- United States

- /

- Hospitality

- /

- NasdaqGS:FWRG

First Watch Restaurant Group (FWRG): Assessing Valuation After Raised Guidance and Surprising Q3 Results

Reviewed by Simply Wall St

First Watch Restaurant Group (FWRG) surprised investors by posting stronger than expected third-quarter earnings and raising its fiscal 2025 outlook. The management team pointed to healthy comparable sales and continued success opening new locations.

See our latest analysis for First Watch Restaurant Group.

Even after raising its guidance and delivering upbeat quarterly results, the share price has cooled off, down 12.2% year-to-date and showing a 6.7% drop just in the past week. Still, long-term investors have seen a positive 15.6% total shareholder return over three years. This suggests momentum may be consolidating as the market weighs new expansion initiatives and recent equity issuance.

If First Watch’s growth story has you scanning for more potential winners, it’s a great time to broaden your search and discover fast growing stocks with high insider ownership

With First Watch’s shares now trading well below analyst targets even as growth prospects ramp up, investors may be wondering whether the market is overlooking the company’s momentum or already pricing in future gains. Is this a buying opportunity?

Most Popular Narrative: 25% Undervalued

With the most popular narrative assigning First Watch Restaurant Group a fair value of $22, the latest closing price of $16.50 suggests considerable upside potential in the eyes of analyst consensus. This difference highlights strong future earnings expectations and a belief in the company's ability to deliver on expansion plans.

The brand's alignment with increasing consumer demand for health-conscious, fresh, and made-to-order daytime dining, plus continued menu innovation and digital investments (waitlist automation, nutrition filters), is likely to drive higher in-store traffic, check growth, and strong long-term same-restaurant sales.

Want to understand the bold assumptions behind this bullish outlook? The narrative is betting on a surge in revenue and margin expansion driven by expansion, innovation, and changing consumer habits. Curious how analysts justify this much higher price despite today’s modest profit margins? Uncover the forecasts propelling this striking valuation by reading the full breakdown.

Result: Fair Value of $22 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent inflation in key input and labor costs, or missteps in new market expansion, could challenge First Watch’s long-term earnings trajectory.

Find out about the key risks to this First Watch Restaurant Group narrative.

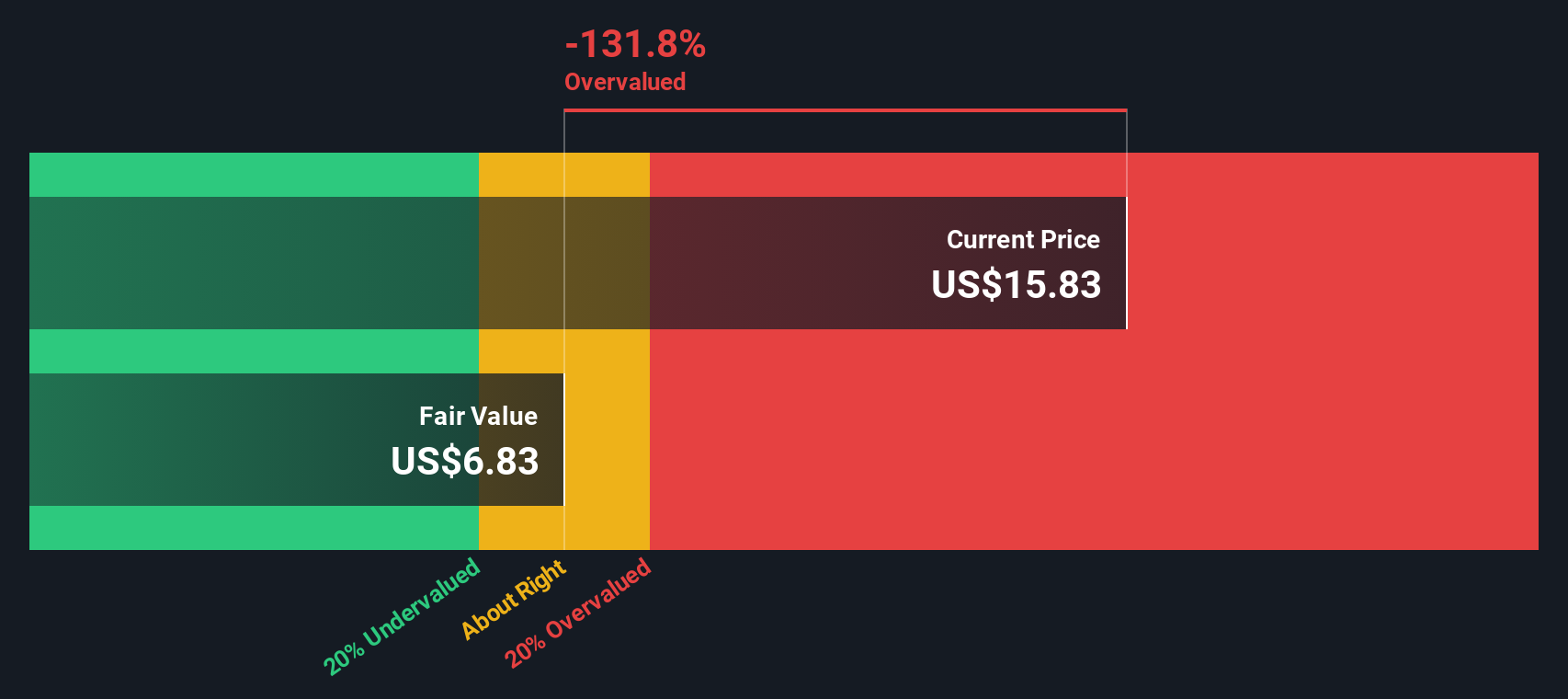

Another View: DCF Model Tells a Different Story

While analyst consensus suggests First Watch Restaurant Group is undervalued, our SWS DCF model provides a more conservative perspective. According to this discounted cash flow approach, the shares are actually trading above fair value. This challenges the optimism and raises an important question about which assumptions will play out in reality.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out First Watch Restaurant Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 894 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own First Watch Restaurant Group Narrative

If you have a different perspective or want to see what your own research reveals, you can craft your own personalized narrative in just a few minutes. Do it your way

A great starting point for your First Watch Restaurant Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let fresh market opportunities pass you by. The right screen could unveil your next winning stock. Take action now and open up new profit potential.

- Catch powerful returns by targeting these 3584 penny stocks with strong financials packed with growth potential and financial stability before the crowd takes notice.

- Tap into AI’s unstoppable surge. Start with these 27 AI penny stocks and identify those at the forefront of technological innovation.

- Secure your portfolio’s future by finding these 894 undervalued stocks based on cash flows that offer robust cash flow and attractive entry points in today’s market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FWRG

First Watch Restaurant Group

Through its subsidiaries, operates and franchises restaurants under the First Watch trade name in the United States.

Good value with reasonable growth potential.

Market Insights

Community Narratives