- United States

- /

- Hospitality

- /

- NasdaqGS:LNW

Is There Opportunity in Light & Wonder After 14.8% Drop So Far in 2025?

Reviewed by Bailey Pemberton

- Ever wondered whether Light & Wonder is offering hidden value, or if the current price leaves little room for upside? You are not alone. Many investors are asking the same question.

- Recently, the stock has seen some turbulence, losing 4.2% over the last week and falling 14.8% year-to-date, even as it remains up more than 100% over the past five years.

- There has been plenty happening in the industry, from new product launches to shifting market regulation, both of which have put Light & Wonder in the spotlight alongside other major players. These developments are influencing sentiment and could be contributing to the short-term volatility we are seeing in the share price.

- On the valuation front, Light & Wonder scores a confident 5 out of 6 on our valuation checks. This is an impressive result, but is that score the whole story? Stick with us as we go beyond the standard checks, compare a few different valuation approaches, and reveal an even more insightful way to assess value at the end.

Find out why Light & Wonder's -22.8% return over the last year is lagging behind its peers.

Approach 1: Light & Wonder Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today's value. This approach offers a grounded estimate of what a business may truly be worth, based on how much free cash it can return to shareholders over time.

For Light & Wonder, the current Free Cash Flow stands at $330 million. Analysts forecast steady growth, with projections showing Free Cash Flow reaching $893 million by 2029. These forward-looking estimates are drawn from analyst forecasts for the next five years, with further projections extrapolated by Simply Wall St's team. All values are denominated in US dollars.

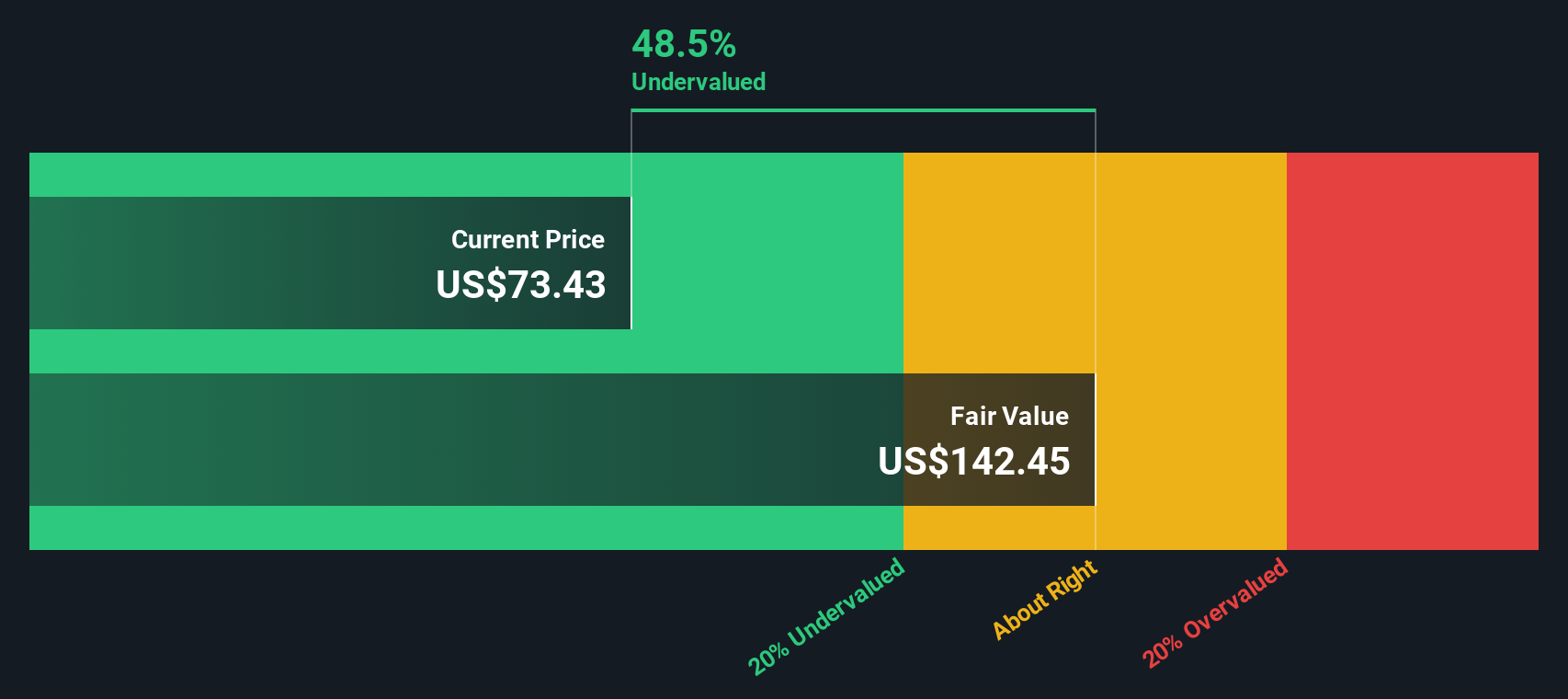

By aggregating these projected cash flows and discounting them appropriately, the DCF model calculates an intrinsic value of $139.88 per share. This figure suggests Light & Wonder's stock is trading at a 48.0% discount to its fair value, implying it is substantially undervalued at current market prices.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Light & Wonder is undervalued by 48.0%. Track this in your watchlist or portfolio, or discover 840 more undervalued stocks based on cash flows.

Approach 2: Light & Wonder Price vs Earnings

The Price-to-Earnings (PE) ratio is a commonly used valuation tool for profitable companies because it directly compares a company’s share price to its earnings per share. When a business is generating consistent profits, the PE ratio can offer a straightforward snapshot of how the market values each dollar of its earnings.

Interpreting what constitutes a “fair” PE ratio depends on several factors. Companies expected to grow faster, or those considered less risky, generally command higher PE multiples. Conversely, riskier businesses or those with slower growth prospects tend to trade at lower ratios. This context makes it important to go beyond a simple comparison of raw numbers.

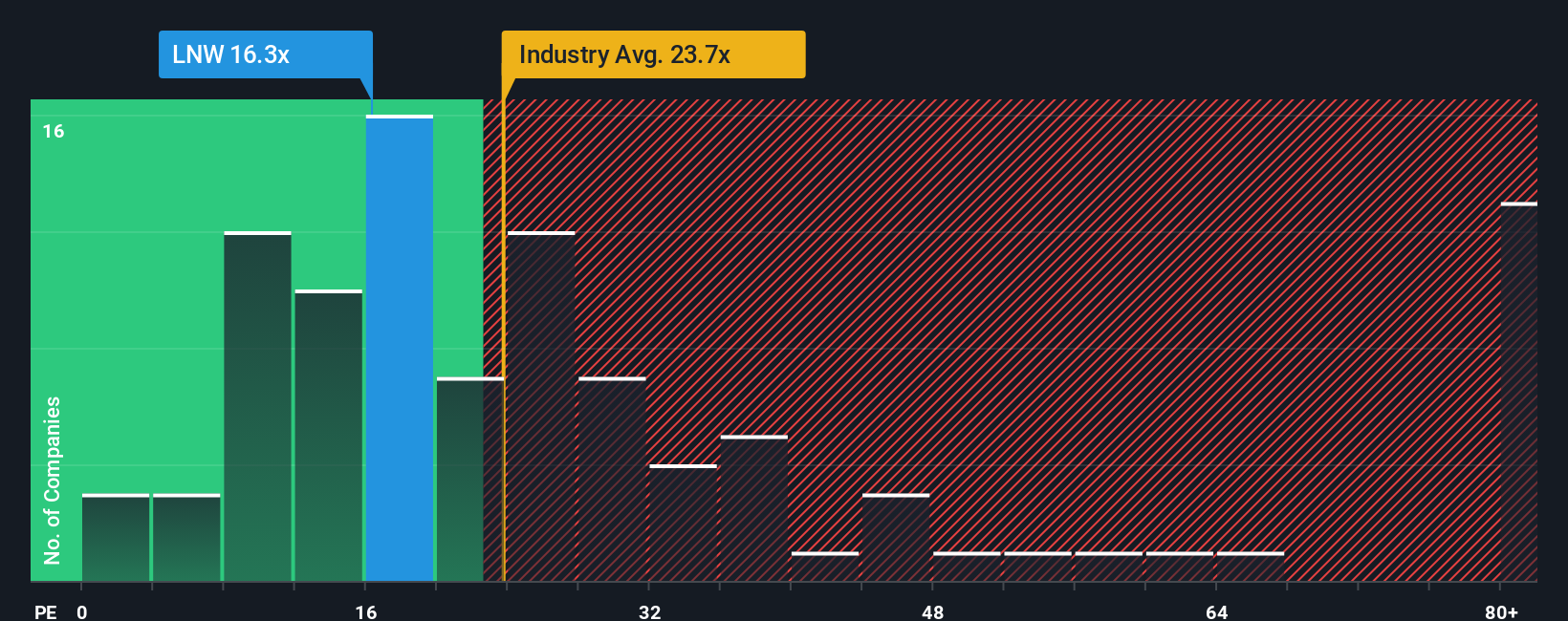

Currently, Light & Wonder is trading at a PE ratio of 17.2x. This sits below the industry average of 23.3x and also lower than the peer average of 18.7x. This suggests the market is pricing in a discount compared to competitors. However, Simply Wall St’s proprietary Fair Ratio for Light & Wonder is 24.0x, a metric that blends factors such as the company’s growth outlook, industry, profit margin, market capitalization, and risk profile. Unlike peer or industry ratios, the Fair Ratio provides a more holistic measure of what the company’s PE should be, tailored to its unique position.

Because Light & Wonder’s PE of 17.2x is well below the Fair Ratio of 24.0x, the stock appears to be undervalued when all these elements are combined into the analysis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1414 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Light & Wonder Narrative

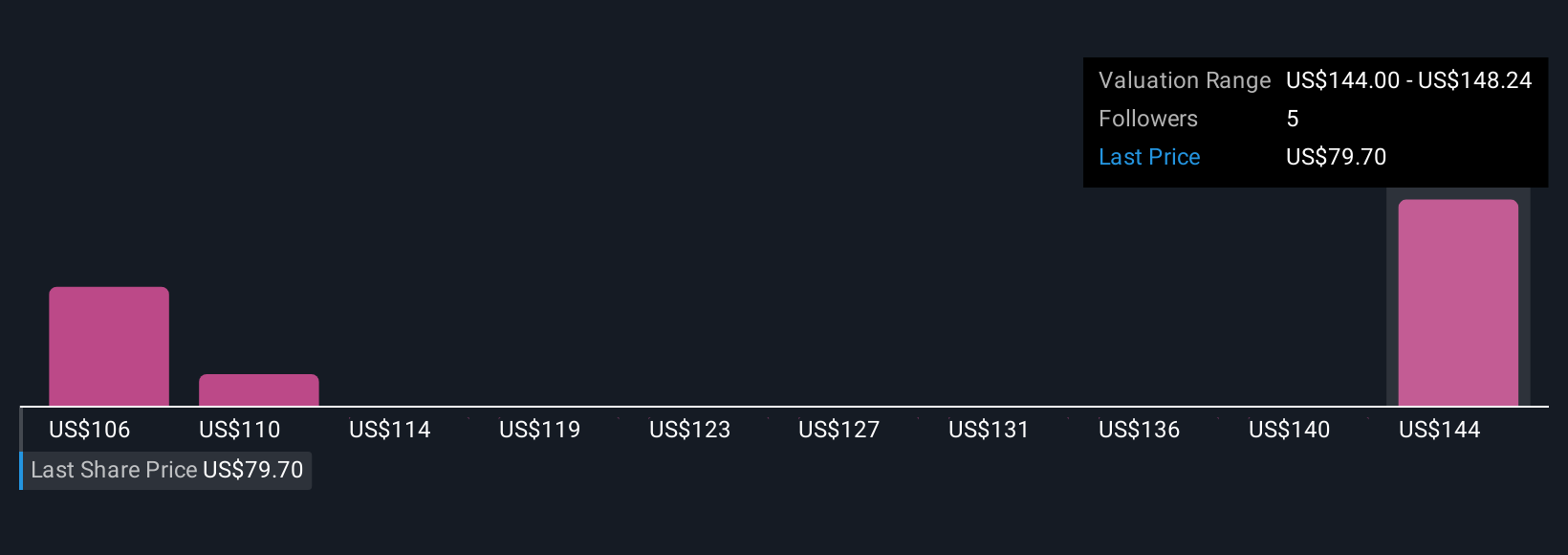

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply your own story about the future of Light & Wonder, where you connect your insights about its business, strategy, and industry events to a set of financial forecasts and your estimate of what it is worth. Instead of relying solely on models or ratios, Narratives allow you to combine the company’s story with your assumptions about future revenue, profit margins, and fair value. This puts your perspective front and center.

Narratives are available right inside the Simply Wall St Community page, trusted by millions of investors as an intuitive tool for investment decision-making. With Narratives, you can see at a glance how your view of fair value compares with the current share price, helping you decide whether to buy, hold, or sell. Every Narrative is automatically updated whenever new news or earnings information gets released, ensuring your view stays fresh.

For Light & Wonder, one investor's Narrative could reflect optimism, betting on rapid digital expansion and strong earnings momentum, leading to a fair value well above today’s price. Meanwhile, another might focus on regulatory risks and potential margin pressure, setting a much lower fair value. Narratives give you the power to act confidently, backed by your own analysis, rather than just following the crowd.

Do you think there's more to the story for Light & Wonder? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LNW

Light & Wonder

Operates as a cross-platform games company in the United States and internationally.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives