- United States

- /

- Consumer Services

- /

- NasdaqGS:LAUR

Laureate Education (LAUR) Margin Growth Reinforces Bullish Narratives Despite Slower Revenue Forecasts

Reviewed by Simply Wall St

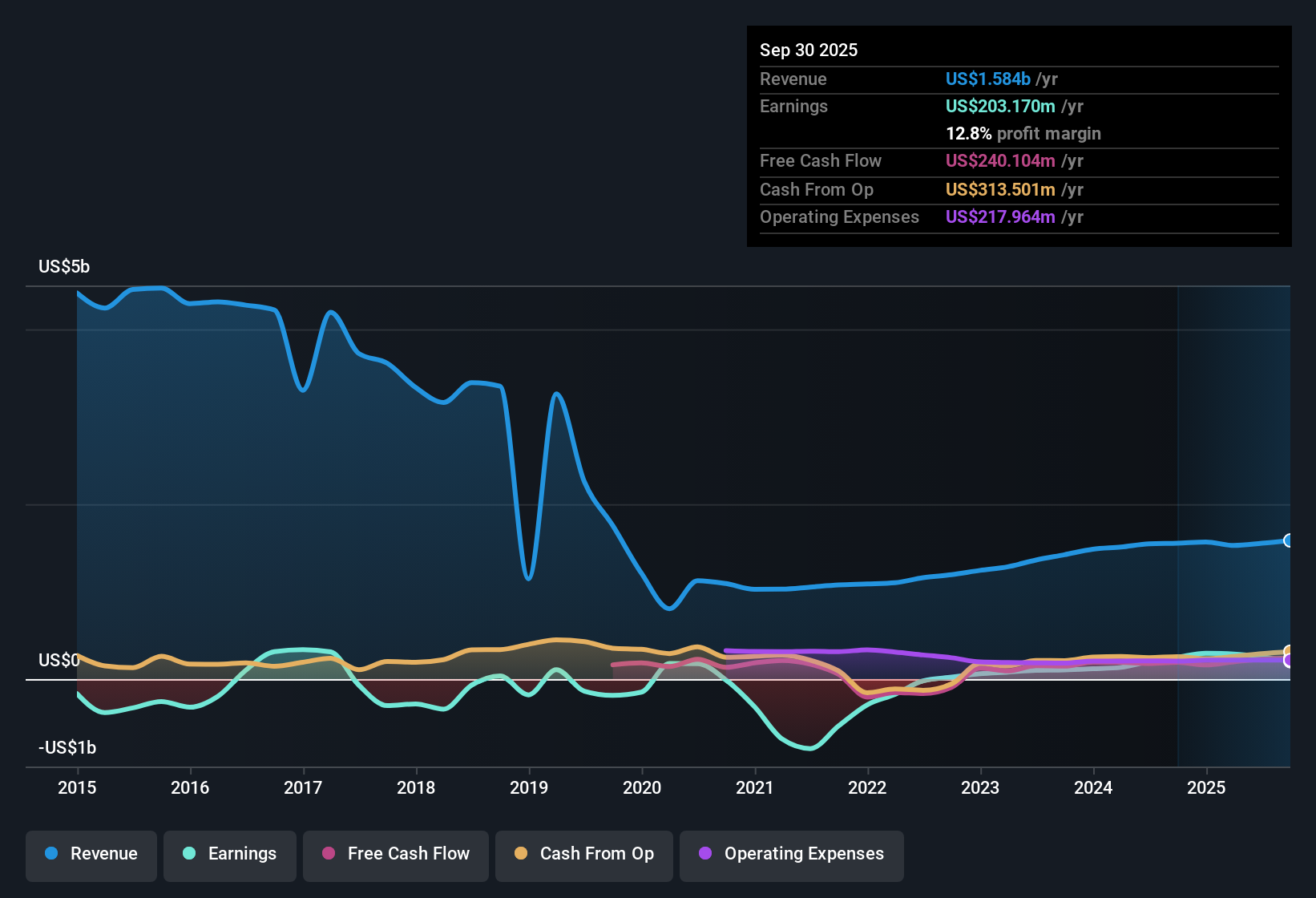

Laureate Education (LAUR) posted another year of solid progress, with EPS climbing 26.6%. This growth is slower than its rapid 74.2% five-year average, but still marks consistent growth. Net profit margins advanced to 16.4% from 13% previously, reflecting greater operational efficiency and ongoing profitability. Investors will note these steady gains, as well as forecasts for ongoing earnings growth outpacing the broader US market, as key positives in the current report.

See our full analysis for Laureate Education.Next up, we’ll see how these results measure up against the most widely held narratives for LAUR, testing which stories still hold and which ones might need a refresh.

See what the community is saying about Laureate Education

Analyst Targets Signal Cautious Upside

- The current share price of $31.79 sits just above the analyst consensus price target of $34.20. This leaves only an 8% potential upside as priced by analysts.

- According to the analysts' consensus view, these muted expectations reflect the belief that revenue will reach $2.0 billion and EPS will climb to $2.16 by 2028. Growth is tempered by exposure to country and currency risks in Mexico and Peru.

- Consensus expectations indicate that the company's push in Latin America and online programs should steadily increase enrollment and margins. However, these tailwinds are weighed down by concerns around economic shifts or regulatory changes in its two key markets.

- With the share price close to the target, market confidence in further upside is limited unless expansion and margin improvements exceed current projections.

- Want the complete breakdown of how analysts connect the dots between today’s growth and their future targets? 📊 Read the full Laureate Education Consensus Narrative.

P/E Discount to Peers Offsets Slower Revenue Growth

- Laureate's Price-To-Earnings (P/E) ratio stands at 18.4x, which is below the peer average of 20.6x, yet slightly above the US Consumer Services industry average of 17.2x. Revenue growth is projected at just 7.7% annually, versus the broader US market pace of 10.3%.

- The consensus narrative highlights that Laureate’s DCF fair value of $61.78 significantly exceeds both its trading price and peer valuation multiples.

- While bulls would normally tout this valuation gap as a clear buying signal, the company's reliance on a few Latin American markets and the need for heavy capital investment create division among analysts about whether this discount is justified or represents an opportunity.

- Cost discipline and margin gains help support the case for a higher multiple. However, subdued revenue growth compared to the industry average leaves room for wary investors to stay cautious.

Profit Margin Gains Fuel Long-Term Optimism

- Net profit margins increased from 13% to 16.4% over the past year, and are forecast by analysts to rise further to 17.4% within three years.

- Consensus narrative notes that efficiency efforts such as campus consolidations and expense management are helping Laureate convert stronger brand recognition and demand into higher-quality profits.

- The company’s ability to achieve higher adjusted EBITDA margins adds flexibility for future investments in digital learning and campus expansion, while also strengthening its defense against economic or currency pressures in Mexico and Peru.

- Greater margin headroom gives the business more capacity to weather competition from online and traditional rivals, supporting long-term earnings stability even as revenue growth lags the sector.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Laureate Education on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the data? Share your insights and build your custom narrative in under three minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Laureate Education.

See What Else Is Out There

Laureate’s slower revenue growth and reliance on a handful of Latin American markets could limit its upside compared to the broader sector.

If you're looking for companies that deliver steadier revenue and earnings regardless of market swings, check out stable growth stocks screener (2112 results) for ideas that may better fit your strategy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LAUR

Laureate Education

Offers higher education programs and services to students through a network of universities and higher education institutions.

Good value with proven track record.

Market Insights

Community Narratives