- United States

- /

- Consumer Services

- /

- NasdaqCM:JZ

Jianzhi Education Technology Group Company Limited's (NASDAQ:JZ) Shares Leap 27% Yet They're Still Not Telling The Full Story

Those holding Jianzhi Education Technology Group Company Limited (NASDAQ:JZ) shares would be relieved that the share price has rebounded 27% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 55% share price drop in the last twelve months.

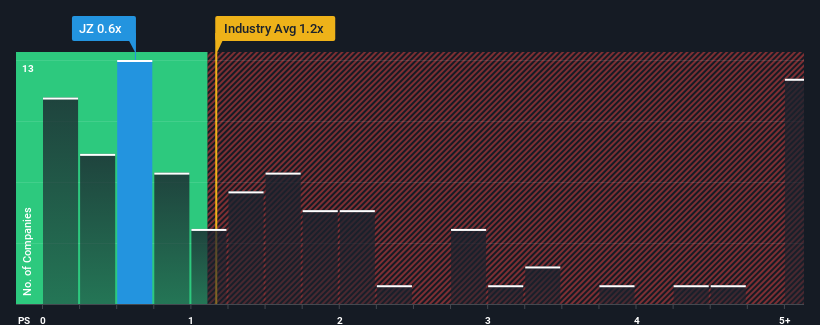

In spite of the firm bounce in price, given about half the companies operating in the United States' Consumer Services industry have price-to-sales ratios (or "P/S") above 1.2x, you may still consider Jianzhi Education Technology Group as an attractive investment with its 0.6x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Jianzhi Education Technology Group

How Has Jianzhi Education Technology Group Performed Recently?

The recent revenue growth at Jianzhi Education Technology Group would have to be considered satisfactory if not spectacular. One possibility is that the P/S ratio is low because investors think this good revenue growth might actually underperform the broader industry in the near future. Those who are bullish on Jianzhi Education Technology Group will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Jianzhi Education Technology Group's earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Jianzhi Education Technology Group?

The only time you'd be truly comfortable seeing a P/S as low as Jianzhi Education Technology Group's is when the company's growth is on track to lag the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 6.9%. The latest three year period has also seen an excellent 41% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 13% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

With this information, we find it odd that Jianzhi Education Technology Group is trading at a P/S lower than the industry. Apparently some shareholders are more bearish than recent times would indicate and have been accepting lower selling prices.

The Final Word

The latest share price surge wasn't enough to lift Jianzhi Education Technology Group's P/S close to the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Jianzhi Education Technology Group revealed its three-year revenue trends looking similar to current industry expectations hasn't given the P/S the boost we expected, given that it's lower than the wider industry P/S, When we see industry-like revenue growth but a lower than expected P/S, we assume potential risks are what might be placing downward pressure on the share price. While recent

And what about other risks? Every company has them, and we've spotted 2 warning signs for Jianzhi Education Technology Group you should know about.

If these risks are making you reconsider your opinion on Jianzhi Education Technology Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:JZ

Jianzhi Education Technology Group

Develops and provides educational content products and IT services to higher education institutions in the People’s Republic of China.

Slight risk with mediocre balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.