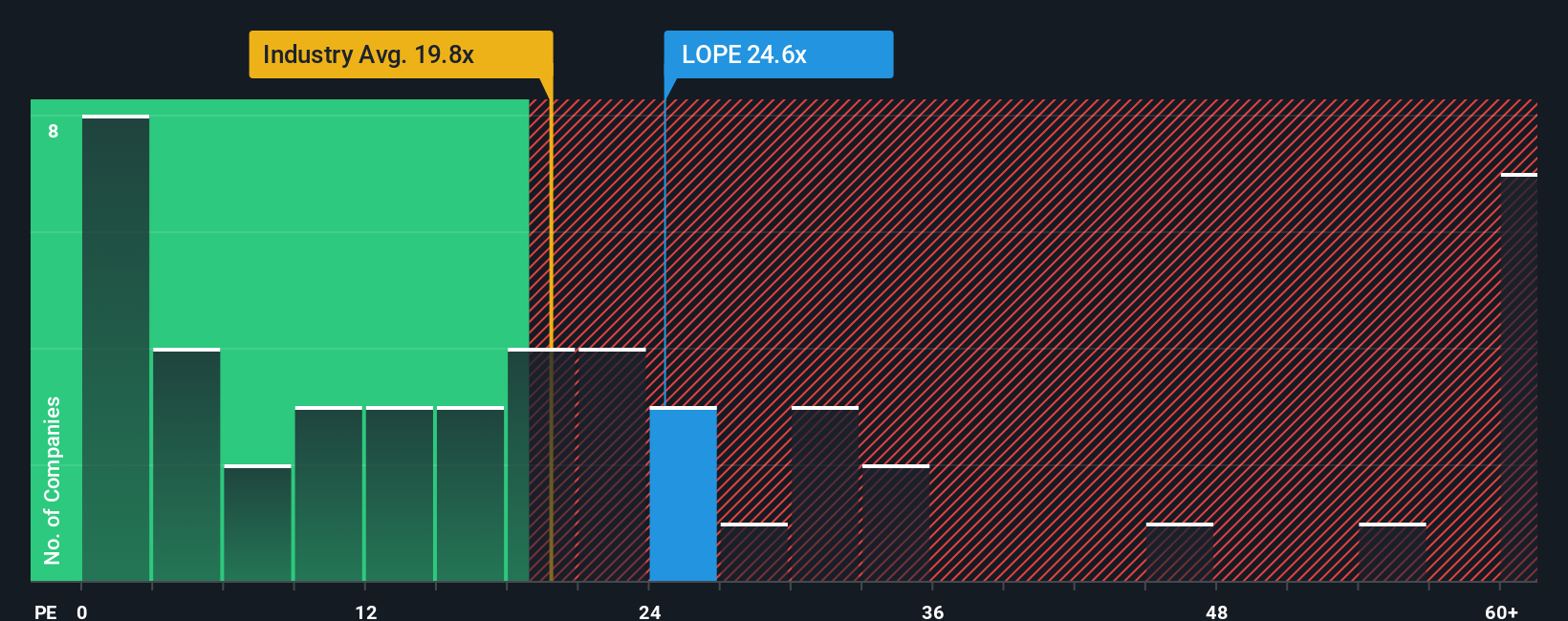

Taking a look at Grand Canyon Education's valuation from another angle, the company's price-to-earnings ratio stands at 25.6x, which is noticeably higher than both the US Consumer Services industry average of 18.9x and the fair ratio of 21.1x. This points to a valuation premium that could create risk if market expectations shift or growth slows. Is the recent momentum enough to justify paying up, or could there be a reality check ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Grand Canyon Education Narrative

If you see the story differently or want to dig into the numbers yourself, you can easily craft your own Grand Canyon Education narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Grand Canyon Education.

Looking for More Investment Ideas?

Give your portfolio an edge by taking the next step. Unique opportunities are waiting just beyond the obvious winners. Broaden your horizons and seek what others might miss with our hand-picked stock ideas below.

- Strengthen your income potential by targeting yield standouts from these 17 dividend stocks with yields > 3% and enjoy reliable returns above 3%.

- Ride the AI wave by tapping into these 27 AI penny stocks, capturing smart companies pushing the boundaries of artificial intelligence innovation.

- Capitalize on tomorrow’s trends by finding hidden value in these 872 undervalued stocks based on cash flows and uncovering stocks priced below their potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LOPE

Grand Canyon Education

Operates as an education services company in the United States.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives