Top Undervalued Small Caps With Insider Buying In August 2024

Reviewed by Simply Wall St

In August 2024, the global markets experienced a notable uptick, with small-cap stocks outperforming their large-cap counterparts amid investor optimism fueled by anticipated interest rate cuts from the Federal Reserve. This positive sentiment was reflected in key indices such as the S&P 600 for small-cap stocks, which saw significant gains. When evaluating potential investments in this environment, it's crucial to consider factors like insider buying activity and overall market sentiment. These indicators can provide valuable insights into a company's perceived value and growth prospects.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Ever Sunshine Services Group | 5.5x | 0.4x | 26.52% | ★★★★★☆ |

| Essentra | 858.4x | 1.7x | 46.68% | ★★★★★☆ |

| Cabka | NA | 0.4x | 49.20% | ★★★★★☆ |

| Lion Rock Group | 6.0x | 0.4x | 45.56% | ★★★★☆☆ |

| Avia Avian | 17.9x | 4.1x | 3.33% | ★★★★☆☆ |

| Sagicor Financial | 1.3x | 0.3x | -42.17% | ★★★★☆☆ |

| Semen Indonesia (Persero) | 15.0x | 0.7x | 24.79% | ★★★★☆☆ |

| China Leon Inspection Holding | 9.6x | 0.7x | 37.26% | ★★★☆☆☆ |

| Franchise Brands | 118.4x | 3.0x | 48.24% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

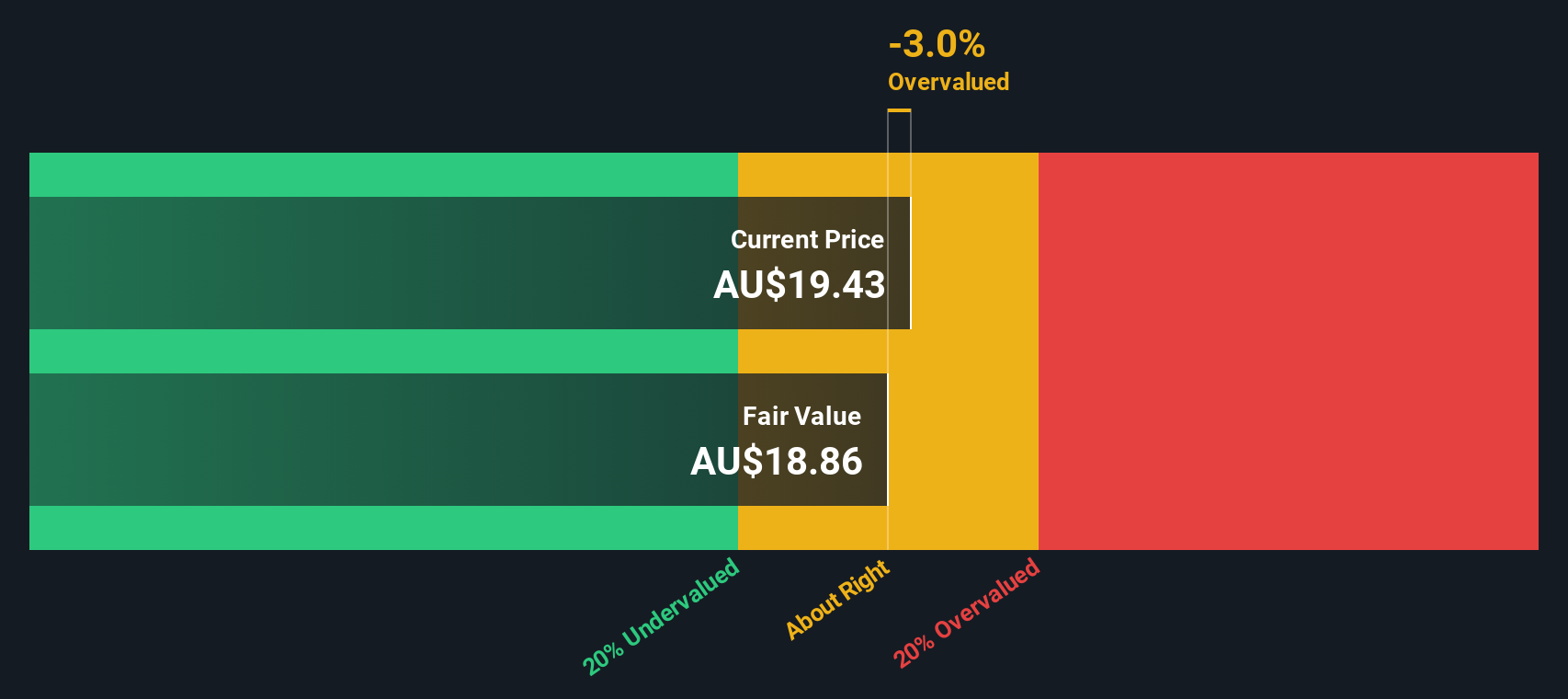

Codan (ASX:CDA)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Codan specializes in the development and manufacturing of metal detection and communications equipment, with a market cap of approximately A$1.20 billion.

Operations: Codan generates revenue primarily from its Communications and Metal Detection segments, with the former contributing A$326.91 million and the latter A$219.85 million. The company's gross profit margin experienced fluctuations, peaking at 60.25% in June 2017 before settling at around 54.42% by December 2023. Operating expenses have shown a general upward trend, reaching A$190.78 million by June 2024, driven significantly by Sales & Marketing and R&D expenditures.

PE: 34.0x

Codan, a small-cap stock, recently reported strong financial results for the full year ending June 30, 2024. Sales increased to A$550.46 million from A$456.5 million last year, while net income rose to A$81.39 million compared to A$67.7 million previously. Earnings per share also grew from A$0.375 to A$0.45, reflecting solid performance despite higher-risk funding sources through external borrowing only. Insider confidence is evident with recent share purchases within the last quarter of 2023 and early 2024.

- Click to explore a detailed breakdown of our findings in Codan's valuation report.

Examine Codan's past performance report to understand how it has performed in the past.

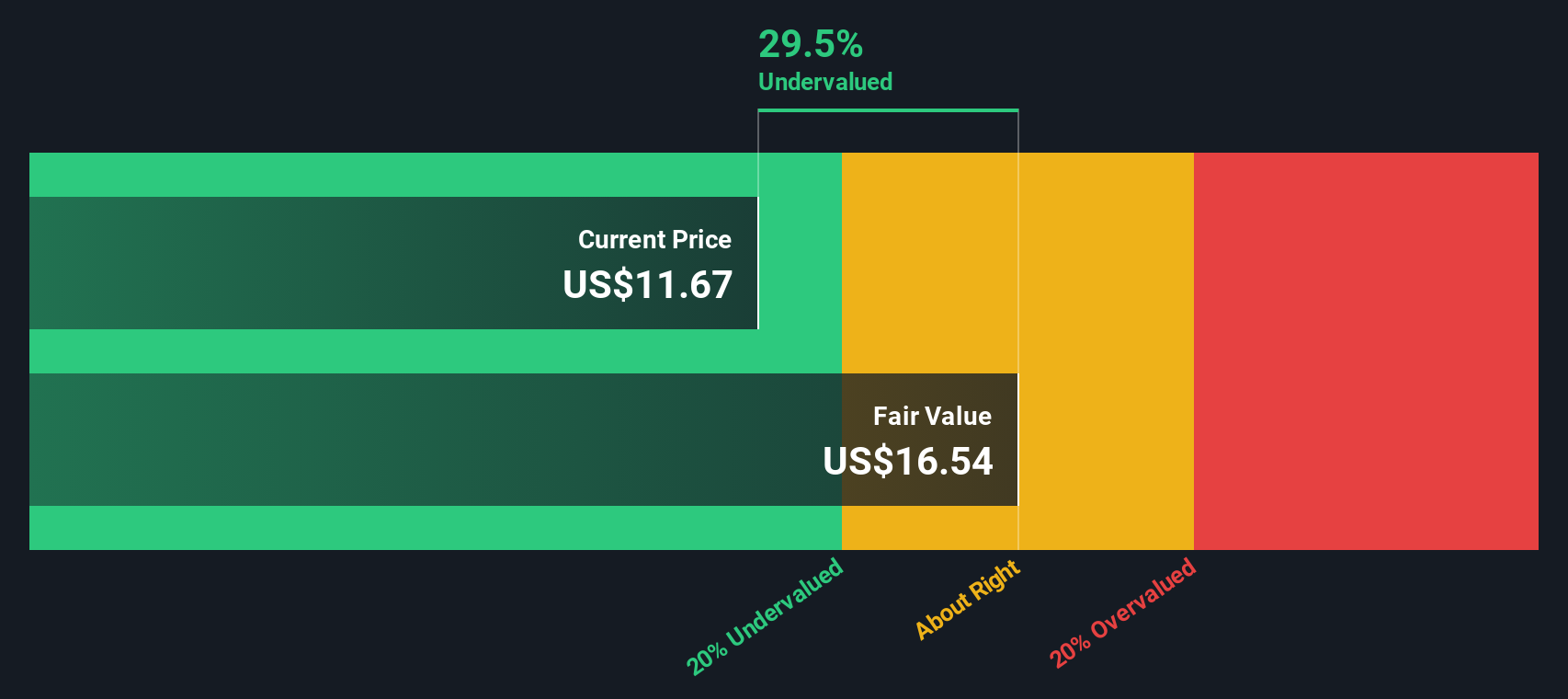

Lindblad Expeditions Holdings (NasdaqCM:LIND)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Lindblad Expeditions Holdings operates expedition cruises and adventure travel experiences, with a market cap of approximately $0.52 billion.

Operations: The company generated $591.46 million in revenue, with a gross profit margin of 44.10%. Operating expenses totaled $254.57 million, and the net income margin stood at -9.28%.

PE: -10.2x

Lindblad Expeditions Holdings, a leader in expedition cruising, recently closed a $6 million shelf registration on August 1, 2024. Their Q2 2024 earnings report showed sales of US$136.5 million, up from US$124.8 million the previous year, but net loss remained steady at around US$24.67 million. Despite higher risk funding through external borrowing and no customer deposits, insider confidence is evident with recent share purchases indicating potential undervaluation. The addition of two new Galápagos vessels highlights ongoing expansion efforts and growth prospects for the company’s unique travel experiences.

Electrolux Professional (OM:EPRO B)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Electrolux Professional operates in the laundry and food & beverage equipment sectors, with a market cap of approximately SEK 8.92 billion.

Operations: Electrolux Professional generates revenue primarily from its Laundry and Food & Beverage segments, amounting to SEK 4.53 billion and SEK 7.52 billion respectively. The company's net income margin has shown variability, with recent figures such as 6.75% for Q1 2022 and 6.05% for Q2 2024 reflecting this trend.

PE: 27.4x

Electrolux Professional, a smaller company in the appliance sector, has shown mixed financial results. For Q2 2024, sales increased to SEK 3.27 billion from SEK 3.15 billion year-on-year, yet net income dipped to SEK 230 million from SEK 257 million. Despite this, earnings are projected to grow at nearly 20% annually. Insider confidence is evident with recent share purchases within the last quarter, indicating potential optimism about future performance despite current high-risk funding through external borrowing only.

- Dive into the specifics of Electrolux Professional here with our thorough valuation report.

Understand Electrolux Professional's track record by examining our Past report.

Taking Advantage

- Unlock more gems! Our Undervalued Small Caps With Insider Buying screener has unearthed 214 more companies for you to explore.Click here to unveil our expertly curated list of 217 Undervalued Small Caps With Insider Buying.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Electrolux Professional might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:EPRO B

Electrolux Professional

Provides food service, beverage, and laundry products and solutions to restaurants, hotels, healthcare, educational, and other service facilities.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives