David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies Muscle Maker, Inc. (NASDAQ:GRIL) makes use of debt. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Muscle Maker

How Much Debt Does Muscle Maker Carry?

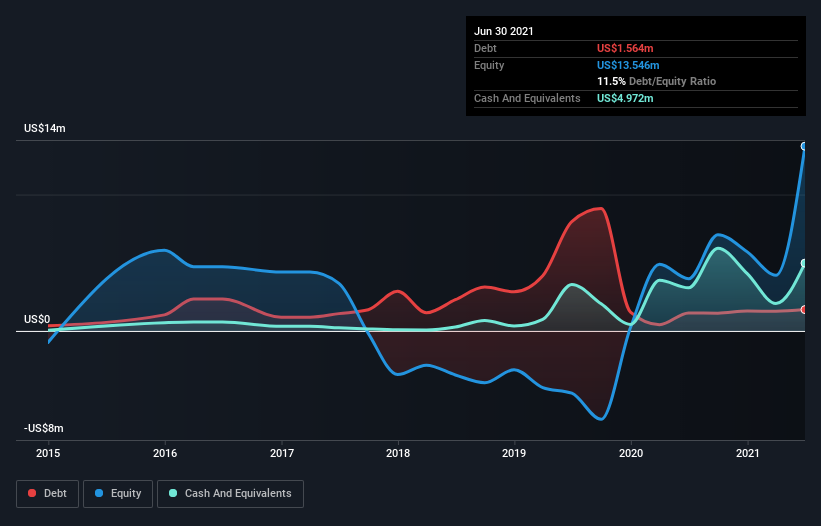

You can click the graphic below for the historical numbers, but it shows that as of June 2021 Muscle Maker had US$1.56m of debt, an increase on US$1.32m, over one year. However, its balance sheet shows it holds US$4.97m in cash, so it actually has US$3.41m net cash.

A Look At Muscle Maker's Liabilities

According to the last reported balance sheet, Muscle Maker had liabilities of US$3.09m due within 12 months, and liabilities of US$2.32m due beyond 12 months. Offsetting this, it had US$4.97m in cash and US$287.0k in receivables that were due within 12 months. So its liabilities total US$158.9k more than the combination of its cash and short-term receivables.

Having regard to Muscle Maker's size, it seems that its liquid assets are well balanced with its total liabilities. So it's very unlikely that the US$19.1m company is short on cash, but still worth keeping an eye on the balance sheet. While it does have liabilities worth noting, Muscle Maker also has more cash than debt, so we're pretty confident it can manage its debt safely. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Muscle Maker's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Over 12 months, Muscle Maker reported revenue of US$6.3m, which is a gain of 35%, although it did not report any earnings before interest and tax. With any luck the company will be able to grow its way to profitability.

So How Risky Is Muscle Maker?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And we do note that Muscle Maker had an earnings before interest and tax (EBIT) loss, over the last year. Indeed, in that time it burnt through US$8.4m of cash and made a loss of US$7.9m. With only US$3.41m on the balance sheet, it would appear that its going to need to raise capital again soon. Muscle Maker's revenue growth shone bright over the last year, so it may well be in a position to turn a profit in due course. By investing before those profits, shareholders take on more risk in the hope of bigger rewards. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. To that end, you should learn about the 5 warning signs we've spotted with Muscle Maker (including 3 which don't sit too well with us) .

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you’re looking to trade Muscle Maker, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:SDOT

Sadot Group

Provides supply chain solutions that address growing food security challenges worldwide.

High growth potential and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.